UK swine herd under pressure

Due to COVID-19 and post Brexit reasons, UK is facing an acute shortage of labor, similarly experienced around the world, impacting meat processing facilities and the ability to get animals through the system. In recent months, UK meat processors have been forced to reduce processing throughput as much as 25%, marking a crisis that is further compounded by a shortage of truck drivers resulting in supply chain disturbance across UK. The reduced throughput has put producers on the defensive, holding animals longer in the barns and now running out of barn space as piglets are born and continue to flow through the farming system. Producers are forced to make difficult decisions with what to do with the animals, already beginning the decision to cull animals.

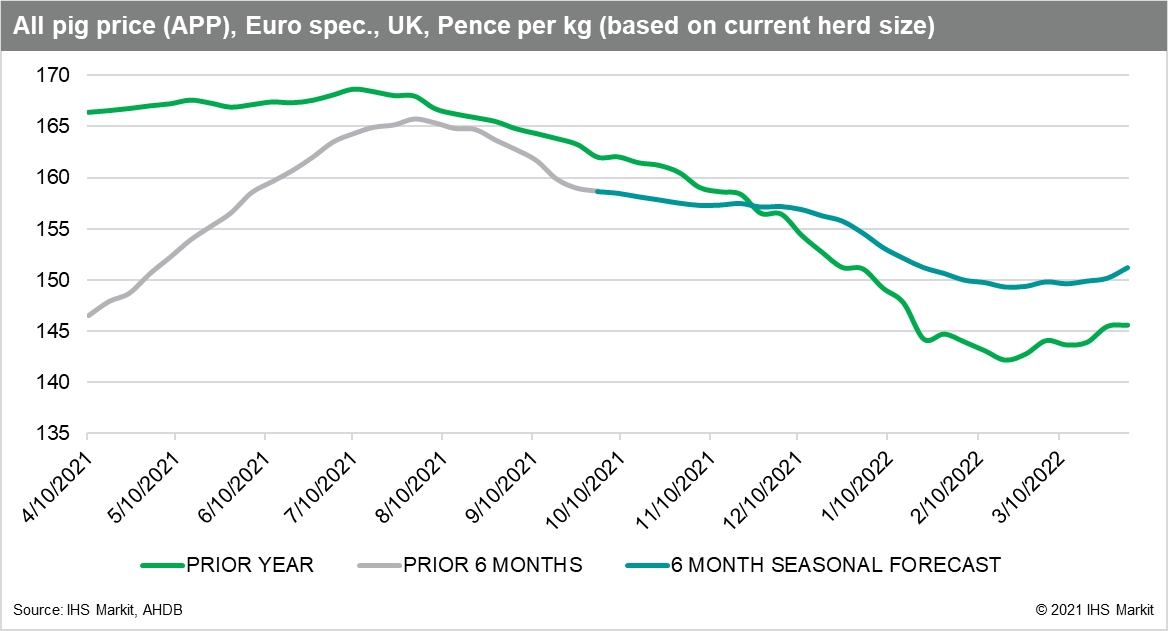

The prices of hogs have fallen away post-July rather sharply in the last 30 days, down roughly 5%. This is making an already difficult situation that has worsened as the level is below breakevens for many producers on this year's higher feed input prices and now the cost to feed hogs in the barns longer is adding to the breakeven point. Because of this, farmers cannot house animals continuously, and processor throughput is not expected to increase any time soon. Producers are thinning animals, with some estimates calling for more than 120,000 swine to be culled. The point of culling is an easier decision for market hogs that are relatively young, with limited costs associated in young life cycle. This opens up barn space and feed availability to hogs already well invested into market readiness and protects some of the producer's profits. If UK producers decide to cull more than 120,000 head, the result could be a drop in annual production by 2.4%; however, this is likely skewed to a smaller window of animal availability. If the reduction in animals occurs at a quarterly level of market hogs (typical due to age and investment in animal), then as the fourth quarter turns into first-quarter 2022, hog production could be harmed as much as 6-7% localized to the quarter.

In the short-term, culling of animals is likely to do little to support or reverse the loss in hog values, since producers are likely to hold onto market ready hogs as long as possible with an oversupply of current hogs. This will keep a backlog of hogs in the system for the next three to four months and hog values lower than breakevens. Culling market-ready animals certainly would reduce the stress on hog barns and feed availability but guarantee a 100% loss of all invested, with producers always aiming to recoup as much of the investment as possible, sans government subsidy. At best, all pig prices in UK could get back to 157 pence per kg before the end of the year, but the current backlog of hogs likely will keep prices down to 150 pence per kg into the start of first-quarter 2022. Significant culling now would be expected to produce strong price accretion as first-quarter 2022 moves into second quarter, with a potential hole in the herd and creating the reverse effect of the present scenario.

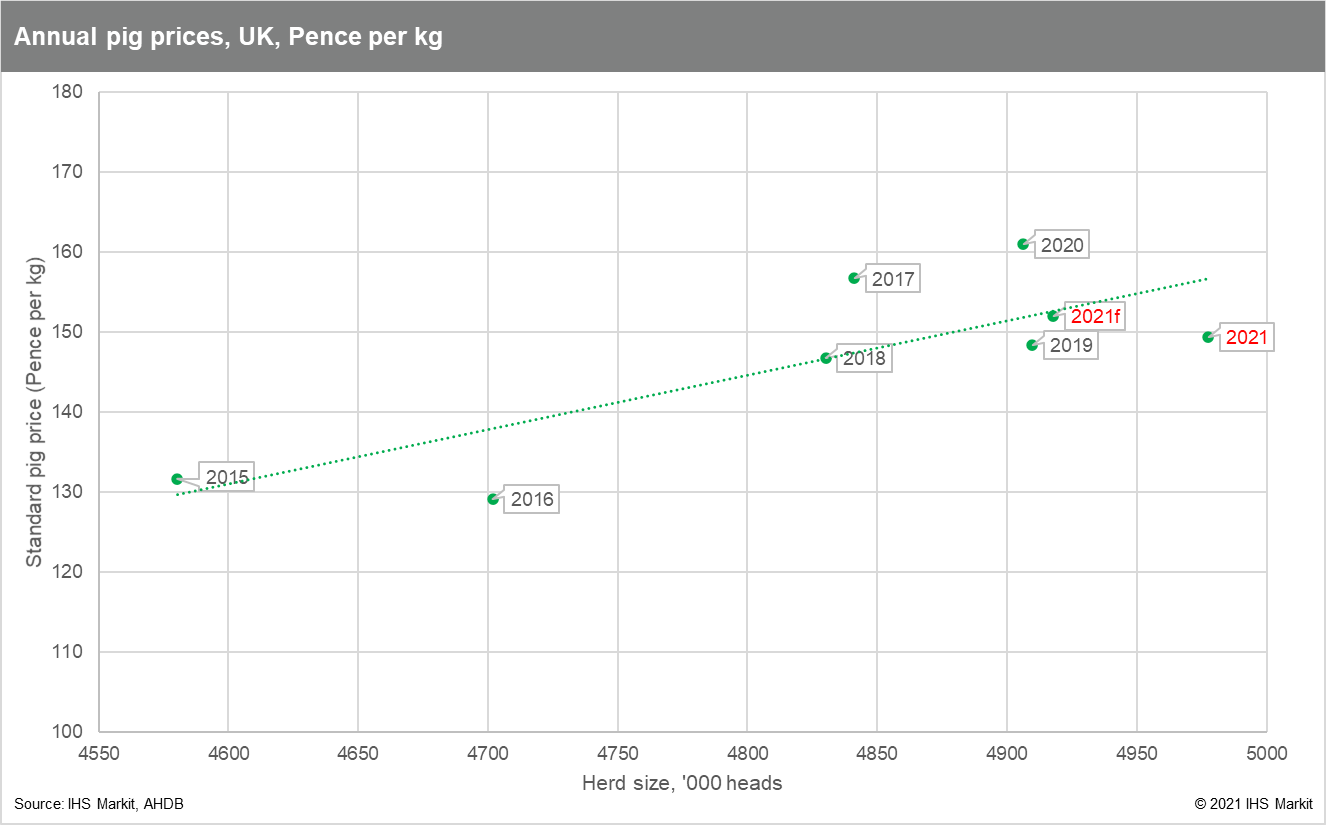

The UK has been in expansion mode of the swine herd over the last five years, now at levels not seen in the last 15 years. This expansion is clearly contributing to the oversupply of hogs currently and any culling of animals in the short term will negate the growth from this year, possibly getting the herd back down to 2019 levels with the risk that 2022 prices approach 2020 levels again.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.