Blog: How animal care industry leaders are working to drive growth

The quest for innovation in the global animal care industry has been accelerating tremendously over recent years as the leading companies develop strategies to offset the maturation of their product portfolios while working to diversify the ways they offer complete health solutions to veterinarians, livestock producers, aquaculture professionals, and pet owners.

In a new Animal Pharm and Stonehaven report called Growth Drivers 2020-2030, industry expert Joseph Burkett outlines the evolution of the traditional animal health industry into what is now being described as the animal care industry, and its likely transition over the next decade in the wake of COVID-19 impacts.

The author analyses the forces that have led to an increased emphasis on new approaches to accessing innovative products and technologies via partnerships, collaborations, acquisitions, or other means. It also dives into a number of potentially transformational technologies and trends that hold promise for driving the growth of the animal care industry to 2030.

These include acceleration of the adoption of telemedicine; on-line shopping and home delivery; digital solutions such as trackers; wearables that monitor vital health signs; implantable devices; artificial intelligence; and what is called "Big Data."

COVID-19 impacts

It is important to note that most of this report was researched, developed, and written prior to the emergence and the known scope of the COVID-19 crisis. As such, an introductory "chapter zero" has been added to the report to acknowledge the many implications that have become apparent for the animal care industry due to the virus.

The added chapter attempts to outline several short-term, mid-term, and longer-term effects that have the potential to fundamentally alter various aspects of the animal care ecosystem for certain stakeholders throughout both the companion animal and farm animal sectors. Readers are encouraged to take into account the ongoing evolution of the COVID-19 scenarios as the dynamics change over time.

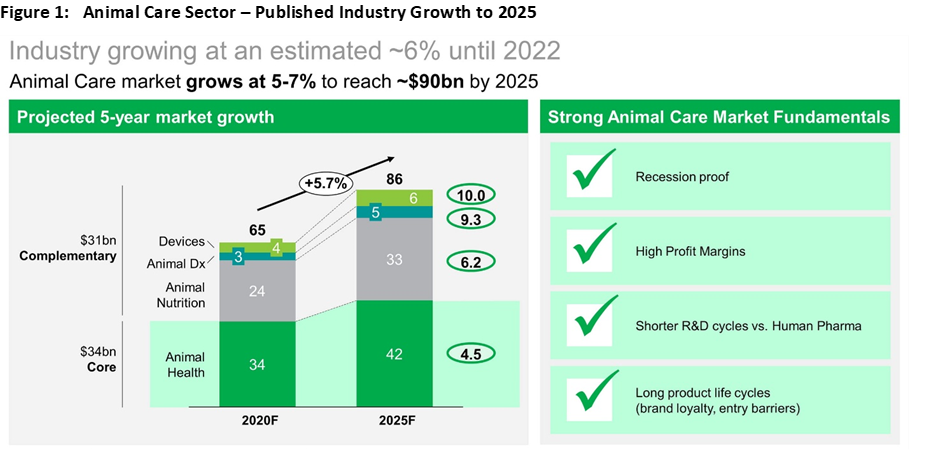

However, the basic premise of this report - that the animal care industry will continue working to drive growth in the coming decade by endeavouring to leverage transformational technologies and trends - has ongoing relevance and remains an important element for industry growth. As a result, we still see the industry growing by 5-7% per annum to reach $90 billion by 2025 (Figure 1).

Structure and Contents

The first section gives an overview the animal care market that developed as a result of the decades of consolidation that has taken place throughout the industry and the move toward adjacent and synergistic market segments such as nutrition, diagnostics, and digital technologies.

This section includes a particular focus on the latest large transaction to be announced in the form of Elanco's pending acquisition of Bayer's animal health business. Following that description of the market and its opportunities, a handful of high potential areas of focus are highlighted, including:

• Nutrition and diagnostics, with emphasis on how some of the major competitors in animal care are finding and capitalizing on the synergies these industry segments bring to their core businesses;

• The digital revolution, including digital technologies/wearables, as well as their place in the animal care segment;

• The role of data and artificial intelligence in the animal care market;

• How classical innovation will continue to grow and prosper as the central mechanism for meeting unmet medical needs in animal health; and,

• The human health/animal health crossover, including technologies like cell and gene therapy and precision medicine.

Finally, the last section of this report describes how he start-up company investment ecosystem and its role in bringing new technologies to the forefront of animal care - in addition to the ongoing investments in all of these technologies, trends, and factors - will support the animal care market's evolution over the next decade.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.