Not in my backyard… or yours: What the new EU Methane Rule means for Kazakh crude oil exports

Introduction

Countries are increasingly targeting greenhouse gas emissions embedded in imported goods as a way to prevent "carbon leakage" [1]. The European Union's newest regulation aimed at carbon leakage (the "EU Methane Rule"), passed in April 2024, seeks to reduce methane emissions in fossil fuels imported into the EU. With the EU importing 97% of its crude oil [2], the rule will have significant global environmental and economic consequences. This report uses asset-level oil and gas methane intensity data to examine the effect of the regulation on Kazakh oil producers.

The EU Methane Rule and the campaign to curb methane emissions

At COP26, over 100 countries signed the Global Methane Pledge, vowing to cut methane emissions by 30% by 2030 [3]. Nonetheless, global methane emissions have continued to rise [4].

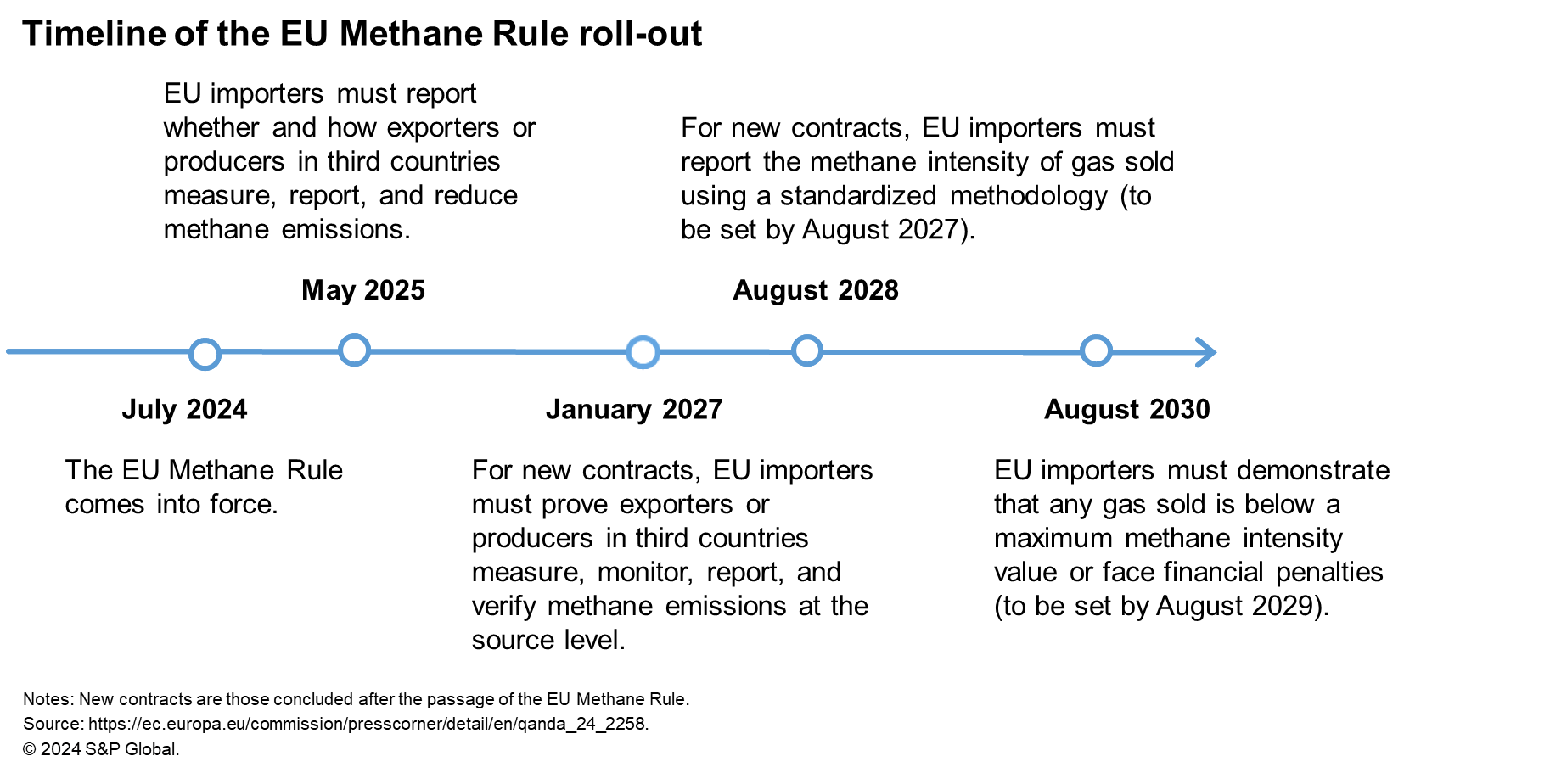

In 2021, the Oil and Gas Methane Partnership 2.0 (OGMP 2.0) created a framework for methane emissions reporting in the oil and gas sector, which is responsible for 14% of anthropogenic methane emissions [5]. The EU Methane Rule will roll out from 2025 to 2030, building on OGMP 2.0's methane reporting framework, mandating leak detection and repair technology, and prohibiting non-emergency venting and flaring [6]. To create a "level playing field", domestic producers and importers will be held to the same standards [7].

Comparing the methane performance of the EU's top crude oil suppliers

In 2023, the US became the EU's largest crude oil supplier at 1.344 million barrels per day (MMb/d), followed by Norway (1.342 MMb/d) and Kazakhstan (0.895 MMb/d). The top 10 exporters supplied 79.5% of the EU's crude oil consumption.

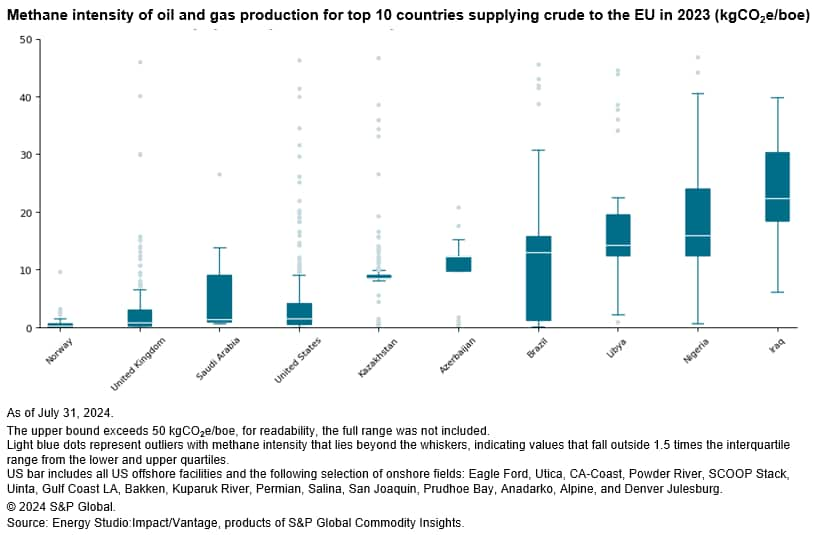

The above chart evaluates the upstream methane intensity of oil and gas fields in the top 10 crude-supplying countries. Kazakhstan ranked fifth with a median asset-level methane intensity of 9.5 kgCO2e/boe and a production-weighted average of 3.7 kgCO2e/boe. This performance is partly due to a 2005 flaring ban, which reduced flaring volumes from 4 Bcm in 2012 to 1 Bcm by 2023 [8].

There is considerable heterogeneity amongst oil and gas plays within each country. The Methane Rule could incentivize exporters to prioritize lower methane intensity sources for the EU market and redirect higher intensity sources elsewhere, potentially mitigating overall methane emissions. This reshuffling would be easier in countries like the United States with more heterogeneity and flexible export routes than in countries such as Kazakhstan with less variation and limited export infrastructure.

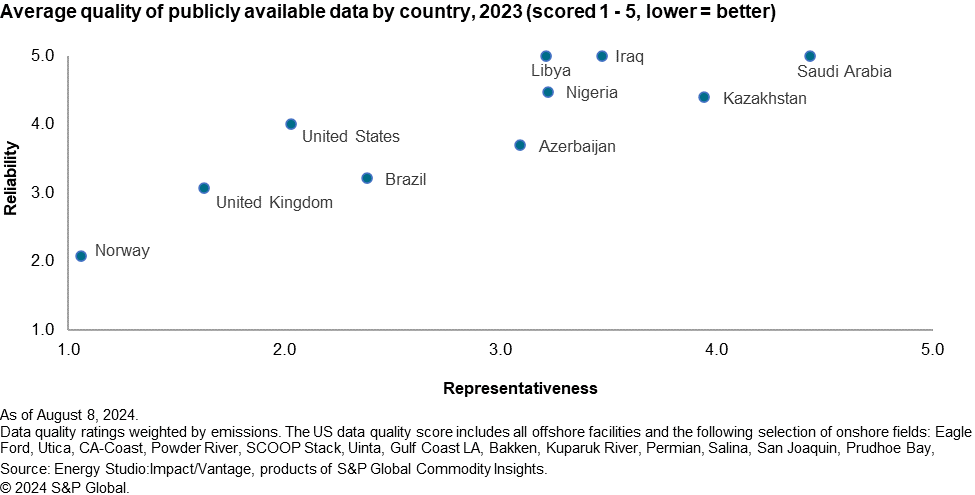

The methane intensities in this report are drawn from S&P Global’s proprietary upstream Vantage and Energy Studio: Impact dataset platforms, which utilize reported, observed, and modeled asset-level methane emissions. Our Data Quality Metric (DQM) evaluates the Reliability and Representativeness of each source on a scale from 1 to 5, with a lower score indicating higher quality. Please note these data quality scores are S&P Global assessment of the representativeness and reliability or the quality of our estimate. This information is important to ensure users understand the limitations of this information. Reliability indicates the degree to which the data can be depended upon to be accurate, such as how much is measured versus estimated, or whether it has been verified by a third party. Representativeness evaluates the granularity and timeliness of the data [9].

Kazakhstan scored 3.94 in Representativeness and 4.39 in Reliability, indicating relatively poor performance. There is also DQM variation amongst individual operators. The EU Methane Rule mandates operators to submit reports equivalent to OGMP 2.0 level 5, the highest compliance level, which includes quantification of source-level methane emissions and site-level measurements [10]. Enhanced data quality may uncover new emissions sources, potentially increasing reported methane intensities.

Potential impact of the EU Methane Rule on Kazakhstan's crude exports

Not only is Kazakhstan a key crude exporter for the EU, but the EU is Kazakhstan's primary market, accounting for 77% of its crude exports from January to April 2024. The EU Methane Rule will significantly impact Kazakh oil exports, especially due to Kazakhstan's landlocked position, which complicates access to alternative markets. But are all Kazakh producers equally affected? To answer this, we need to identify Kazakhstan's main producers and exporters and assess their methane intensity.

In 2023, Kazakhstan produced 683 MMb of oil, exporting 530 MMb, including 350 MMb to the EU. The Caspian Pipeline Consortium (CPC) pipeline transported 479 MMb, with major contributions from the "Big-3" fields: Tengiz, Kashagan and Karachaganak. Kazakhstan relies on the CPC for oil exports but is diversifying routes to reduce reliance on Russia, including via the Baku-Tbilisi-Ceyhan pipeline and rebranding some exports under the KEBCO grade.

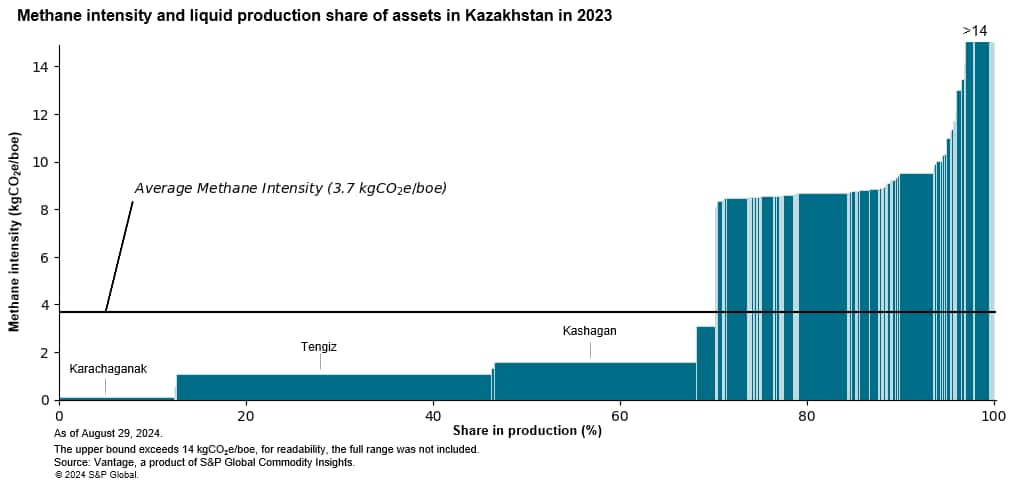

Seen this way, we can group Kazakh producers into three risk levels, based on their methane intensity and export destination.

- Low risk: Nearly 70% of 2023 production, or 463.8 MMb, came from the Big-3 fields. These fields are operated by consortia of international oil companies and have methane intensities between 0.17 kgCO2e/boe and 1.5 kgCO2e/boe, making them among the lower-emitting sources of EU imports [11]. The oil from these fields is almost entirely exported, mainly through the CPC and the Atyrau-Samara pipeline. Some oil is also shipped by tankers towards the Baku-Tbilisi-Ceyhan pipeline.

- At risk: A portion of Kazakh oil, produced by local operators and exported to Europe, has methane intensity levels above the 3.7 kgCO2e/boe country average. This crude oil, exported under the KEBCO brand via the Atyrau-Samara pipeline and Transneft's export routes, had significantly smaller volumes compared to CPC exports in 2023. Producers in this group are less productive than the Big-3 and benefit less from the economies of scale that reduce methane intensity. While they may have limited options to redirect exports outside the EU, they could target EU exports depending on how each Member State sets financial penalties for crude exceeding the methane intensity threshold. Following the EU sanctions on Russian crude, European refineries, especially in Germany, Hungary and Bulgaria, are interested in KEBCO as an alternative to Urals due to its similar properties. Buyers are willing to pay a premium, which could help offset EU penalties for producers with higher methane intensities.

- No risk (not applicable): Producers from this group send their oil to refineries in Kazakhstan or to international markets outside the EU. China is the largest non-EU importer of Kazakh oil. However, increasing export volumes to China has its own constraints. The Kazakhstan-China pipeline (KCP) remains underutilized, as the netback values for deliveries via this route are generally relatively unattractive. Additionally, oil demand is not as high in China's western regions served by the KCP as it is in the eastern and central regions which are served by maritime oil routes.

Conclusions

As a major EU crude exporter, Kazakhstan will be affected significantly by the EU Methane Rule. Most Kazakh exports come from less methane-intensive fields such as the Big-3, which are well-positioned to meet EU requirements. However, fields with higher methane intensities may face higher compliance costs. Collaboration between the Kazakh government, industry leaders, and international partners is essential. The success of Kazakhstan's flaring ban demonstrates effective policy use to reduce emissions. Further support, including from the US and EU, will be needed to cover the estimated $1.4 billion required for the full methane mitigation of Kazakhstan's oil and gas sector by 2030 [12].

This insight is part of a continuing series of analyses from Commodity Insights' upstream GHG emissions dataset.

[1] European Commission. (n.d.). Carbon leakage. https://climate.ec.europa.eu/eu-action/eu-emissions-trading-system-eu-ets/free-allocation/carbon-leakage_en.

[2] Council Regulation (EC) No. 2024/1787 of 13 June 2024 on the reduction of methane emissions in the energy sector and amending Regulation (EU) 2019/942.

[3] Global Methane Pledge. (2023, November 22). Global Methane Pledge. https://www.globalmethanepledge.org/resources/global-methane-pledge.

[4] Lan, X., Thoning, K. W., & Dlugokencky, E. J. (2024). Trends in globally-averaged CH4, N2O, and SF6 determined from NOAA Global Monitoring Laboratory measurements (Version 2024-08). https://doi.org/10.15138/P8XG-AA10.

[5] International Energy Agency (2023), Methane Tracker Database, IEA, Paris. License: Creative Commons Attribution CC BY 4.0.

[6] Council Regulation (EC) No. 2024/1787 of 13 June 2024 on the reduction of methane emissions in the energy sector and amending Regulation (EU) 2019/942.

[7] European Commission. (2024, May 27). Questions and Answers on the EU Regulation to reduce methane emissions in the energy sector.

[8] World Bank. (2023, December). Kazakhstan. https://flaringventingregulations.worldbank.org/kazakhstan.

[9] Birn, K., Crawford, C., Roustapisheh, M., & Vakalopoulos, M. (2022, March). The Right Measure: A guidebook to crude oil life-cycle GHG emissions estimation. S&P Global Commodity Insights.

[10] Council Regulation (EC) No. 2024/1787 of 13 June 2024 on the reduction of methane emissions in the energy sector and amending Regulation (EU) 2019/942.

[11] All methane intensities in this study are based on publicly available data and S&P Global assumptions, and therefore are reported with a degree of uncertainty, which we estimate using the DQM.

[12] U.S. Department of State. (2022, November 2). U.S.-Kazakhstan joint statement on accelerating methane mitigation to achieve the global methane pledge. https://www.state.gov/u-s-kazakhstan-joint-statement-on-accelerating-methane-mitigation-to-achieve-the-global-methane-pledge/.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.