Article: Novel Coronavirus 2019 Update - Impact on Chinese Pesticide Exports

Read below an article taken from our Phillips McDougall platform dated 31/03/20.

COVID-19 was first identified during an outbreak of pneumonia in Wuhan City, Hubei Province, China in December 2019. Investigations into the origins of the virus, its pathology and the way it affects humans are ongoing, and the situation is rapidly evolving, with the virus gaining significant momentum since our last report on the subject highlighted by the World Health Organization (WHO) declaring the outbreak a pandemic.

As part of this report, we aim to illustrate the impact of the outbreak on Chinese pesticide trade in the first two months of the year. It should be noted that all trade data contained in this report was derived from IHS Markit's Global Trade Atlas (GTA) database.

*Data derived from IHS Markit's GTA database

The above chart illustrates total pesticide (HS code 3808) exports from China for the first two months of each year back to 2010. Between 2010 and 2018 the value of such trade increased at an average annual rate of 13.5% per annum to reach approximately $881 million. Similarly, total volumes have also increased significantly, rising by 10.7% p.a. to reach 247,000 tonnes. The lower level of growth experienced in volumes highlights the improvement of prices of generic produce emanating from the country a contributing factor, with the environmental crackdown on agrochemical production in the country, requiring chemical companies to invest in costly pollution control and effluent treatment plant. In addition, a growing number of domestic manufacturers are becoming publicly traded and hence under pressure to increase profits for shareholders. The increased cost of production led to prices of generics products increasing and hence benefiting the global pricing situation. This has been a driving force behind global market growth in recent years.

Coming into 2019, however, we do see a significant decline in both value and volumes, falling by 14.0% and 8.7% over the previous year respectively. The 2019 market situation was impacted by the trade war with the USA and Canada, impacting the demand from North America. Also in North America, demand was impacted by detrimental weather in the US Midwest during the first quarter with severe cold temperatures and snowstorms followed by significant flooding delaying pre-season crop protection applications and spring planting. Elsewhere, unfavourable weather was also experienced in Europe with hot, dry conditions in northern and eastern parts impacting pest and disease pressure and liquidity remained an issue in Ukraine. In Asia Pacific, drought followed by flooding impeded potential in India; continued severe drought was experienced in Australia; and dry conditions in Southeast Asian nations reduced demand for agrochemicals.

As we move to 2020, we may have expected to see an increase in trade, particularly in North America where weather conditions are more positive in comparison to the previous year. However, as seen in the graph above, total pesticide exports have not only continued to fall from the highs of 2017/2018 but have declined at a rate in excess of that experienced the previous year; it is therefore clear that the coronavirus outbreak played a detrimental impact on shipments in the first two months of the year. Total volumes have fallen by 12.7% over the previous year to 226,000 tonnes, reflecting a decline of 18.7% to $616 million.

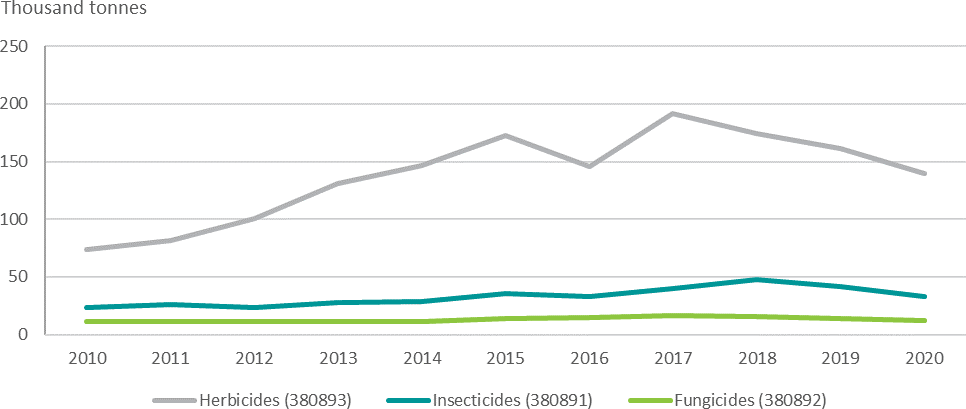

VOLUME OF CHINESE AGROCHEMICAL EXPORTS - JAN-FEB*

*Data derived from IHS Markit's GTA database (HS Codes)

At the product level, insecticides experienced the most significant decline in volume, decreasing by 21.0% over the first two months of 2019 to 33,000 tonnes; value fell by 16.3% to $156 million. Herbicides recorded the most significant drop in value, declining by 22.5% to $362 million with volumes reduced by 13.6% to 140,000 tonnes. In contrast to the other product sectors, although still falling over the previous, the decline recorded for fungicide volumes was not as significant as that experienced between 2019 and 2018 - this can be attributed to reduced demand in key export markets (notably south east Asia and Australia) due to hot and dry weather limiting disease pressure. Volumes fell by 7.7% to 13,000 tonnes with the value of these shipments being down 14.6% to $72 million.

Conclusion

Although recorded mortality rates for COVID-19 remain lower than similar viral outbreaks in recent years (SARS/MERS) the spread of infection is significantly greater and as a result a number of major countries have entered lockdown, with only essential operations to continue. Therefore, the main impact of the current pandemic will be felt outside mainland China, particularly in the western hemisphere. With specific focus towards the agricultural and agrochemical sectors in these markets, although farming will remain largely business as usual with food production an essential industry, the effect of labour shortages (particularly in the EU) and reduced biofuel prices in the Americas will limit farmer income and hence expenditure on crop protection products, to the detriment to the market. The situation will also be constrained by the reduced export of generic products from China.

Looking to related sectors, our colleagues in Fertecon who track the global fertilizer sector expect a relatively limited impact on farm-level demand given the exception of the food supply chain to the lockdown policies across the globe. Major impacts are likely to arise from the physical availability of product at the right time in the right place as a consequence of logistical disruptions such as port closures as seen in China and India.

This situation is likely to be reflected in seed sales with demand remaining high for production in the food supply chain; indeed, according to data provided by Phillips McDougall's sister company IEG Vantage, global acreages of all major crops are set to increase during the 2020 season. However, looking towards the 2021 season when the industry may begin to recover, potential impacts on the seed industry will be an increase in farmer saved seed due to reduced incomes (notably so for cereal crops), and a shift away from GM varieties into conventional seeds due to pressure on prices.

The analysts across IHS Markit's agribusiness teams will, continue to closely monitor the ever-evolving situation and will provide updates when further data is made available.

This analysis is an excerpt from our latest Agrifutura report, provided by Phillips McDougall, our crop protection and seed intelligence service. To get ongoing access to analysis of the industry, including the latest coronavirus developments why not take a free demo of our service?

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.