COVID-19: Effects on the Fertilizer Industry

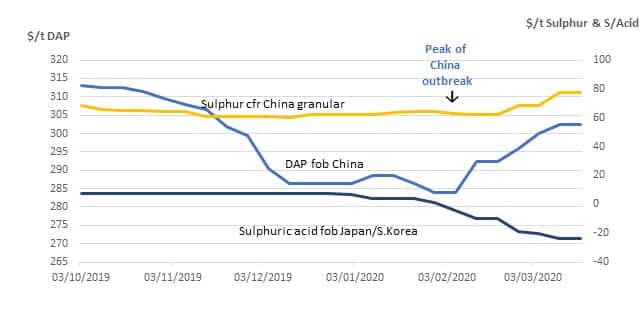

The world markets are currently reeling from the effects of the Covid-19 pandemic that is sweeping the globe. The fertilizer sector has been affected since the outset, primarily in China, the most significant producer and consumer for phosphates, sulphur and sulphuric acid, while going forward it could be Brazil and India that hit the headlines. The reaction on prices however has been mixed with tighter supply of phosphates, due to the production constraints in China, prompting a reversal in the downward trend while the price of sulphuric acid, already weak, has all but collapsed. In response to the increase in domestic phosphate prices since the outbreak, the Ministry of Agriculture and Rural Affairs has stated that it will closely monitor supply and price movement of chemical fertilizers to prevent the "unreasonable increase of prices". The outbreak of novel coronavirus in China has to date had the most critical impact across the Chinese fertilizer sector, affecting the movement of both fertilizers and raw materials moving in, out and around the country and particularly in Hubei province, the initial epicentre of the virus. Large swathes of industry were shut down from the end of January, limiting both demand and supply for all relevant products as transport and storage constraints presented mounting challenges across the sector.

The experiences of China over the past few weeks will be analysed closely as the virus increases its hold over other parts of the globe. In this vein it is worth looking more closely at developments in the Chinese market since the outbreak began in January to help try and gauge the potential impact to the wider fertilizer sector.

Production in China

The province of Hubei plays a pivotal role in the Chinese phosphate

industry as some 45% and 27% of the country's MAP and DAP capacity

respectively is located in Hubei. With a clear freight advantage

being located on (or close to) the Yangtse river and its barging

system, Hubei phosphate fertilizer producers have some of the

lowest costs for exports and for domestic shipments to NorthEast

China. The province also has around 30% of China's total phosphate

rock production, accounting for between 25-30 million

tonnes/year.

For nitrogen and potash, the region is less significant in terms of

production with just three urea producers in Hubei with a total

capacity of 2 million t. Nevertheless, annual demand ranges between

2.7-2.8 million t resulting in up to 1 million t urea is delivered

into the province each year. It has no primary potash capacity but

has high demand for MOP & SOP to supply large NPK compound

producers in the region.

As of mid-February, only four of the larger DAP and MAP producers in the Yichang region of Hubei were producing: Yihua, Xingfa, Sanning and Xangfeng, along with a few medium sized MAP plants. All other Hubei based phosphate plants had suspended production (or else were not allowed to resume production after winter turnarounds), representing approximately half of Hubei's phosphate industry. Producers elsewhere in the country had sufficient stocks of product to meet the emerging localized shortages in key demand areas ahead of the spring application season, meaning that operating rates outside of Hubei (e.g. in Guizhou or Yunnan) did not increase to compensate lower output from Hubei during this period.

Production rates fell to around 20-30% of total capacity causing

a significant impact not just on the supply of phosphate

fertilizers but also on demand for raw materials such as sulphur

and sulphuric acid. Hubei accounts for some 25-30% of all sulphuric

acid consumption across China. The lockdown in Hubei has caused

severe bottlenecks in the delivery chain for sulphuric acid leading

to storage constraints for many smelters all over the country. This

in turn led to some smelters having to reduce production levels to

contain the sulphuric acid inventory situation while reducing

ex-works prices of sulphuric acid to zero and below.

While demand for sulphur from the phosphate industry declined in

accordance with the curtailment of production, domestic sulphur

supply has also declined as refineries and gas plants in the

affected regions have cut back or suspended production in response

to a lower demand from the wider industrial sector. At Sinopec's

Puguang plant, production of sulphur was running at a lower rate

through February and much of March. With the uncertainties over

freight combined with lower domestic availability and anticipation

of improved domestic demand, delivered sulphur prices into China

have found some much needed support in recent weeks.

As of 10 March, those phosphate fertilizer plants that had been

shut down since January have been allowed to start proceedings to

resume production. Operating rates will be low to begin with while

production is ramped up and as such, normal activity is not

expected until April. This is providing much needed relief to the

copper smelting industry which has been faced with sulphuric acid

tanks reaching capacity against a backdrop of falling demand.

Wuhan, the epicenter of the Chinese Covid-19 outbreak, will finally

end its two month lockdown on 8 April, according to a statement by

the Hubei Provincial government while travel curbs for other parts

of the province will be lifted from 25 March.

Logistical Constraints

Logistical constraints have been the main challenge for all sectors

of the industry. During the peak of the outbreak the country was

divided into thousands of islands by the isolation policy. In a bid

to contain the virus, people and cargoes were separated between

provinces, cities, towns or even villages. The railway system has

continued to operate but loading & unloading have been

constrained by a shortage of labour resulting at one point in the

transport capability dropping by some 50%.

Trucking has been hit the hardest. Cross-border transport would

require drivers to be quarantined for two weeks if the road hadn't

already been blocked. Most adjacent provinces refused to admit

vehicles from Hubei. The option to barge product through the river

system remained viable but ports in Jiangsu, for example, refused

barges from Hubei to dock.

Logistics continue to remain a challenge for the industry and

although overall conditions have improved with roads no longer

blocked by local governments, there is still a shortage of labour

both for transportation purposes and at the plants themselves.

It will take some weeks still before normal activity across the whole industry is resumed, assuming there is no second wave of infection, and the effects will be felt for longer as the phosphate fertilizer plants try to capture what is left of the domestic spring season against a backdrop of still challenging logistical issues. In the meantime, supply of Chinese phosphates has tightened prompting prices to firm both in the domestic and export markets.

Global View

While the situation improves in China, CoVid-19 is moving across

the world, having now been declared officially a pandemic by the

WHO, creating a ripple effect through the global markets. The same

logistical issues are now being felt in other regions where the

virus is escalating, such as Europe, Asia and the Americas. The

emergence of confirmed cases in India is of major concern for many

industries and phosphate plants in India are already starting to

shut down. All over, borders are closing, vessels are being

quarantined and the movement of people and product is being

steadily constrained- including fertilizers and their raw

materials. As such further disruption is anticipated in the

fertilizer industry across other parts of the globe over the coming

weeks and months.

Looking across the globe, many countries have now put into place similar restrictions on movement as China in a bid to arrest the spread of the virus. As mentioned in the update above, the Chinese trucking sector was the worst affected form of transport due to the combination of higher labour requirement as well as the incidence of road blockages in a bid to quarantine whole regions.

Going forward it will be those countries more reliant on trucking that could be worst affected in terms of logistics constraints and the one that shines out is Brazil. The Brazilian transport system is heavily reliant on transport by truck and unlike China, has no back up in the form of a reliable river (barge) or rail system. The agricultural sector uses a backhaul system to transport crops across vast distances by truck to the ports and take back fertilizers and raw materials. After the general shutdown of truck freight in 2018, several companies acquired their own truck fleet, such as Bunge, Cargill and cooperatives, reducing the impact of a possible shutdown. According to data from the IHS Automotive, in the first bimester of this year, the sale of heavy trucks (bi-trains) used for handling grain has increased in relation to the last few years, as companies continue to acquire fleets. In relation to the ports, a standstill of independent dockers can generate a migration of cargo to own terminals, such as Coopersucar and Rumo, minimizing the impact.

To date, the logistics sector in Brazil has not yet been affected. A union of dockworkers in the port of Santos requested a halt to activities, but in a meeting on March 18th, decided to continue operations and periodically monitor the progress of Covid-19. The Brazilian government has since come out to state that logistics channels including ports will not be closed due to the spread of covid-19 and that it will endeavour to do all it can to prevent any disruption to the flow of key commodities and goods in the coming weeks.

There is now concern over the potential impact on a market such as India given its high population and from a fertilizer perspective, given its prominence as an importer, producer and consumer. In terms of logistics, India does not rely on trucks and instead uses its widespread rail network for the transport of goods across the country. In response to the outbreak, the government has just announced a lockdown in more than 80 cities and districts across the country including all domestic flights and passenger rail until the end of March. As yet inland freight transport does not appear to have been unduly affected although there will undoubtedly be some disruption to the transport system in the wake of current restrictions. However Indian ports have put in place a number of stipulations including strict 14-day quarantine rules for vessels arriving from affected areas. If the virus spreads and a more widespread lockdown is enforced, there will inevitably be some disruption to the movement of fertilizer and raw materials to and from ports and plant. Some plants, including Zuari, RCF and GSFC have announced curtailments or closures while many fertilizer plants are taking annual maintenance and therefore any disruption in the coming weeks could be mitigated accordingly but if the situation persists beyond April, it could affect the start of the Kharif season. All major ports have been advised to issue force majeure clauses in the event of circumstances preventing loading and discharging of cargo.

In the meantime any further weakening of the INR against the USD

will further erode margins for imported fertilizers and raw

materials.

Using the China model seen earlier this year, labour constraints

could cause most challenges going forward with transportation at

the forefront of this issue. Production is the other key area and

the Jordanian government is already reported to have already shut

down all industrial facilities until at least the end of March to

curb the spread, including JIFCO and JPMC's phosphoric acid/DAP

plant at Aqaba. Although JPMC was about to take its annual

turnaround at this time, there is no guarantee that the plants will

be allowed to resume production from early April. In contrast, OCP

has stated clearly it aims to maintain normal activity across the

platforms in the coming weeks.

Nevertheless, it should be remembered that over half the phosphate industry in Hubei was forced to suspend production at the peak of the outbreak in China and there is now concern over how plants in other parts of the globe may weather the crisis and there remains the real possibility of further curtailments in certain regions going forward. Any production curtailment and/or disruptions in supply chains and logistics will obviously have the effect of tightening the demand/supply balance and increasing the upside risk for fertilizer pricing. For raw materials the situation remains more complicated with additional moving parts but demand from the fertilizer side is likely to be compromised for the reasons above while supply, if generated from the energy sector, may also see some reduction.

This analysis is taken from our Sulphur Fertecon Futures report - part of IHS Markit's Agribusiness coverage. Fertecon offer in-depth analysis of varying Fertilizer markets, including current information, trade data and forecasting for prices, costs, supply & demand.This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.