Shipping flows through the Suez Canal are on the verge of resuming after the Ever Given container vessel was successfully freed on March 29, but the repercussions of the blockage are likely to reverberate for weeks, market watchers told S&P Global Platts.

Not registered?

Receive daily email alerts, subscriber notes & personalize your experience.

Register NowThe closure of one of the world's most critical commodity chokepoints has resulted in a logjam of more than 360 ships -- including crude, product and chemical tankers, dry bulk carriers and container vessels -- waiting to transit the waterway from both sides as of March 29, according to data from S&P Global Platts trade flow software cFlow.

This traffic backlog is expected to take at least a week to clear, pushing up freight rates and delaying the shipments of many key commodities such as oil, refined products, LNG, iron ore, metals, consumer goods and chemicals.

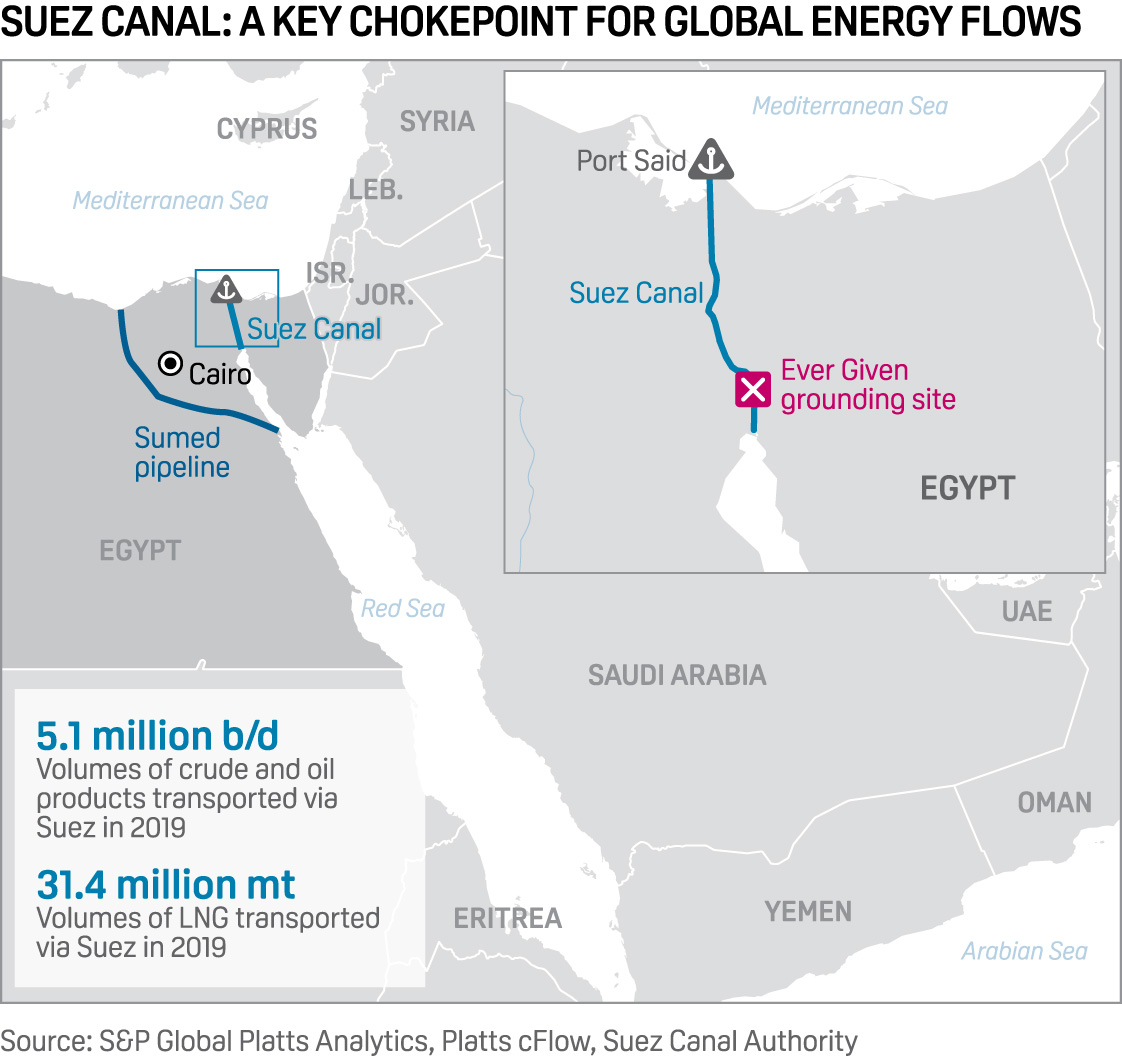

The Ever Given ran aground on March 23 blocking the key waterway for almost a week. But by 1505 Egypt time (1305 GMT) on March 29, the container ship was fully refloated with the help of 13 tugboats and several dredgers. The vessel was now en route to the Great Bitter Lake region of the canal for technical inspection, several sources said.

The successful refloating of the Ever Given was confirmed by the Suez Canal Authority, which operates the chokepoint; the charterer of the vessel - Evergreen Maritime Corp; and Royal Boskalis Westminster, which is a Dutch dredging and heavy lift company, that was hired to carry out the salvage operation.

A strategic route for crude oil, petroleum products and LNG shipments, the 120-mile canal connects the Red Sea with the Mediterranean and sees more than 18,000 ships transit each year, according to the SCA.

Get S&P Global Platts full coverage: Suez Canal blockage

Significant impact

Leading container line AP Moller-Maersk said that, despite the progress on the Ever Given, the "significant impact" of the closure could take a long time to clear.

"... The ripple effects on global capacity and equipment are significant and the blockage has already triggered a series of further disruptions and backlogs in global shipping that could take weeks, possibly months, to unravel," Maersk said on March 29.

The Danish company also said it will take "six days or more to clear up" the backlog of vessels. It has already redirected 15 vessels around the Cape of Good Hope, which will add sailing time equal to the current delay of sailing to Suez and waiting, it said.

By 16:45 BST (1535 GMT), there were at least 35 crude tankers estimated to be carrying around 26 million barrels and 24 product and chemical tankers holding around 1 million mt waiting to navigate through the canal, according to cFlow.

These tankers are carrying crudes such as Saudi Arabia's Arab Light and Arab Extra Light, Libya's Es Sider, Iraq's Basrah Light and Kazakhstan's CPC Blend, and also refined products including naphtha, jet fuel, gasoil, LPG, and fuel oil.

Many ships had already diverted from their original trade routes and head the long way around the Cape of Good Hope. The rerouting to the cape could add as many as 15-20 days to a voyage from the Middle East to Rotterdam that would normally go via Suez.

Firmer freight rates

Freight rates on tankers and containers have risen sharply as tonnage lists start to shrink as ships divert from their original trade routes to avoid being caught up in the logjam.

S&P Global Platts Analytics said the ever-growing queue of vessels waiting to transit the chokepoint is causing owners and charterers to still consider their options, and this has already resulted in higher freight costs.

"Monthly average freight rates on some affected Suezmax routes are forecast to increase between 9%-35% for April compared to March. The LR1s are also forecast for similar increases in the region of 14%-18% for the same period," Platts Analytics said in a note.

Suezmax and LR1 fleets are expected to be the most affected as these tankers are some of the most active in the Suez Canal.

Related news: Asian LR2 tankers flip to premium as Suez Canal disruption lingers: sources

The ripple effect was reported across regions and ship sizes, with fresh fixtures on the VLCC West Africa-to-East run reported at Worldscale 43.5, or w4.5 points above last done on the run.

"These high fixtures were done on Friday and over the weekend on the back of panic buying," a broker said. "There are very slim chances of charterers lifting the subjects now with the Suez Canal situation unfolding, and the high fixtures should start failing, pushing freight rates back down."

Freight rates on the Suezmax Black Sea-to-Mediterranean run jumped to close to $10/mt on March 29, from levels of around $7/mt last week, according to Platts data.

Almost 10% of total seaborne oil trade and 8% of global LNG trade passes through the Suez Canal, according to the US Energy Information Administration.

Before the pandemic hit trade flows, the canal transported some 5 million b/d of crude and oil products and 31 million mt of LNG in 2019, according to Platts Analytics and data from the SCA.