London — Southbound and northbound traffic on the Suez Canal has recommenced a day after the stricken Ever Given container ship was freed, market sources said March 30.

Not registered?

Receive daily email alerts, subscriber notes & personalize your experience.

Register NowBut the backlog of almost 400 vessels is likely to take at least a week to clear, with severe port congestion expected at some commodity terminals worldwide.

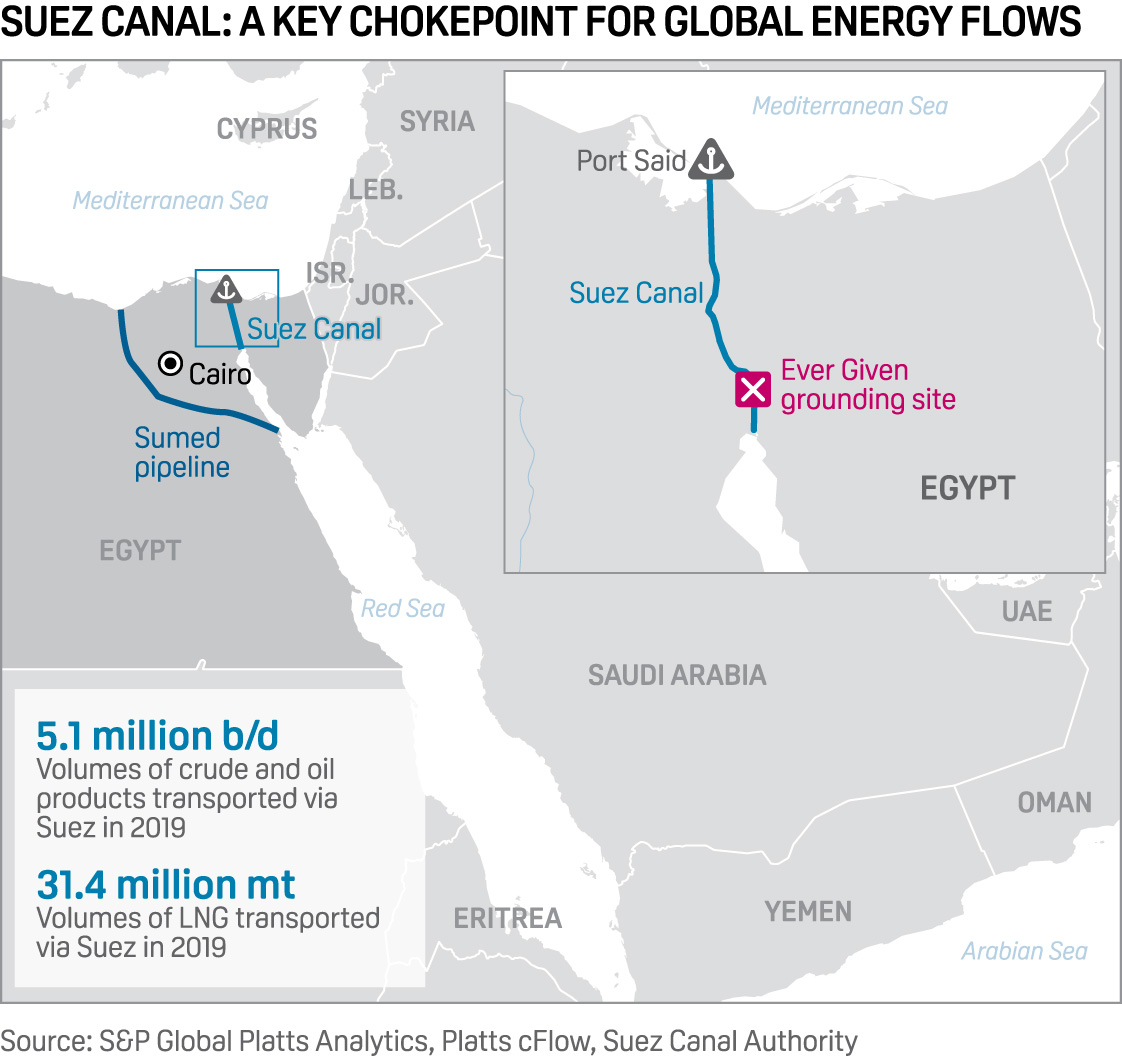

The Ever Given container vessel ran aground in the Suez Canal on March 23, which blocked the vital commodity chokepoint, and the ship was only successfully freed March 29.

Get S&P Global Platts full coverage: Suez Canal blockage

Northbound and southbound traffic had fully resumed by the morning of March 30 after almost a weeklong hiatus on the vital trade route. By 1220 GMT, there were almost 400 ships -- including crude, product and chemical tankers, dry bulk carriers and container vessels -- waiting to transit the canal from both sides along with some already in the waterway, according to data from S&P Global Platts' ship tracking and trade-flow service cFlow.

There were at least 33 crude tankers estimated to be carrying around 30 million barrels and 30 product and chemical tankers holding a total of around 1.5 million mt waiting to navigate through the canal, according to cFlow.

Photo: Platts cFlow

The Ever Given reached the Great Bitter Lake region of the key trade route late March 29 for technical inspection.

A strategic route for crude oil, petroleum products and LNG shipments, the 120-mile canal connects the Red Sea with the Mediterranean and sees more than 18,000 ships transit each year, according to the Suez Canal Authority.

Ripple effects

Many industry sources have said the repercussions on commodity markets from the week-long blockage are likely to reverberate for weeks.

Leading container line AP Moller-Maersk said the "ripple effects on global supply chains" would be for weeks to come, with severe port congestions expected.

"We estimate that the delays could have an impact on our ocean network capacity for the coming several weeks. We are doing our utmost to mitigate the impact and contingency plans are still being made, but the loss of capacity to be 20-30% over multiple weeks, depending on market dynamics," it said on March 30.

However, freight rates on some crude oil tanker markets were already starting to dip after a brief boost to some routes.

Suezmax freight rates jumped on March 26 in the Mediterranean and Black Sea region, supporting also the West African markets. The Mediterranean-to-East run basis 130,000 mt was assessed up to $3.2 million on March 26, up from $2.8 million on March 25. But by March 30 offer levels were now closer to the $3.10 million on this route, sources said.

But the canal closure did tighten the tonnage lists of many vessels, which could help support some freight rates, they added.

"Monthly average freight rates on some affected Suezmax routes are forecast to increase between 9%-35% for April compared to March. The LR1s are also forecast for similar increases in the region of 14%-18% for the same period," Platts Analytics said in a note.

Almost 10% of total seaborne oil trade and 8% of global LNG trade passes through the Suez Canal.

Before the pandemic hit trade flows, the canal transported some 5 million b/d of crude and oil products and 31 million mt of LNG in 2019, according to Platts Analytics and data from the Suez Canal Authority.