The global agricultural insect pheromones market sees major growth amid rising acceptance of sustainable agricultural practices

The agricultural insect pheromones market is accelerating as agriculture looks to more sustainable, less environmentally impactful pest control solutions.

The phasing out and bans on insecticides in different regions will continue to drive the growth of the agriculture pheromones market. The consolidation of the biological pest control industry is continuing in general, and companies in the pheromone sector will be prone to consolidate and merge in the next few years.

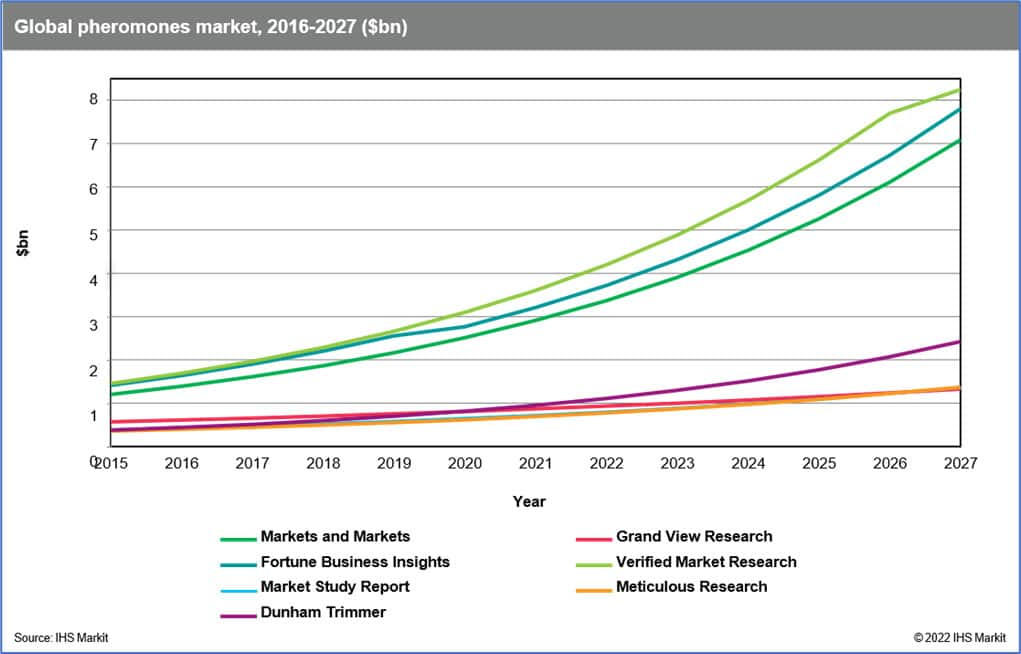

The estimates of the global agricultural pheromones market (including the value of trap and lure) varies, and in 2020 range from $600 million to over $2 billion.

There is strong growth in agriculture automation platforms with pheromone application components. Multinationals will continue investing into agricultural pheromones, to ensure industrial diversification and benefit from the trend favoring sustainable agriculture.

In addition to rising acceptance of sustainable agricultural practices, market drivers include:

- Pest resistance concerns to conventional insecticides

- Targeted action which is not harmful to beneficial insects - 40% of all insects are declining

- The ongoing phasing out of broad-spectrum insecticides

- Improvement in production and application methods

Challenges exist as well, with market resistors such as:

- High cost of pheromone insecticide product in comparison with conventional insecticides

- High maintenance costs

- Pheromone products require skilled labour

- Specific action of pheromones can serve as a disadvantage

Here is a quick rundown of new companies and investments in the insect pheromone space.

Startup companies:

- SemiosBio

- Provivi

- M2i Life Sciences

- BioPhero

Multinational investments:

- In January 2020, Provivi announced that they have signed an agreement with Syngenta Crop Protection AG for the development of a new, natural and sustainable pheromone based product concept for the effective management of major rice pests in Indonesia.

- In May 2020, Corteva Agroscience announced multiyear global agreements with M2i Life Sciences for the research, development and global commercialization of pheromone based insect control solutions.

Pheromone/biological company investments:

- In October 2021, Suterra and Phytech have partnered to deliver to growers a comprehensive solution to optimize irrigation, nutrition, and pest control with agricultural pheromones.

Recent pheromone insecticide product launches:

- In August 2020, ISCA announced that it launched SPLAT FAW in Brazil, a mating disruption control for the fall armyworm Spodoptera frugiperda.

- In August 2020, Provivi announced that that its pheromone based mating disruption product for the control of Fall Armyworm (Spodoptera frugiperda) PherogenTM received the regulatory approval in Brazil and Pherogen ™ Dispenser SpoFr mating disruption dispenser for the control of Fall Armyworm (Spodoptera frugiperda) in corn received approval in Mexico.

- In April 2021, Provivi announced regulatory approval of Pherium AL mating disruption products to control damaging pests in rice, notably the Rice Stemborers like Chilo suppressalis in Indonesia.

- In March 2021, Bayer introduced Vynyty Citrus®, its latest biological and pheromone based crop protection product to control pests on citrus farms.

Looking for more information on this growing marketplace? Get sample data of IHS Markit's comprehensive research for the global agricultural insect pheromones market.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.