Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 24, 2020

US crude oil exports down in September but more heading to China

Significance

China seems to be finally purchasing more US crude oil again, likely in an attempt to come closer to energy import quotas agreed with Washington last year. Current prices support this as well with Chinese refiners having reason to consider more flows of the supercheap US barrels. So far in September, more than 700,000 b/d have been shipped from US ports to China, with estimates that volumes could even surpass 800,000 b/d by the end of the month.

Implications

US crude oil production fell sharply during H1 2020. The recovery of the country's oil industry deeply relies on stronger oil prices, but market signals suggest more time will be required until this happens. Exports dropped from their record-high of 3.7 million b/d in February to much lower levels throughout June, when the country only exported 2.75 million b/d of crude oil. Seaborne exports of crude oil from the US increased in July to more than 2.9 million b/d, but have dropped since, having remained below 2.8 million b/d so far in September.

Outlook

Recent disruptions due to weather conditions have kept refining capacity of nearly one million b/d offline in Louisiana since late August. Concern around weaker demand due to Tropical Storm Beta have also pushed US gasoline prices down. Market fundamentals have turned more negative for gasoline demand due to more remote working, schools remaining closed and a potential increase of COVID-19 cases in the autumn.

...

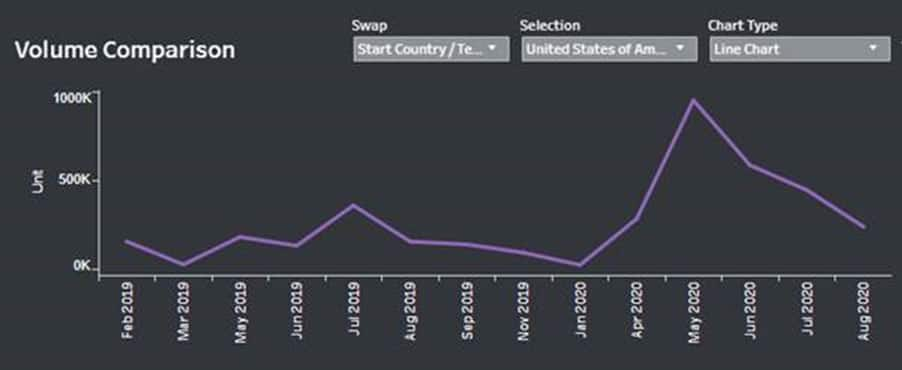

China seems to be finally purchasing more US crude oil again, probably in an attempt to come closer to energy import quotas agreed with Washington last year. Current prices support this as well with Chinese refiners having reason to consider more flows of the supercheap US barrels. So far in September, more than 700,000 b/d have been shipped from US ports to China, with estimates that volumes could even surpass 800,000 b/d by the end of the month. Barrels loaded on tankers recently will only reach destination in late November or even later. Whether this trade could prove long-lasting is a different story, as China's imports overall are recently sending signals of pressure. Meanwhile, increased flows from the US to China in April-June have been highly related to strategically built inventories or even floating storage. Chinese refiners have been stocking up on cheap crude oil rather than satisfying stronger demand.

US crude oil shipped to China b/d

Source: IHS Markit Commodities at Sea

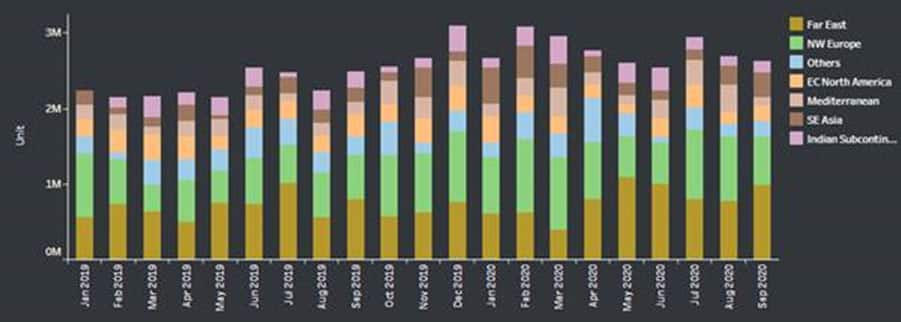

Meanwhile, the sharp decline in US crude oil production during H1 2020 further emphasized the much stronger market share China has in US crude oil trade flows. With oil prices remaining below USD 45 per barrel, the situation isn't ideal for most US crude oil producers. This could turn the country's supply tighter. US oil recovery relies on stronger oil prices, but market signals suggest more time will be required until this happens. The shock that the global oil demand experienced earlier this year driven by the COVID-19 pandemic pushed US crude oil exports significantly down. Exports dropped from their record-high of 3.7 million b/d in February to much lower levels throughout June, when the country only exported 2.75 million b/d of crude oil, as reported by the Energy Information Administration.

Most recent data by IHS Markit Commodities at Sea suggests that seaborne exports of crude oil from the US increased in July to more than 2.9 million b/d, but have dropped since, having remained below 2.8 million b/d so far in September. Despite having been under pressure, US exports in H1 2020 are still higher than a year ago.

US crude oil seaborne exports by region of destination in b/d

Source: IHS Markit Commodities at Sea

US crude oil seaborne exports - year-on-year comparison

Source: IHS Markit Commodities at Sea

US Gulf production has recently been affected by the weather too, with Tropical Storm Beta having caused up to 10% of the region's oil production to remain offline for the week commencing September 21st, just after Hurricane Sally. Hurricane Laura had the biggest impact on US production in late August. However, Beta is also affecting tanker movements from Texas coast to Souh West Louisiana.

Refineries near Corpus Christi area will continue operating during Beta but will closely monitor the storm, as refining capacity of nearly one million b/d remains offline in Louisiana after hurricanes Laura and Sally. Together with the lower export demand, more pressure has been added against locally produced grades such as Mars medium sour crude, with price differentials to cash WTI narrowing further.

Concern around weaker demand due to Tropical Storm Beta have also pushed US gasoline prices down. Market fundamentals have turned negative for gasoline demand due to more remote working, schools remaining closed and a potential increase of COVID-19 cases in autumn.

For more insight subscribe to our complimentary quarterly commodity analytics newsletter

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fus-crude-oil-exports-down-in-september-but-more-to-china.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fus-crude-oil-exports-down-in-september-but-more-to-china.html&text=US+crude+oil+exports+down+in+September+but+more+heading+to+China+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fus-crude-oil-exports-down-in-september-but-more-to-china.html","enabled":true},{"name":"email","url":"?subject=US crude oil exports down in September but more heading to China | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fus-crude-oil-exports-down-in-september-but-more-to-china.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+crude+oil+exports+down+in+September+but+more+heading+to+China+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fus-crude-oil-exports-down-in-september-but-more-to-china.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}