Blog: How will Covid-19 affect the global crop protection sector?

As part of a 'Day After Tomorrow' blue-skies thinking exercise we present some tentative thoughts about where the global crop protection sector may next be heading as it gradually looks beyond the initial impacts of COVID-19.

Summary

The key market trends would seem to be a continued sustained shift to biological solutions and decline in conventional Active Ingredients; and an increased predominance by China and India in the global Crop Protection market, particularly through generics and products coming off-patent.

There is also likely to be a spurt in protectionist measures and 'de-globalisation'. New technology development and adoption might be accelerated, albeit tempered by reduced availability of R&D finance. Farmland consolidation looks set to continue, which again might propel the growth of digital agriculture.

Key trends

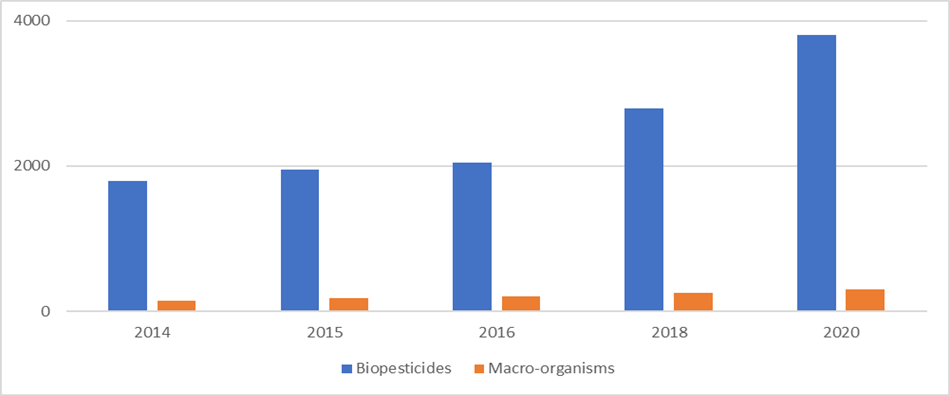

Increased trends towards sustainability and environmental solutions - such as biologicals. The COVID-19 pandemic might have a short-term impact on market growth but is likely to boost investment in biologicals as part of a wider shift to interest in food security and sustainable crop production and ensuring more robust supply chains. This should in turn drive interest in new product formulations for biopesticides and biostimulants.

Size of the Global Biologicals Market - estimated at almost US$5 billion in 2020 (IHS Markit)

Accelerate the loss of many existing Crop Protection products, especially in European Union. The requirement to re-register Active Ingredients (AIs) has been in place since 1991 (Council Directive 91/414/EC). However, this directive was replaced by stricter regulation in 2009 which instructed that any ingredient deemed to be mutagenic or carcinogenic at any level is withdrawn. Another important factor is efficacy. Whether the UK will diverge will depend on the type of Brexit deal with the EU and US that eventually emerges.

Many major companies outside India/China will likely place less capital into R&D in the short-medium term - they will instead focus on getting most promising actives in late-stage to market. Continued decline in the rate of new product introductions, growth of off-patent manufacturers and reduced share of new molecules in the market. Further stimulation of Indian generics production (once plants are fully back to capacity although exempted) and further out, increasing adoption of proprietary chemistries. This might stimulate domestic R&D efforts (already underway from a small base).

In the short term we will likely continue to see Chinese generic AI supply issues, that will to a small extent stimulate the use of proprietary formulations/patented chemistries. Once generic supply issues have improved, the economic impacts of COVID-19 will have begun to hit farm economics, so there will be significant downwards pressure on overall CP industry. Potentially this will be detrimental to innovation in the medium term, possibly delaying the uptake of biologicals and precision agriculture.

In addition to growth in proprietary formulations/patented chemistries, could there also be a stimulation in the demand for domestic generics? This would be particularly so in the US where President Donald Trump has regularly branded COVID-19 as the "Chinese virus". Will this lead to some farmers boycotting Chinese generics in the country, boosting the attractiveness of local manufacturers such as Albaugh/Gowan?

Or, on the other hand, will there be a recovery in the rate of introduction of new Crop Protection products as a result of new discovery technologies such as artificial intelligence and computational biology, such as faster development and application of gene-editing and CRISPR technology. There is likely to be some acceleration in the Chinese adoption of biotech, again already underway with the Syngenta acquisition by ChemChina acting as a stimulus, plus recent GM approvals.

Gene-editing will become mainstream in developing improved crop varieties, especially for qualitative traits, to increase the consumption of fruits and vegetables, and plant-based food in people's diet. Thus, the breeding company might be separated into trait design platform (which might be disrupted by a few boutique AgTech firms) and actual breeding operation contractors (the bread and butter of traditional seed companies). Acceleration of Digital Solutions is seen - especially to replace manual labour and weeding of crops in fields. This could reduce herbicide volumes with 'see-and-spray' robotics, and also attract new market entrants e.g. Bosch, Sony.

Consolidation of farms and farmland is likely to see an uptick after COVID-19. This may also drive the adoption of precision agricultural practices due to economies of scale. A longer-term trend may be towards 'domestic food security' which might involve more farm subsidies which then begin to increase proprietary market share again and the use of newer technologies such as biologicals and precision AgTech. This might have a flattened adoption curve, which may then accelerate later.

The digital platform currently owned by the seed/CP company might become independent since a more open and connected platform is important in order to maximize farmers profit. The more data fed into its algorithm, the deeper its reach. Contractors will also become an integral part of the platform who will provide the service to farmers or landlord, so the professional farmer may not own any land, but just own the production process affiliated with the platform.

View our special reports

Game Changers Gene-editing Technologies and their Applications 2020

Podcast

Listen to what a post-Covid-19 crop science market will look like

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.