S&P Global upstream consultants apply industry experience with in-depth analysis, using our world-class databases, research and tested methodologies to assist clients in developing and evaluating choices for major asset, business unit, and corporate decisions. Our strategy development process is tailored to the capital allocation decision-making processes of most oil and gas companies to help them make informed decisions on how to optimize assets or portfolios.

Anticipate the future business landscape and develop winning business strategies with guidance for:

- Asset strategy – Evaluate key assets (costs, resource base, upside potential, fiscal terms) and recommend ways to optimize the commercial results from the assets

- Corporate strategy – Develop appropriate strategic growth options and test the risk and reward aspects of each under different scenarios. Formulate strategies and tactics to implement strategic goals.

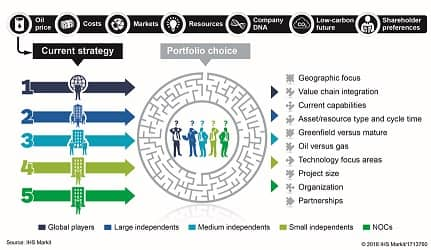

Strategy & portfolio choices

Click to Enlarge

In an increasingly uncertain E&P environment, with sustained low oil prices, squeezed margins and limited capital availability, oil and gas producing companies must optimize their portfolios to remain competitive.

S&P Global upstream oil and gas consultants work closely with you to conduct a thorough analysis of your current portfolio and assess strategic options, with the aim of establishing an optimal portfolio based on your company's starting position, competitive advantage and goals. We will detect portfolio-wide risks, assess where synergies exist or can be found, and identify acquisition and divestment opportunities.

We help clients answer questions such as:

- How do I balance value creation and production/reserves growth?

- How should I allocate capital across my portfolio to meet my objectives?

- What is the right asset class mix?

- Are the dynamics of my portfolio complementary or dysfunctional, and how do I improve them?

- How do I manage risk and reward across my portfolio?

- Which geographies/countries provide optimal investment places for my company?

- Which assets should I divest?

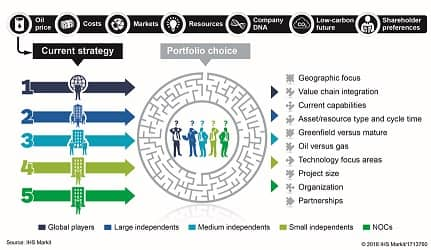

Strategy & portfolio choices

Click to Enlarge

S&P Global upstream consultants help E&P companies and investors in upstream oil and gas find new opportunities, ranging from entry to new countries and basins, to identification of assets and companies for acquisition. We identify, characterize, evaluate, screen and prioritize country, basin, asset, company and partnership opportunities.

Opportunity identification, screening and analysis follows a structured process analyzing various metrics, sourced from robust S&P Global databases and supported by our consultants' expertise and use of established methodologies.

Current market conditions highlight the need for E&P companies to better understand their operational and financial performance relative to competitors. S&P Global upstream consultants use in-house proprietary databases – among the world's largest - and the most advanced software tools available to offer independent, transparent and reliable analysis that can help you benchmark against your peers and improve:

- Financial and operational performance

- Project performance, scheduling and cost overruns

- Portfolio risk and reward

We help clients answer these types of questions:

- How does my company/business unit compare to those of my peers?

- What are the best comparable metrics and KPIs to use as comparisons?

- What are the "best in class" performance areas in my company?