In this week's Platts Market Movers Asia, Agriculture Editor Shikha Singh sheds light on how China's energy crisis is affecting the country's industrial fuel demand (00:14), metals and steel production (00:54), as well as LNG and coal prices (01:31).

Also in Asia's commodity markets this week:

*Refiners call for oil supply boost ahead of OPEC+ meeting (02:41)

*China's pre-holiday shopping spree drives palm oil prices to historic highs (03:30)

This week: Asian buyers call for OPEC to boost supplies, and Brazil's corn crop estimates are in focus.

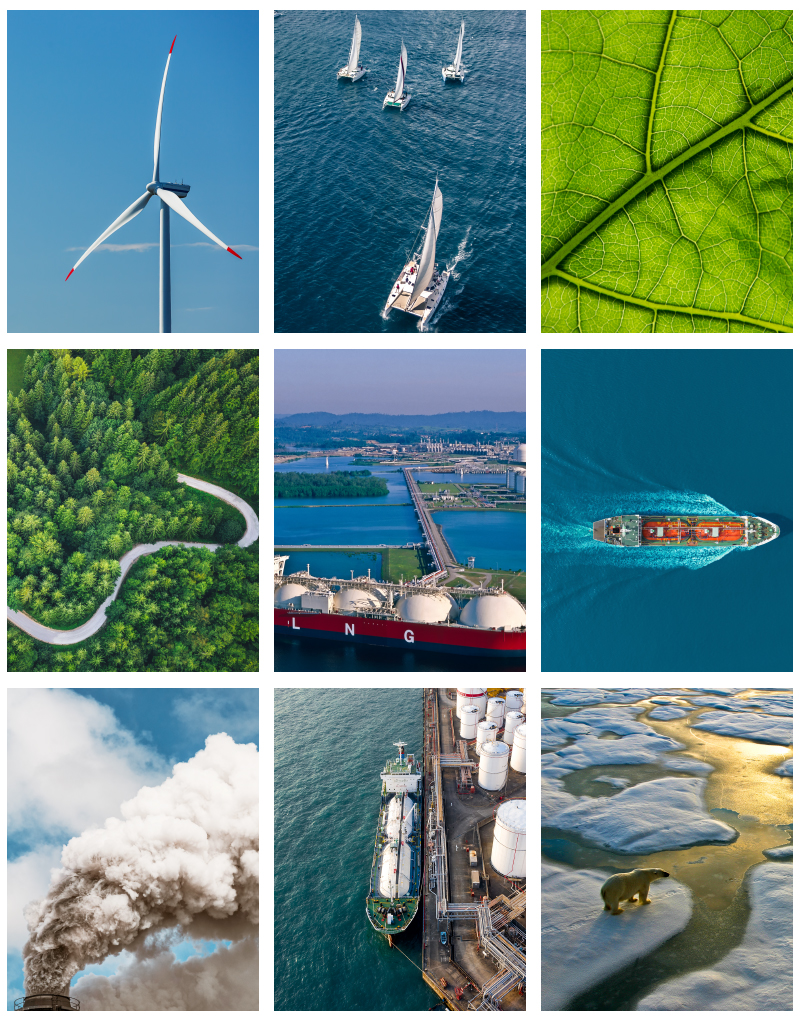

But first, all eyes on China's power crisis, which is sending shockwaves across commodity markets. Industrial fuel demand in China could take a hit in the near term, as construction, manufacturing and transportation sectors were forced to reduce their operation rates. Multiple provincial governments rolled out electricity rationing measures to conserve fuel ahead of the peak winter demand season. Industries are also encouraged to meet energy consumption targets towards the end of the year. Market analysts expect gasoil demand to bear the biggest brunt of this power conservation mandate. Gasoil demand in September was lowered by roughly 100,000 barrels per day. Analysts said further rationing can take out 180,000 barrels per day of gasoil demand.

Expanding power curbs in China are also affecting metals and steel operations. Aluminum smelters are seen running into further production hurdles after facing hydropower shortages and tightening energy targets.

China's power rationing is seen impacting long steel production more than flat steel. This could encourage markets to keep an eye on inventory levels for long steel that have been depleting faster than that of flat steel of late. China hot rolled coil prices were robust in September and are expected to continue with this momentum into October.

Turning to LNG, concerns over China's power shortage and lower winter temperatures forecast in North Asia have also sparked spot demand for winter cargoes by end-users. This, as well as high European gas hub prices and intense portfolio optimization by global LNG suppliers continue to support prices. The benchmark Platts JKM for November was assessed at 34.47 dollars per MMBtu on September 30—the highest since its launch in early 2009.

Coal prices are also hitting record highs amid China's rush to replenish inventories ahead of winter. This will likely support Indonesian thermal coal prices despite China's Golden Week holiday. Australian thermal coal prices are also expected to remain firm on the back of strong demand from ex-China markets. India stock levels in particular are hovering at dangerously low levels. Platts Northeast Asia Thermal Coal Index crossed 150 dollars per metric ton last week. China's power supply shortage situation is expected to last through October and support the prices of key energy feedstocks like coal, natural gas and LNG.

Elsewhere in the region, refiners and trading companies Platts surveyed during Asia Pacific Petroleum Conference, said OPEC+ should ideally raise supply by at least 700,000-800,000 barrels per day. They said current oil prices appear overheated, and Asian consumer sentiment is hurt by the high prices. Oil prices are trending higher and front-month ICE Brent crude futures recently crossed the 80 dollars per barrel mark. But OPEC and its allies are widely expected to stick to an existing deal to raise supplies by 400,000 barrels per day for November.

That brings us to our social media question for the week: Do you think OPEC+ will consider raising output to ease prevailing high oil prices? Share your thoughts on Twitter with the hashtag PlattsMM.

Finally in agriculture, market participants expect palm oil futures to shed some gains after benchmark futures prices hit an all-time high of 4,598 Malaysian Ringgits per metric ton on the Bursa Malaysia Derivatives index on September 30. Prices were driven by Chinese buyers, who went on shopping spree before their national holiday. Asian corn buyers, including Vietnam, Japan and South Korea. will also be looking at Brazil's monthly crop survey. They will examine Brazil's preliminary view on the size of its 2021-22 corn crop as corn supplies are tightening globally.

Thank you for kicking off your Monday with us. Have a great week ahead!