Article: Chile report July 2020 - Sulphuric acid market and Covid-19

In Chile there has been a rise in the cases of coronavirus over June and July, and 2,621 mining workers in the country were reported to have been infected by 26 June with 969 recoveries, and a reported 48% of the mining sector workforce demobilized, according to the Ministry of Mining data. In late June Antofagasta was the hardest hit region in Chile by the coronavirus, with 7,700 confirmed infections and a reported 128 deaths by 26 June.

Chilean mining saw minimal reductions to production up until late June despite the pandemic, with Cochilco in June estimating a reduction of around 200,000 t copper produced translating to a decline of around 3.5% in FY2020 from previous estimates. However, the delay in new production capacity due to the stoppages to new projects will be felt in the coming years. Among halted construction and expansion projects in Chile are the Teck Resources Quebrada Blanca phase 2 project, the Antofagasta Minerals INCO (Los Pelambres expansion) project, as well as Codelco's Rajo Inca and Chuquicamata. The share of workers involved in mining expansions demobilized stood at a reported 90% in late June.

The price of copper strengthened following the concerns over supply from Chile going forward, buoyed by the robust demand for the metal from China. The copper concentrates market was also tightened due to many mines not running at capacity due to increased safety measures to curb infection rates, and while rates in Peru were ramping up over June and July, they still remained below usual levels of production. This resulted in reports of a copper shortage for Chinese smelters in July and August.

The main copper producing region of Antofagasta in Northern Chile where mining accounts for 70% of the economy has been the hardest hit by the spike in coronavirus infections seen in June-July, with Calama the city with the highest number of infections. On 23 June a total number of mine workers infected with coronavirus in the Antofagasta region stood at 1,263. Local quarantine measures were instated in the cities of Antofagasta, the capital of the region of the same name, and Mejillones.

This prompted Codelco to not only halt the construction of all new projects and expansions with these being the main operations in mining where the workforce is required to travel, but also to reduce its workforce at its Chuquicamata operations to a minimum at least from late June to at least 2-half July, impacting both the mine and the smelter. A volume of 40,000 t sulphuric acid production was estimated to be lost during the closure of the smelter over the minimum period two weeks, which offered some small measure of relief to tank space at Mejillones. Chuquicamata was reported to be operating with 45% of the workforce following the rise in infections in the region of Antofagasta and the city of Calama where a 90% of the workforce is reported to live. Chuquicamata also moved to a 7-days on, 7 days off rota system.

While the Calama El Loa airport remained in operation, Codelco announced 29 June that none of its local mining operations would use El Loa airport from 1 July while infection rates in Calama remained high. This applied to direct employees of the company and the measure has been recommended to sub-contractors. Codelco's charter flight would only be used in exceptional circumstances. Some private mining operations continued to fly in workers however, with BHP Billiton reported to have re-routed workers through Antofagasta airport due to the high number of infections in Calama, as well as issuing workers with social distancing guidelines during travel. BHP was also reported to have instated further safety precautions at its Escondida mining operation following 150 workers testing positive for the coronavirus. Other mining operations in the region include Codelco's Rodomiro Tomic and El Abra, Antofagasta Minerals operating the Centinela mine, the Anglo-American/Glencore JV Collahuasi mine, and Glencore's Lomas Bayas.

The region of O'Higgins where Codelco's El Teniente is located was the second-hardest hit region in the country in late June-July, with a number of 705 confirmed infections on the 25 June. Additional hygiene measures and a 14 day of, 14 days off rota were instated at El Teniente to halt the spread of the pandemic.

The CEO of Codelco stated at the beginning of July that any further restrictions placed on its mining operations would be catastrophic for the Chilean economy. Copper output and shipments held steady in April and May according to the state producer, despite the growing number of infections. Unions indicated a number of around 2,300 of Codelco's workers having been infected and calls to introduce further measures were growing. The economic cost of the shutdown of the Chuquicamata smelter and reduction of the mine's workforce down by as much as 50-55% was estimated to cost the producer $7 million per month- with the smelter closure meaning that exports of refined copper cathode would need to be replaced by copper concentrate, missing out on margin. Some analysts expected the earlier forecast of 200,000 t of lost copper production in FY2020 due to covid-19 now at a minimum of 320,000 t, with potential for further decreases if stoppages persist.

The announcement from worker unions of AES Gener, the main electricity provider for Northern Chilean mining operations, from Monday 13 July members would go on strike due to the increase in coronavirus infections among workers- with miners impacted by the strike named as Codelco's Northern operations, Escondida and Spence. The strike action was later called off following negotiations, but the threat illustrates the concern among unions over the level of protection of workers from infections.

More disruptions in Chile on sulphuric acid demand are expected with several mines reducing operating rates to adhere to social distancing measures as coronavirus infections have increased in the country. More than 1,500 mine workers had reportedly been infected by mid-July, with more than half of those employees of Codelco, with 60% of infections at El Teniente and Chuquicamata. The second mining company in numbers of infected workers was reported to be BHP, followed by Antofagasta Minerals.

As a result of having to reduce workers able to safely operate on site, BHP's Escondida offered workers a voluntary redundancy payout applicable in July 2020 only. Lundin Mining's Candelaria copper mine also decided to reduce its workforce by 7% according to the worker's union representing the mine's supervisors. The union was reportedly notified of the restructuring of the workforce as a response to the global pandemic this Monday 13 July, in what is understood to be a permanent move. The union is set to begin negotiating with management in August on new worker contracts.

A further risk factor was from employment contracts set to run out at the end of the summer and negotiations being particularly difficult with the pandemic restrictions and constraints in place. The worker's union at Luksic Group's Zaldivar mine in the Antofagasta region indicated a strike will take place this Wednesday 15 July following 99% of members rejecting the offer made by management on employment contracts. The Centinela mine is also going through the process of negotiating employment contracts, with a risk of a strike action remaining.

In the latter part of July, some medium-sized copper producers were reportedly having difficulties in resuming production due to a lack of available personnel due to the pandemic, while most mining operations were operating at lower levels, which also reduced sulphuric acid demand.

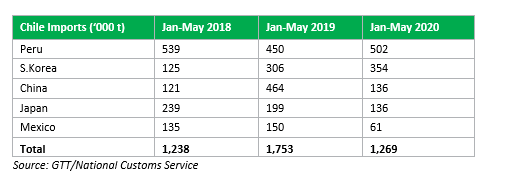

Only two sulphuric acid vessels have been identified as arriving in June- late July from outside Peru, with Far East suppliers seeing lower demand from Chile than previously expected. The line up of vessel arrivals at Mejillones port has been maintained over June and July on the back of what are believed to be delayed contract shipments from Peru following the earlier lockdown due to covid-19 limiting Peruvian operations in 2-half March and April. As a result of decreased consumption of sulphuric acid by Chilean industry over recent months, tank space at Mejillones port has become extremely limited with several imports cargoes having been re-directed and domestic prices seeing downward pressure. Even the closure of the Chuquicamata smelter has not been sufficient in easing the glut of product at port, despite at least 80,000 t of local production having been lost so far due to the extended closure of the smelter. Any further shutdowns of mining facilities or strike action over employment contracts would likely serve to further increase the oversupply of sulphuric acid, soften local pricing and potentially place further downward pressure on Far east fob pricing due to lack of export outlets for product.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.