Article: Elanco and Bayer - Animal heath’s largest ever acquisition is a done deal

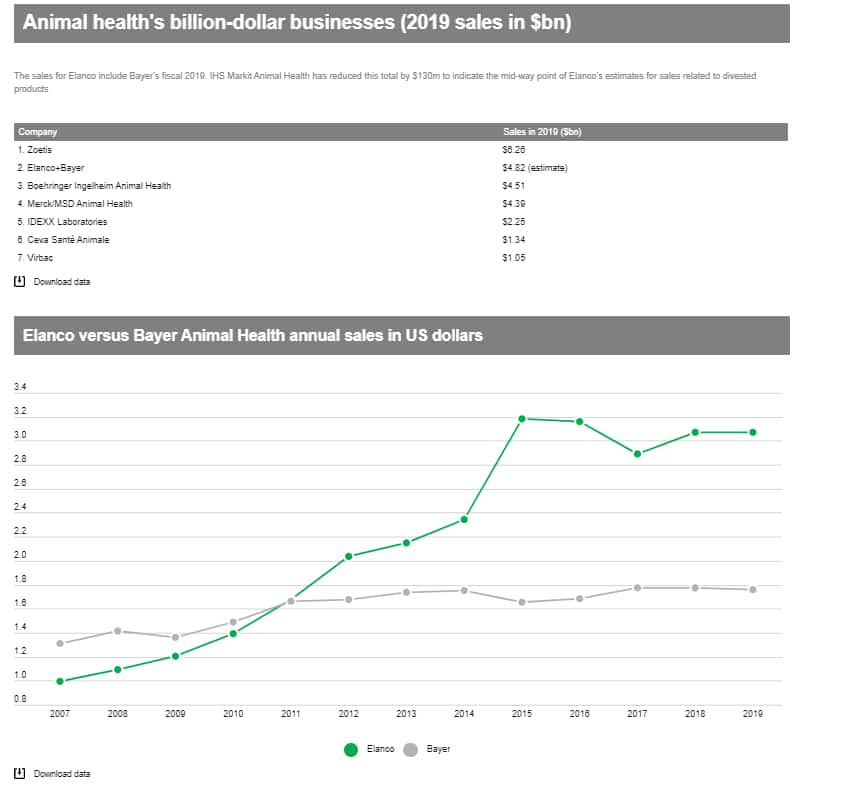

Elanco has closed its purchase of Bayer Animal Health - a deal that is expected to propel the former to second in the industry rankings.

The transaction was valued at $6.89 billion. This was funded by $5.17bn in cash and 72.9 million shares. These shares will be subject to a lock up clause, whereby Bayer cannot sell any of them for the first 90 days. In the second 90 days, 50% of shares are eligible for sale and the remainder may be sold after 180 days.

The fee is smaller than the $7.6bn that was originally signposted when the deal was first announced. Elanco told IHS Markit Animal Health this change is based on the difference in Elanco's stock price since the deal was first struck. Stock received by Bayer was subject to a 7.5% symmetrical collar centered on Elanco's volume-weighted average price for the 30 trading days ended August 6, 2019 of $33.60.

Elanco has also completed all the anti-trust product divestments that were required to finalize the Bayer transaction. The divested products had 2019 revenues in the range of $120 million to $140 million.

As well as being the industry's largest ever acquisition, it is also the animal health deal that has witnessed the most public and media scrutiny. Previous multi-billion-dollar transactions - Elanco's purchase of Novartis Animal Health and Boehringer Ingelheim's capture of Merial - were not conducted by public standalone animal health businesses.

Since it was first announced almost one year ago, Elanco's reasonings for the deal and its ongoing anti-trust manoeuvres have been fully documented.

Employees of both companies have been taking to social media over the weekend to hail the deal that not only gives Elanco a much broader business platform but marks the end of more than 100 years of Bayer owning an animal health division.

The acquisition also signifies animal health's declining reliance on human pharma businesses. Boehringer Ingelheim and Merck are now the only major human health groups that retain animal health.

Benefits of the deal

The deal provides the combined company with the scale and capabilities to not only weather the current market insecurities linked to COVID-19 but to capitalize on animal health's long-term growth drivers.

Elanco now owns a broader omni-channel customer focus that encompasses its relationship with veterinarians and taps into Bayer's direct-to-consumer expertise.

While the two firms entered an agreement before the global consequences of COVID-19 were fully apparent, the transaction will enable Elanco to benefit from trends that have been accelerated by the pandemic - increased interest in access to pet care via online, retail, telemedicine and direct-to-doorstep sources.

The deal also allows Elanco to offer a 50:50 balance for the mix of products for companion animals and food animals. The purchase of Bayer has significantly upped Elanco's companion animal offering and nearly tripled the firm's international pet health business.

Elanco's pet parasiticide portfolio will be broadened with topical treatments and collars, while Seresto has become the company's top-selling product globally. Seresto registered revenues of €293m ($343m) in 2019.

Elanco will also benefit from Bayer's major cattle brands, global bio-protection portfolio and warm water fish products.

There are now five extra expected launch equivalents from Bayer in the Elanco pipeline. This means the company anticipates 25 new launches by 2024. Of these, five are expected by the end of 2021.

The deal also provides Elanco with new R&D capabilities that bolster its dosing and delivery technology platforms. The company has also gained access rights to Bayer's Crop Science R&D pipeline and de-prioritized clinical pharma assets.

Elanco said it plans to "leverage its extensive integration experience - and ownership mindset - to efficiently and quickly integrate the new business". The timing of achieving goals from the deal have been impacted by COVID-19. Nevertheless, Elanco expects to deliver $275-$300m in synergies by 2025.

Making advances in time of pandemic

Jeff Simmons - president and chief executive of Elanco - pointed out the deal was pursued and sealed in the shadow of vast barriers.

He stated: "Nearly two years into our journey as an independent company, we have made significant progress in creating a purpose-driven, independent global company dedicated to animal health - all while weathering the century's most significant animal and human health pandemics: African swine fever and COVID-19.

"Delivering on the timely close of the acquisition and bringing momentum into day one in this challenging environment underscores the deep capability and disciplined execution from both companies.

"This milestone is another key step in Elanco's journey. But, ultimately, today is about improving the lives of animals, people and improving the health of the planet. Pets and protein have never been more important. Food supply disruptions and increasing unemployment are driving food security challenges around the world. At the same time, research shows increased time at home has changed the long-term relationship between pets and their owners, as pets increasingly provide valuable emotional support. We know making life better for animals, simply makes life better."

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.