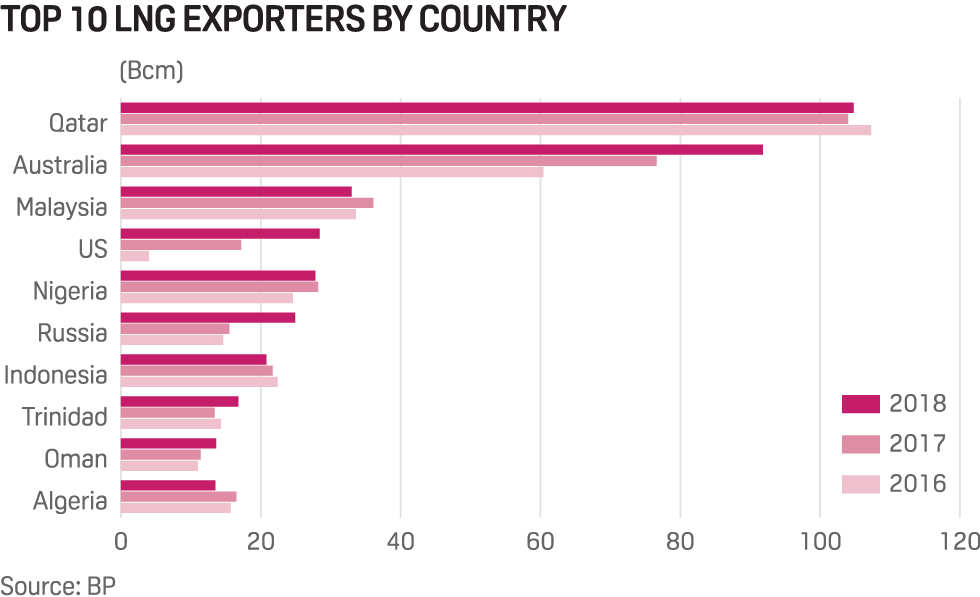

Doha — Qatar Petroleum, the world's largest LNG producer, is poised to announce new long-term supply deals for the fuel, despite more major consumers in Asia looking for spot market cargoes, the company's chief executive told S&P Global Platts in an interview on Monday.

Saad al-Kaabi, who is also Qatar's energy minister, told Platts the death of long-term LNG deals was "just a myth" and that QP's percentage of volumes going to the spot market was shrinking. QP currently sells around 80% of its volumes to long-term buyers, but new deals to be announced by the end of the year will see this increase.

"We are going to sign a few deals by the end of the year," said Al-Kaabi in the interview from QP's headquarters in Doha.

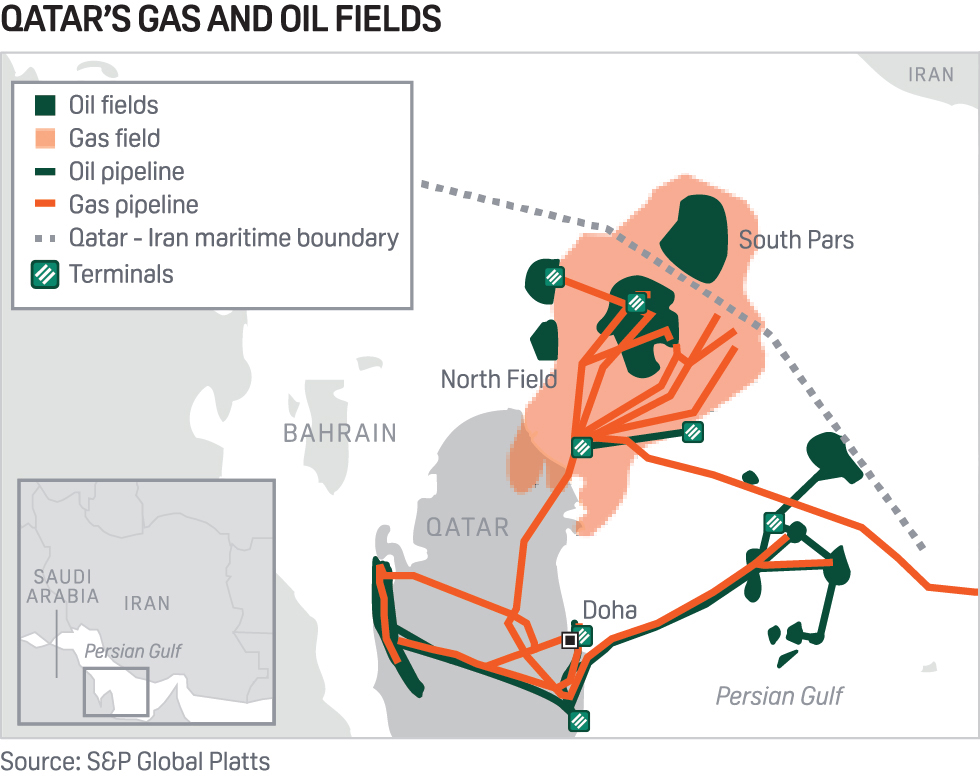

QP has embarked on a giant LNG expansion, which will bring its output capacity up to 110 million mt/year from a current 77 million mt/year. The North Field expansion project is targeting first gas by 2024, and is in the tendering stage for onshore contracts.

"We have selected a few companies giving them documents for what they'd like to bid for, and they are," Al-Kaabi said. "The one that has something that will be of benefit to us will come in and if not we'll just continue on our own."

One scenario could involve QP taking stakes in overseas assets in exchange for an international oil company taking a share in the LNG expansion project. But QP intends to retain a minimum stake of 70%, and at the moment funds are earmarked for the project to be completely equity financed.

"We have three very solid bidders, and probably we will decide by the end of this year, or the first quarter [of 2020]," he said.

In addition to the liquefaction project, QP also has a tender outstanding for between 60 to 100 LNG vessels, which will service QP's projects worldwide. Bidders from Japan, China and South Korea are taking part and results are expected next year.

Al-Kaabi said he thought oil indexation was still the optimum choice for both buyers and sellers of gas from Qatar, though QP currently uses a variety of indices for its projects worldwide, such as linking to the US's Henry Hub, the UK's NBP and the Dutch TTF hub.

"I think it will always be a juggle between when the [oil] price is high the buyers want something else, and when it's low they want [oil indexation]," Al-Kaabi said. "For us as an oil and gas company, we accept the oil price risk."

BUSINESS AS USUAL

Qatar has been locked out of trade with fellow Gulf countries since 2017 when a blockade was imposed. But Al-Kaabi said the blockade was not affecting QP's strategy or trading operations. Despite the blockade, Qatar continues to supply gas to the UAE through the Dolphin pipeline.

"We decided this as a business, we're not going to bring politics [into QP's operations]," Al-Kaabi said.

He added that he viewed the attacks in Saudi Arabia as an attack on the oil and gas industry as a whole, but said he did not think there was a need for oil and gas companies to implement new safety measures. Al-Kaabi said it was ultimately the role of the military to ensure the security of a country's infrastructure.

Qatar is one of the smaller oil producers in the Gulf, with output of around 600,000 b/d. The country dropped out of OPEC last year, citing a need to focus on its gas expansion strategy.

"We don't see ourselves as a national oil company (NOC) anymore, we see ourselves as an international oil company," Al-Kaabi told Platts. "We think we are the number one NOC in the world in every sense."

QP is following the same path as many NOCs in the Gulf region that are looking to expand overseas, joining alongside IOCs to build a presence in new markets.

--Miriam Malek, miriam.malek@spglobal.com

--Claudia Carpenter, claudia.carpenter@spglobal.com

--Edited by Jonathan Loades-Carter, jonathan.carter@spglobal.com