The North American Power Analytics product provides extensive sensitivity analysis data relating to natural gas price and long-term renewables penetration on a visually dynamic and interactive platform, supplementing the S&P Global comprehensive power outlook out to 2050. Customize your workflow and gain a deep understanding of the North American power market to better assess business opportunities and gain a competitive edge.

North American Power Analytics

What Key Questions Does This Product Address?

Renewable energy project developers:

- What are the merchant tail risks for my project development pipeline?

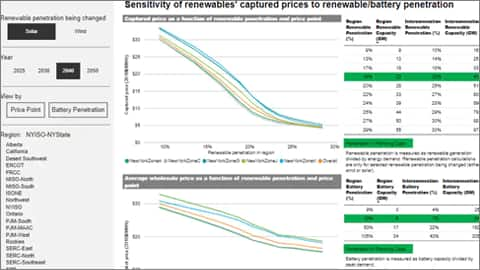

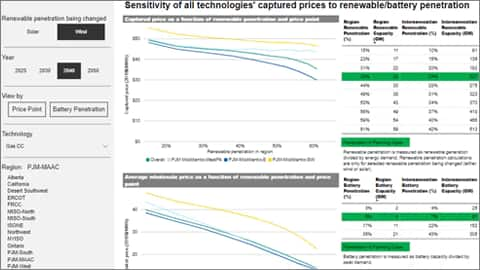

- How will varying levels of battery penetration interact with merchant tail revenues?

Financial sector:

- How can I easily view the range of risks during deal support?

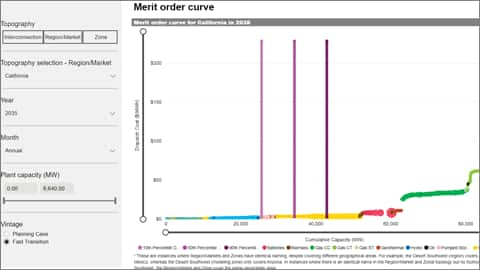

- How will an asset’s position on the merit order curve evolve over time?

- How can I get a quick view of energy margins in the comprehensive power outlook to 2050?

Global energy companies:

- What are the risks inherent in the electricity markets?

- How can I get sensitivity analysis visualizations to study new power markets at a glance?

Independent power producers:

- What are the operational risks to my portfolio?

- How will my position on the merit order curve change with higher renewables penetration?

Who Benefits From This Product?

- Renewable energy project developers

- Financial sector

- Global energy companies

- Independent power producers

How Do Clients Use This Product?

- Senior analyst at a private equity firm:

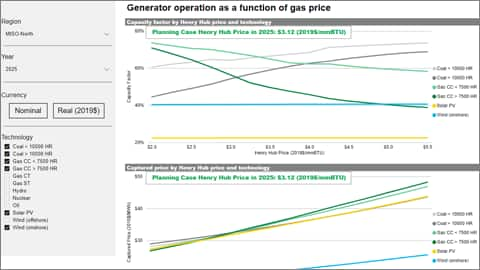

Scrutinizes the merchant tail and long-term operational and financial risks for several acquisition targets, across different markets and asset classes.

- Strategic planner at a global energy company:

Delves deeply into North American power markets, examining how the merit order curve, capacity factor, captured price and energy margins change over time within specific markets to study potential investment diversification opportunities.

- Origination manager at a renewable energy project development company:

Examines the impact of increasing battery penetration on existing project and pipeline portfolio.

What Makes Us Rise Above the Competition?

- This product is analytics-rich. It features 1200 renewable energy penetration simulations to portray a granular level of risk.

- We offer unrivaled combination of depth and breadth. We include a more in-depth look at both our comprehensive power outlook and sensitivities across a broad range of possible outcomes.

- The expertise of our wide-ranging team of experts is unparalleled. Built out by the S&P Global power team, this offering is backed by deep knowledge and expertise in technology, policy, and regional power markets.

Provides visualizations of key price and operational data, in response to increasing levels of renewable energy penetration:

- All North American markets/regions; multiple price points

- Captured prices for renewables and thermal generators, all-hours market prices, renewables curtailments (zonal)

- Diurnal operating patterns of batteries and other technologies

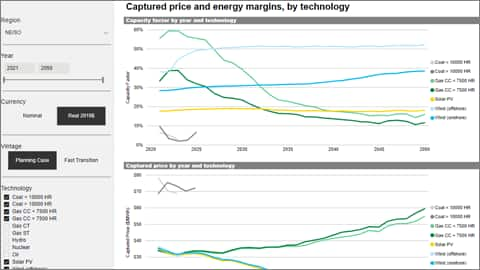

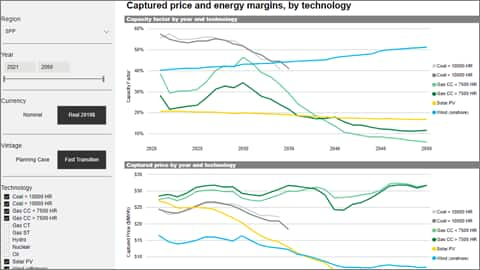

See the sensitivity of each generation technology’s capacity factor, captured price, and energy margin to the natural gas price; presented for each year and market/region.

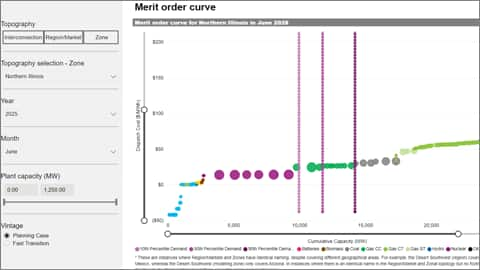

Features generation supply curves by month-year or year for each market/region, depicting each technology type along with 10th, 50th, and 90th percentile market demand levels.

Features capacity factor, captured price and energy margin by technology, year, and region for the S&P Global forecasting base case for the North American power markets.

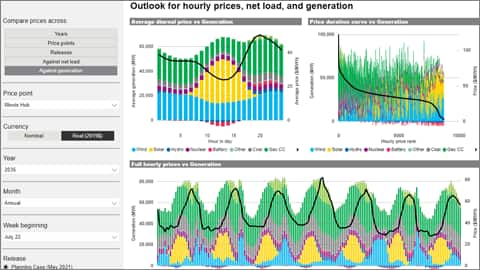

Detailed visualizations of hourly prices, net loads, and generation by technology for the S&P Global forecasting base case and a number of sensitivity cases. Contains the average diurnal price, price duration curve, and full hourly prices for any price point and time period. Compare hourly prices across years, price points, cases, or compare hourly prices against net load and generation by technology.

Comparison of hourly prices across different years in Dominion in S&P Global's comprehensive power outlook

Product Specialist

Drew Bobesink

As a member of the North American Power Analytics team, he works with power modeling simulations to develop long-term power sector outlooks. He has conducted research on numerous aspects of the energy sector, such as economic retirements of coal plants and the increasing importance of hourly price shapes in the electricity market. In addition to his work in North America, Drew has analyzed power systems in Africa and the Middle East, including Rwanda and Oman. His previous research experience includes quantifying the importance of considering future uncertainty in power simulations for both risk-neutral and risk-averse decision makers.Drew holds a Bachelor of Science degree and a Master of Science degree from Johns Hopkins University.

Barclay Gibbs

Barclay advises on power economics, due diligence, wholesale power price forecasting, and environmental/climate policy. He has advised electric utilities, independent power producers, fuels producers, investment banks, private equity firms, manufacturers of power generation equipment, construction/engineering firms, and industrial users of power.Recent/ongoing consulting projects include investment advisory and market benefits assessments for offshore wind projects in the Northeast US, market scenarios and strategic advisory services for a wind/solar developer, preparation of a report to support the refinancing of a solar portfolio in SERC, an in-depth market study supporting a US nuclear power plant portfolio transaction, a buy-side market assessment for a portfolio of combined-cycle gas turbine plants (northeast US), and a property tax assessment in the WECC for a gas-fired power plant.Educated in chemical/environmental engineering, applied economics, and technology policy, Barclay holds a BS from Bucknell University, an MA from Johns Hopkins University, and MS degrees from both Clemson University and the Massachusetts Institute of Technology (MIT).

Douglas Giuffre

Douglas has more than 15 years of energy industry experience, with expertise in supply and demand forecasting, demand response, and capacity markets. He is the lead author of the Northeast Power Market Briefing, PJM Power Market Briefing, and North American Power Market Outlook. Prior to joining S&P Global, Douglas was a research economist at the Beacon Hill Institute, where he specialized in regulatory policy issues, including tax incentives for renewable energy.He holds a Bachelor of Arts from the University of Massachusetts and a master's degree from Suffolk University, United States.

A new visualization of power market evolution: Examining the impact of renewables and battery penetration on North American power markets with data-driven analytics (Americas/EMEA)

November 17 2020 | North America We introduce our newest data analytics solution, North American Power Analytics (NAPA), a powerful interactive tool built around hundreds of power...