Global Feed Demand 2023

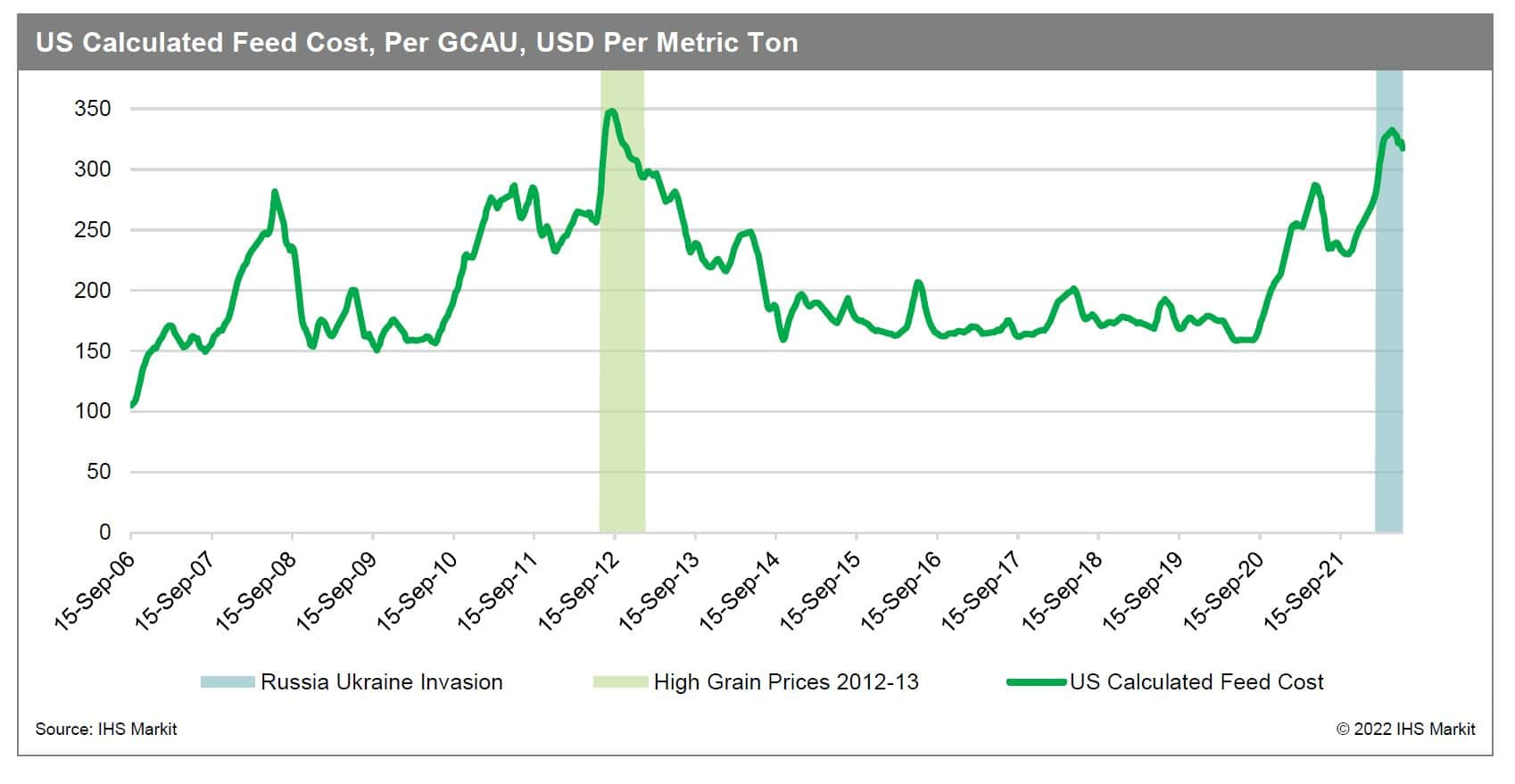

2022 has brought about a highly volatile environment across commodities markets. Inflation, which began during the pandemic and was exacerbated by the Russian invasion of Ukraine, has sent agriculture markets soaring. The prices of hogs, cattle, and poultry have all increased at a rate near or higher than their respective input costs. This has led to strong margins in the US and in most of the world. However, declining, and sometimes negative, margins are beginning to weigh on the livestock industry. Looking towards 2023, we expect a confluence of factors to reduce global livestock numbers. This is clear when examining each of the major livestock sectors.

Global Feed Demand is likely to fall in 2023

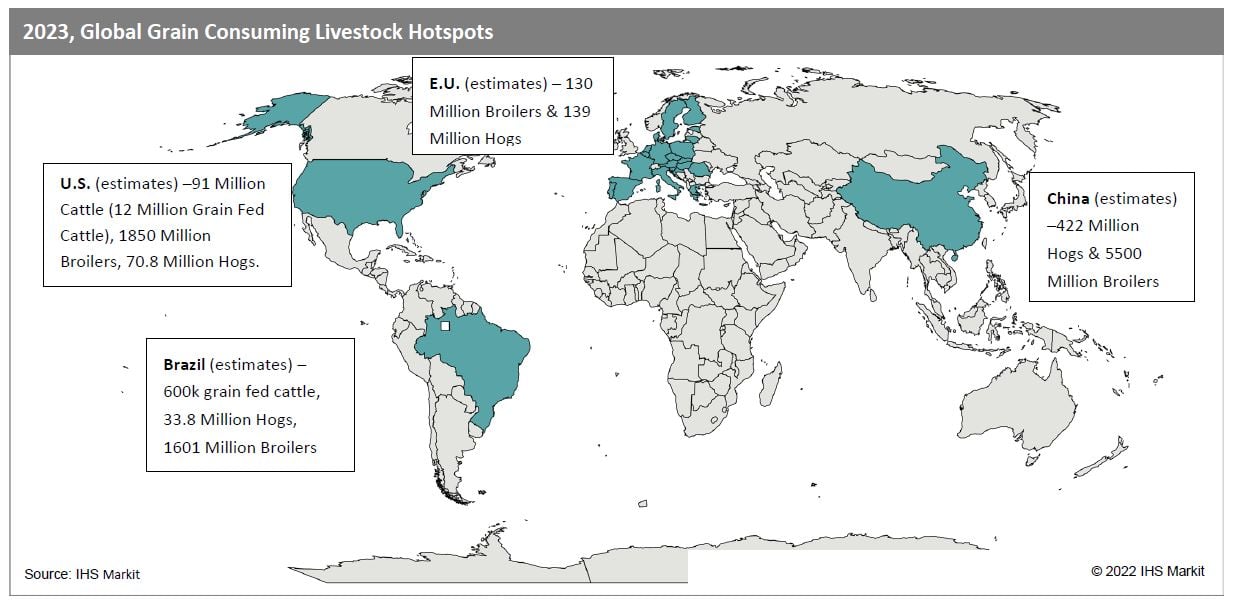

- US cattle herd, the world's largest grain-fed cattle herd, is in contraction.

- Hog herd is likely to contract in 2023 in the EU, US, and China.

- There were severe outbreaks of bird flu and HPAI in the EU and US, and poultry inventory is already down in these regions, further contraction is expected in 2023.

Download the Full Report with an anlysis of:

- Cattle - The U.S. has the biggest grain-fed cattle herd in the world, which is in contraction and likely to contract in 2023 as well.

- Hogs - Global Hogs inventory is likely to decrease in 2023 as the herd is in contraction in the EU and US.

- Poultry - Global broiler inventory is likely to contract in 2023 in Europe and USA as highly pathogenic avian influenza (HPAI) outbreaks loom.

- Recession, Inflation & Currencies - As inflation is high all around the globe and fear of recession continues to grow, what does it mean for protein demand and consumption?

- Effect on Grains and Meal Markets

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.