Digital agriculture - traversing the intrinsic vs novelty value of emerging technologies

We live in a connected world. This is driven by the powerful technology trends informed by the continuing rise in processing power, storage, and bandwidth at ever-lower costs along with "the rapid growth of cloud, social media, and mobile computing; the ability to analyze Big Data and turn it into actionable information; and an improved ability to combine technologies (both hardware and software) in more powerful ways — make it possible to realize more value from connectedness"1. All vocations are impacted by the trend. This includes agriculture where the pressure to drive productivity, reduce costs through judicious use of inputs and improve employee productivity are central to driving competitiveness. From equipment automation to data collection and analysis, the digital evolution of agriculture is giving progressive farmers effective tools to benefit their enterprises.

Auto-steer systems developed for example by Volvo, which use GPS receivers to ensure that following cane harvesting, the stubble is not trampled over by the self-steering truck collecting the harvested cane and thereby potentially increasing ratoon crop yield by 12%. Similar systems developed by the start-up Bear Flag keep rows straight and avoid gaps or overlap, for a range of equipment from tractors to harvest combines to sprayers with 100-foot-wide booms. Precision seeders and fertilizer systems can be satellite-guided to accuracy of an inch or less. Add to this the development in driverless farming equipment using sensors (lidar, radar and digital video) similar to those in autonomous road vehicles, the prospect of addressing labour shortage and carrying out tractor operations around the clock is becoming a reality.

The rise of digital farming technologies such as remote sensors, satellites and drones backed up by artificial intelligence-based tools has given farmers access to wealth of data distilled into trends/insights from which they can both monitor a range of crop production parameters (e.g. plant health) and make critical, timely, and in-field decisions promptly, and thereby optimise crop productivity. Through its FieldView™ and FarmRise™ platforms, Bayer is supporting farmers in both the developed and emerging economies with digital solutions. In the latter case, it is targeted towards smallholders whereby they are supplied with key agronomic information through their mobile devices to help improve their operations.

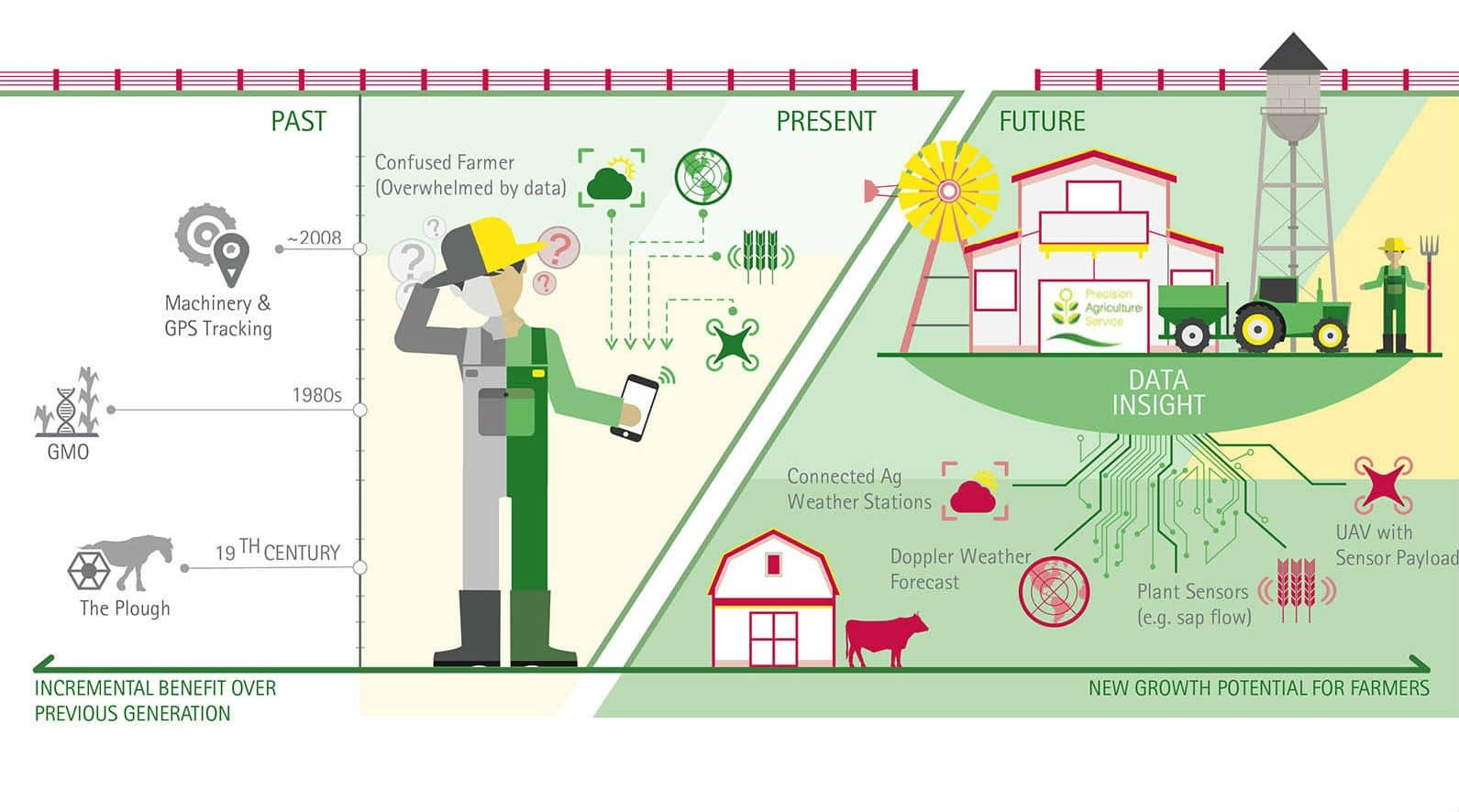

The evolution of digital agriculture

Image Source: Accenture

At the moment, the rate of adoption of digital agriculture is slow. At an agric tech event I attended recently, the Managing Director of 6000- hectare enterprise suggested two reasons for the slow uptake. Farming operations first need to be at the very top end as automation is driven by profitability. Even under these circumstances, investment is not compelling as tractor operations represent only 4-5% of the cost. Further, agriculture production systems are complex by their very nature, affected as they are by weather, plant genetics and nutrition, soil type, pest and diseases complex, which have made digitizing more difficult. Yes, sensors are available that support farmers to optimize irrigation and fertilizer use through cloud-based analytics platform via their mobile devices. But these sensors do not support the entire value chain. For example, in sugar beet production, AI technology is not yet refined to distinguish two diseases (rust and cercospora) at an early stage due to the challenges in the calibration of spectral data.

Finally, farmers are generally conservative in their nature. Well remember, in the '80s there was a multi-lateral supported agricultural development project in Sokoto state where irrigation over 25,000 hectares supported the production of three crops. Farmers made enough money from one crop to maintain their life-styles rather than break their backs making money. It is not that the farmers in the west do not value the strides made in digital agriculture, it is simply what value they can extract it from the investment. It appears, that technologies for agriculture still need to go through some maturity phase.

Arvind Chudasama | Editor - International Sugar Journal arvind.chudasama@ihsmarkit.com

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.