The OPEC+ alliance will implement a modest 100,000 b/d rise in production quotas for September, in a slight gesture to US President Joe Biden, who pressed for more supplies to tackle high oil prices—but also a big nod to Russia and other members that sought a measured approach to protect their windfall earnings.

The increased quotas, approved by OPEC+ ministers at a virtual meeting Aug. 3, are distributed among the 23 countries pro rata.

In practice, however, with every member of the alliance incapable of sustainably raising production, except for Saudi Arabia and the UAE, the actual supply increase will be much smaller—about 34,000 b/d, between the two countries.

In its post-meeting communique, the alliance made no mention of the lobbying pressure from the US and other major consuming countries. Instead, it said it was acting cautiously amid "dynamic and rapidly evolving oil market fundamentals," scheduling its next meeting for Sept. 5.

Dated Brent prices remain well above $100/b, contributing to sky-high inflation in many economies. But record gasoline prices have retreated in recent weeks and the market structure has been weighed down by concerns over resurgent coronavirus infection rates and fears of a global recession in the months ahead.

The 100,000 b/d quota hike is much smaller than the 648,000 b/d increases enacted for July and August. Analysts said it was likely less than what Biden had hoped for.

The US president had visited Saudi Arabia in mid-July for a summit with Gulf leaders and emerged from the trip confident that the producer bloc would heed his call for more production.

French President Emmanuel Macron also hosted Saudi Crown Prince Mohammed bin Salman in Paris to discuss oil supplies, and Japanese Foreign Minister Hayashi Yoshimasa met with Saudi counterpart Prince Faisal al-Saud in Tokyo to push for more crude.

Investment woes

Saudi officials had been more circumspect, saying only that they would evaluate the market's needs, but a sign of a potential quid pro quo emerged Aug. 2, with the US State Department approving the sale of a $3 billion missile defense system to the kingdom.

Gulf leaders had said enhancing regional security in the face of attacks by Iranian-backed groups, including on vital oil and shipping infrastructure, was a top priority.

A more aggressive production hike was unlikely in the cards, OPEC+ delegates had signaled leading up to the meeting.

The decision could prompt the Biden Administration to look elsewhere for barrels—including extending the record 1 million b/d release from the US Strategic Petroleum Reserve that is scheduled to run through September, imposing a possible ban or limitations on domestic oil exports, or re-engaging with Iran and Venezuela on talks to lift sanctions.

The EU's top Iran deal negotiator, Enrique Mora, was en route to Vienna Aug. 3 to try and rekindle negotiations between the two sides.

Analysts with ClearView Energy Partners also said the administration could ratchet up it's messaging against the oil industry, "accusing operators of investing too little and blaming refiners and retailers for charging too much."

On at least that first point, the US president will find some alignment with OPEC+ ministers, who have long bemoaned the lack of oil and gas investment that they say is contributing to extreme volatility, exacerbated by policy shifts toward greener fuels.

"The meeting highlighted with particular concern that insufficient investment into the upstream sector will impact the availability of adequate supply in a timely manner to meet growing demand beyond 2023 from non-participating non-OPEC oil-producing countries, some OPEC member countries, and participating non-OPEC oil-producing countries," ministers said in their communique.

OPEC, Russia in alignment

For Russia, the result is a big win, having warily eyed efforts by the US and other western countries to drive a wedge in the OPEC+ alliance between its core Middle East members and Moscow, while the war in Ukraine rages.

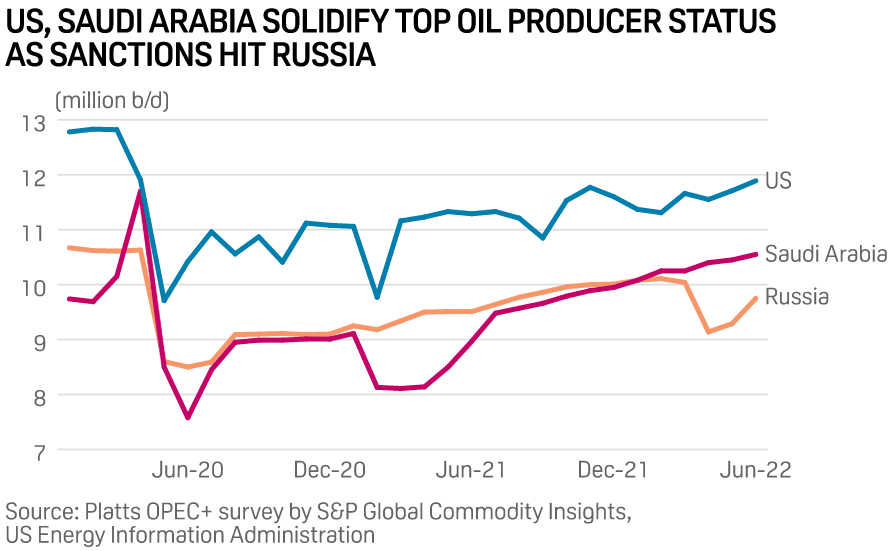

Russian crude production has been hit by western sanctions, with further punitive measures, including the EU's ban on seaborne oil imports, set to ratchet up. But the resulting rise in crude prices has more than offset its output losses.

Russia pumped 9.75 million b/d in June, according to the latest Platts OPEC+ survey by S&P Global Commodity Insights, compared to 10.11 million b/d in February.

Deputy Prime Minister Alexander Novak, who handles Russia's OPEC+ affairs, had met with Saudi energy minister Prince Abdulaziz bin Salman, in Riyadh on July 29 to align their positions, with delegates saying the two countries were united in not opening up a market share battle.

"In my opinion the market today is balanced, … although, of course, there are uncertainties, [which] we also discussed," Novak said after the OPEC+ decision in an interview broadcast on the Russia 24 television network. "First of all, there are increasing COVID cases, of a new strain. We see uncertainty linked to breaking transport and logistics chains due to restrictions being introduced, including on Russian oil and oil products. … Therefore, today such cautious decisions are being made."

Small margin for error

But the decision will nevertheless eat into the group's rapidly depleting spare production capacity, which Platts Analytics estimated at 1.1 million b/d as of September – all held by Saudi Arabia and the UAE—nearing historic lows seen only during times of war or other energy crises.

The thin buffer, along with international emergency oil stocks hitting a more-than-30-year low, will handicap their ability to respond to any further outages, which the OPEC+ alliance acknowledged in its communique.

"The meeting noted that the severely limited availability of excess capacity necessitates utilizing it with great caution in response to severe supply disruptions," it said.