Published September 2024

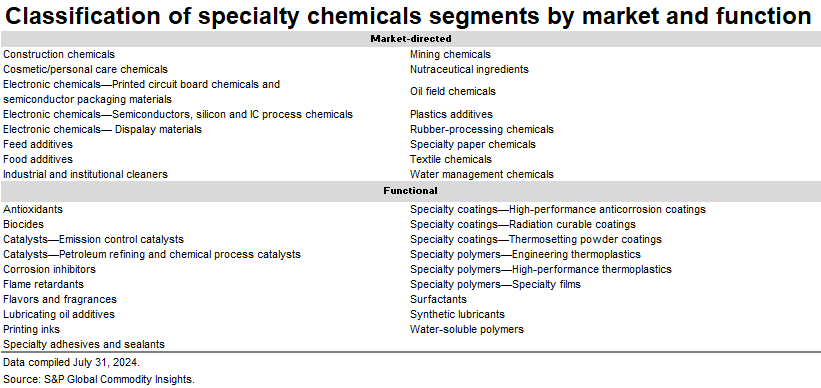

Specialty chemicals can be single-chemical entities or formulations whose composition sharply influences the performance and processing of the customer’s product. This report covers 28 specialty chemical segments categorized either as market-oriented products (used by a specific industry or market, such as electronic chemicals or oil field chemicals) or functional products (groups of products that serve the same function, such as adhesives, antioxidants or biocides). There is considerable overlap in this method of characterization. Market-oriented groups often include numerous functional chemicals used by the same market, while functional chemicals typically are used by several different markets. This distinction is made for convenience in discussing strategic aspects of the business segments rather than because of a real difference in the products.

The specialty chemicals covered in the report are listed in the following table:

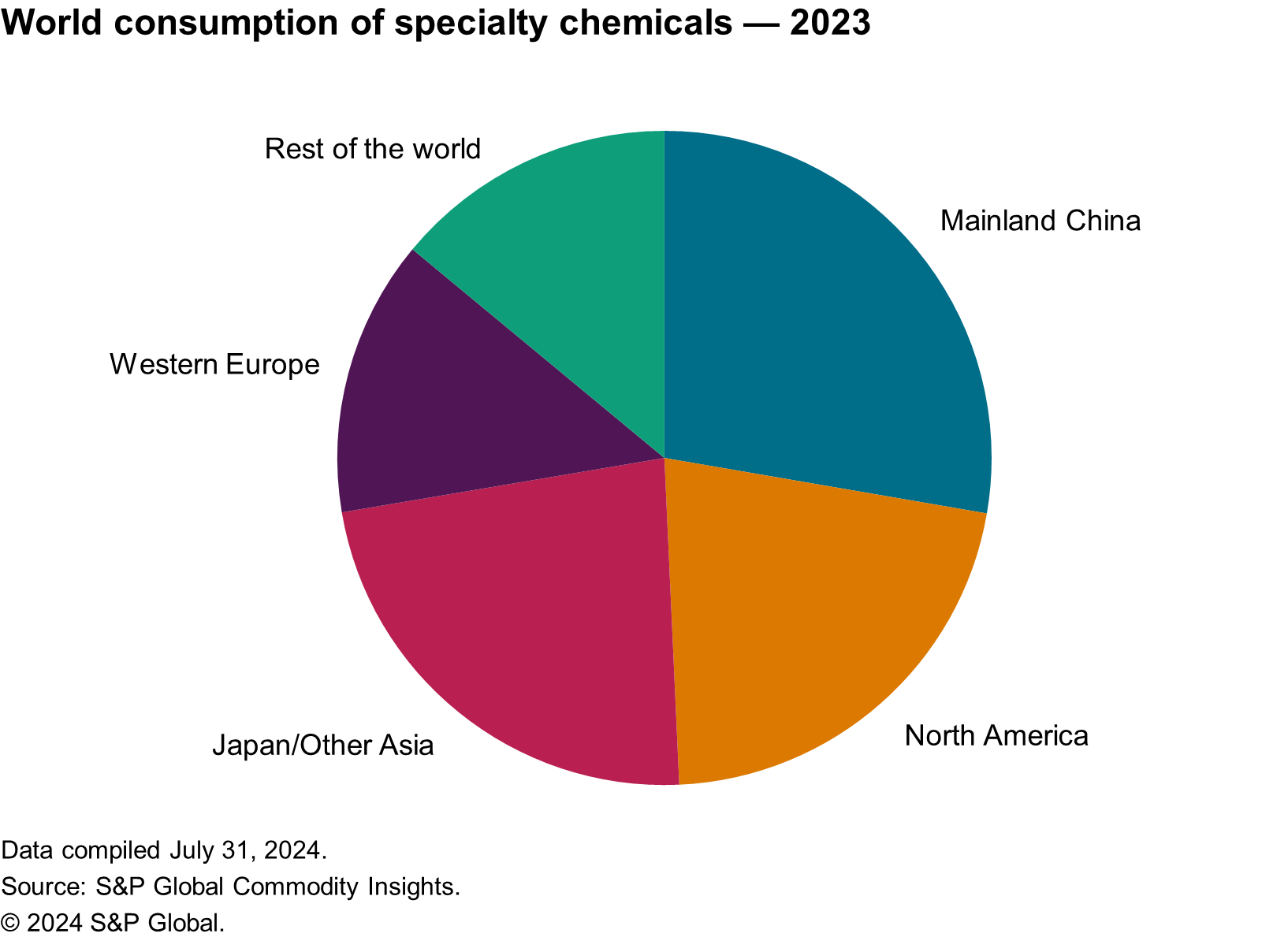

Mainland China and North America are the largest markets for specialty chemicals on a value basis.

In 2023, the world’s five-largest specialty chemicals segments — electronic chemicals, specialty polymers, industrial and institutional cleaners, water-soluble polymers and construction chemicals — had a market share of about 38%. Each specialty chemicals business segment comprises several subsegments, each with individualized product, market and competitive profiles.

Mainland China is the largest consumer of the following specialty chemicals: antioxidants, catalysts for petroleum refining/chemical processes and emission control, high-performance anticorrosion coatings, thermosetting powders, coating construction chemicals, electronic chemicals for display materials and printed circuit boards and packaging, feed additives, flame retardants, flavors and fragrances, paper chemicals, plastics additives, rubber-processing chemicals, specialty adhesives and sealants, specialty polymers (compounded engineering thermoplastics and specialty films), textile chemicals, water management chemicals and water-soluble polymers.

North America is the leading consumer of biocides, cleaners for industrial and institutional, corrosion inhibitors, cosmetic/personal care chemicals, food additives, high-performance thermoplastics, lubricating oil additives, oil field chemicals, printing inks, surfactants and synthetic lubricants.

Western Europe leads in radiation-curable coatings consumption. Other Asia has the highest consumption value for chemicals in semiconductor fabrication and nutraceutical ingredients. The Middle East and Africa region is the largest consumer of mining chemicals.

In the past, specialty chemical companies sold their products on value. Their products represented only a small portion of the cost structure of their customers’ products. Advances in supply-chain management, strategic sourcing and ecommerce have increased transparency and customer awareness. As a result, the specialty chemicals industry is becoming more commodity-like in some areas as companies sell certain products on price rather than on performance. The specialty chemicals industry is now trying to improve its margins by implementing price increases to compensate for higher R&D, energy and raw material costs.

Some specialty chemical companies are trying to raise barriers to entry into their markets by becoming more serviceoriented. They are focusing less on products and more on support services and specific customers. Providing services alongside products has long been the way to do business in some specialty chemical sectors, including automotive coatings, fluid catalytic cracking catalysts, pharmaceutical ingredients and water treatment. However, as more sectors wrestle with slowing growth rates and encroaching commoditization, more specialty chemical companies have increased the service component of their portfolios.

For more detailed information, please see the table of contents listed below.

S&P Global’s Specialty Chemicals Update Program – Overview of the Specialty Chemicals Industry is the comprehensive and trusted guide for anyone seeking information into this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Specialty Chemicals Update Program – Overview of the Specialty Chemicals Industry has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade and economics.

This report can help you

- Identify the competitive environment and key players

- Assess key issues facing both suppliers and their end-use customers

- Understand industry integration strategies

- Keep abreast of industry structure changes, regulatory requirements and other factors affecting profitability

- Identify new business opportunities and threats

- Follow important commercial developments

- Recognize trends and driving forces influencing specialty chemical markets