Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 08, 2019

Crude Oil Trade: Nigeria shipped less in October, but demand for Suezmax increased

There is no doubt that the construction of the 650,000 b/d Dangote refinery in Nigeria will be a landmark both for the oil industry in West Africa and the shipping sector. Once completed, this will be the world's largest single train refinery, complimented by petrochemical and fertilizer projects, with the refinery's by-products to be used as raw materials. The refinery, located at the Lekki Free Zone near Lagos, is not expected to be operationally ready before the end of 2020, a year later than originally planned. The main obstacle has proved to be importing steel and other equipment required. The refinery's CEO has recently mentioned that the refinery tank farms are scheduled for completion by the end of December 2019. Being connected to five SPMs (single point mooring buoys), the refinery could start receiving crude and pumping refined products back into tankers. Refining operations will commence in early 2021, around two months after the mechanical completion of the refinery. However, the market still remains sceptical around what to expect, with some experts suggesting that full scale commercial operations at the refinery could start in 2022.

The plan includes the refinery to deliver its fuels to the Nigerian market, effectively replacing all imports of fuel once fully operational. Dangote's officials clarified that fuels would be carried domestically on shuttle tankers to Warri and Calabar, while the Lagos state government has been investing in roads and other infrastructure to aid shipments. The refinery also plans to export diesel of high quality (meeting European winter standards), gasoline and other refined products to Europe and Latin America on tankers as large as Suezmax (LR3). This will cause a significant shake in the market, especially for European refineries that have been traditionally supplying gasoline to West Africa. Meanwhile, the Dangote group has also been exposed to sugar and molasses, with a plant in Adamawa state under its control. The company now considers producing ethanol as well, having the required facilities at its refinery to blend ethanol with fuel. Based on current plans, the refinery could have an annual production of 10.4 million tonnes of gasoline, 4.6 million tonnes of diesel and four million tonnes of jet fuel.

Bearing in mind West Africa has been importing more than 1.1 million b/d of refined products while exporting crude oil, the impact on demand for shipping could be enormous. There is a major downward correction expected once operations approach full capacity. Assuming that most Nigerian crude oil will be refined domestically, trade flows to Europe and Asia will decline fast, with a significant gap to be filled, most probably by additional volumes coming from American suppliers, including the US and emerging South American producers such as Brazil, Colombia and Guyana.

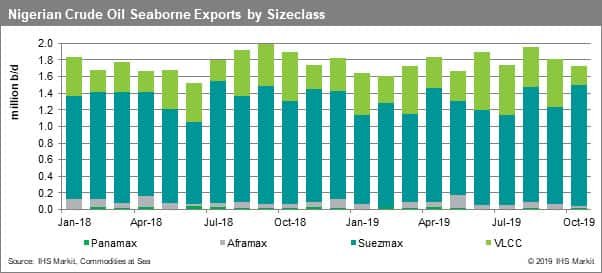

As data by IHS Markit Commodities at Sea shows, Nigeria has primarily been shipping crude oil to European countries, primarily Spain, Netherlands and France, while Asian importers have an increasing market share that cannot be ignored. Flows to the US have been under pressure earlier this year, with some recovery to observe during 2019 Q3. October volumes have been pushed lower, having fallen below 1.8 million b/d for the first time since late July. But quite interestingly, demand for shipping on Suezmaxes seems to have increased last month, with loadings having surpassed 1.45 million b/d for the first time since July 2018. This means that almost two Suezmax ships were fully loading in Nigeria on a daily basis throughout October. The trend followed by VLCCs has been quite different, with average volumes only reaching 236,000 b/d, less than half the volumes of 550,000 b/d loaded on VLCCs on average during 2019 Q3. This means that there were only four full cargoes for VLCCs in Nigeria last month. Charterers seem to have preferred loading on Suezmaxes, as VLCC rates went through the roof much faster following the US sanctions on COSCO tankers. Spot rates for both size segments have been falling quickly during the last couple of weeks, with the correction expected to last. We expect market shares to shortly return back to normal levels, with Suezmax loadings to drop back to around 1.2 million b/d (three vessels every two days) and close to 500,000 b/d for VLCCs (one full cargo every four days).

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcrude-oil-trade-nigeria-shipped-less-in-october.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcrude-oil-trade-nigeria-shipped-less-in-october.html&text=Crude+Oil+Trade%3a+Nigeria+shipped+less+in+October%2c+but+demand+for+Suezmax+increased++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcrude-oil-trade-nigeria-shipped-less-in-october.html","enabled":true},{"name":"email","url":"?subject=Crude Oil Trade: Nigeria shipped less in October, but demand for Suezmax increased | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcrude-oil-trade-nigeria-shipped-less-in-october.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Crude+Oil+Trade%3a+Nigeria+shipped+less+in+October%2c+but+demand+for+Suezmax+increased++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcrude-oil-trade-nigeria-shipped-less-in-october.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}