Published July 2022

Acetone supply tends to be in excess globally. For roughly every two units of phenol produced, one unit of acetone is produced. While bisphenol A has been one of the better-performing derivatives, it consumes a higher phenol ratio at three parts to phenol to one part acetone. In turn, strong bisphenol A demand will lead to a longer acetone market. Secondly, methyl methacrylate (MMA) is another important acetone derivative and MMA technologies have been shifting. As capacity is built to meet increasing demand, some of the new capacity is based on nonacetone routes, such as units that can consume ethylene and methanol. Both of these feedstocks can be produced at very low cost, if natural gas is available at the low prices seen previously in the Middle East and now in the United States.

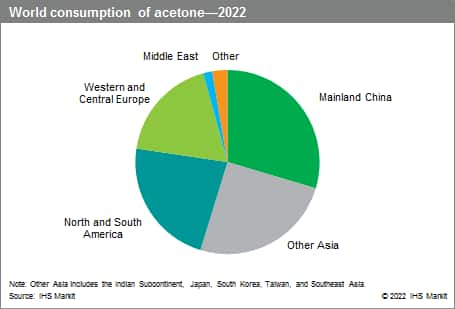

The following pie chart shows world consumption of acetone:

The global acetone industry is mainly driven by the solvents chain, the MMA sector, and BPA derivatives. The solvents chain is acetone’s largest market and is estimated to consume 29% of global acetone demand in 2022. The main end-use markets for direct solvent are the manufacture of pharmaceuticals, including vitamins (vitamin C) and antibiotics (cephalosporins); glass-reinforced plastics (GRP); rubber chemicals; cosmetics (primarily nail polish remover); and spinning solvent for cellulose acetate fibers. For the most part, distributors handle solvent uses for acetone. In cosmetics, acetone used as a nail polish remover continues to compete with ethyl acetate. The solvents sector is often the last place acetone ends up, moving there only if it cannot be sold into the other higher-valued applications. Over the next five years, demand for solvent applications is expected to grow at an average rate of 3.9% per year.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Acetone is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key Benefits

S&P Global’s Chemical Economics Handbook – Acetone has been compiled using primary interviews with key suppliers, organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability