Published February 2024

This report covers two types of emission control catalysts according to the source of the emission — emission control catalysts for mobile sources (such as automobile catalysts) and for stationary sources (such as fossil fuel–fired power plants, diesel- and gas-fired engines, chemical and industrial processes and marine and locomotive applications). More than 90% of the emission control catalyst market is accounted for by mobile sources. The global catalyst market is expected to decline annually (excluding platinum group metals) over the next five years.

Emission control catalysts stand at the forefront of the ongoing battle against air pollution, playing a pivotal role in curbing the release of harmful hydrocarbons and nitrogen oxides into the atmosphere. As urbanization continues to rise and vehicular populations surge, the significance of these catalysts cannot be overstated. Their substantial contribution has played a significant role in the notable enhancement of air quality in bustling metropolises, promising a cleaner and healthier future.

Over the past three decades, the market has consistently expanded. However, a significant transformation is occurring as battery-electric vehicles (BEVs) take the place of internal combustion engines (ICE), driven by ambitious goals to reduce CO2 emissions. Regions are actively considering the phased retirement of specific coal power plants, aligning with cleaner energy commitments, with a particular emphasis on wind and solar power.

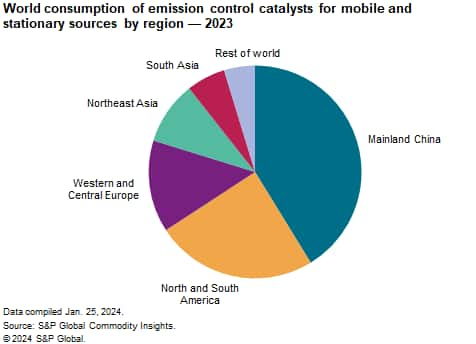

The following chart shows world consumption of emission control catalysts for mobile and stationary sources in 2023:

Mainland China is the leading consumer, followed by North America and Western Europe. The mobile emission control catalyst segment fights with challenges in a shrinking market, foreseeing a negative growth rate. Demand for light vehicles equipped with internal combustion engines is expected to decrease from 2024 to 2029, while their heavy-duty counterparts are projected to experience marginal growth. This trend aligns with the broader vehicle production scenario, anticipating a decline in emission control catalyst consumption across most regions, except for the Middle East and Africa. The decrease is attributed to the rising adoption of battery-powered vehicles. Conversely, the growth observed in the Middle East and Africa is driven by the enforcement of stricter emission control regulations.

In addition, the smaller stationary emission catalyst market encompasses power stations, chemical plants and stationary diesel engines and turbines. This segment anticipates a declining growth rate, influenced by the global emphasis on renewable energy, particularly in the form of wind and solar power. The overall market dynamics reveal a complex interplay of factors, signaling a shift in the industry landscape over the next five years.

Crucial technologies employed in addressing and managing vehicle emissions include three-way catalysts and gasoline particulate filters for gasoline vehicles, while diesel vehicles utilize diesel oxidation catalysts, diesel particulate filters and selective catalytic reduction (SCR) systems. Primary chemicals utilized in the production of these catalysts encompass platinum group metals, rare earth oxides, aluminum oxide and other metal oxide ceramic materials. SCR technology, primarily applied in stationary emission catalysis, employs chemicals such as TiO2, V2O5, WO2 and zeolites.

For more detailed information, see the table of contents, shown below.

S&P Global’s Specialty Chemicals Update Program – Catalysts, Emission Control is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Specialty Chemicals Update Program – Catalysts, Emission Control has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade and economics.

This report can help you

- Identify the competitive environment and key players

- Assess key issues facing both suppliers and their end-use customers

- Understand industry integration strategies

- Keep abreast of industry structure changes, regulatory requirements and other factors affecting profitability

- Identify new business opportunities and threats

- Follow important commercial developments

- Recognize trends and driving forces influencing specialty chemical markets