Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 02, 2015

Short sellers' red October

Markets turned against short sellers last month as US equities rallied, lifting a number of high-in-demand names and reversing a five month trend of sought after short positions posting declines.

- Oprah's investment in Weight Watchers results in worst short of October

- However, shorts overall remain undeterred and continue to hold majority of positions

- Shorts double down and increase stakes in some of the worst performing names

US equities rally

It was a tough month of trading for resilient short sellers holding onto high conviction names as US equity markets rallied. The month saw the SPDR S&P 500 ETF increase 8.5% and the iShares Russell 2000 ETF rise by 5.6%.

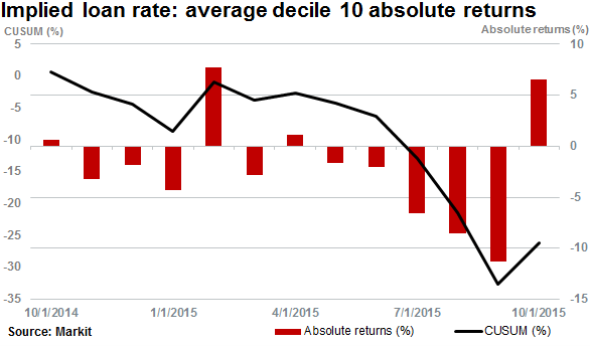

Markit's Research Signal's Implied Loan Rate** equity factor ranks US stocks according to the benchmark fee to borrow. High conviction names, those that have a high cost to borrow (which is driven by supply and demand), saw the worst performance recorded in October since February.

After five months of consecutive declines (positive trades for shorts), the top 10% of expensive names posted a positive 6.5% return for the month. Despite the negative monthly performance, shorting the top 10% has delivered returns of 26% on a cumulative basis over the last 12 months.

Oprah yet to squeeze out short sellers

Weight Watchers shares spiked on October 18th on news that Oprah had taken a 10% stake in the business and a board seat.

Earlier in the year, short sellers covered positions from a high of 21% of shares outstanding on loan, taking profits. In the last few weeks of October, shares jumped over 150% in two days, easily propelling the stock to the most unprofitable short position of October.

Short sellers have yet to cover positions with short interest initially increasing to 15.4% as shares rose. The benchmark fee to borrow also spiked 50%, indicating increased demand as the fee neared 30%. The share price has subsequently subsided by 15.7%, but the cost to borrow remains above 20%.

The second worst short position of October was Penn West Petroleum, whose shares jumped by 126%. Short sellers, however, remain undeterred, with shares outstanding on loan rising more than a fifth to 10.7%. Continued lower oil prices have forced the US oil and gas producer to evaluate selling prized assets as debt pressures mount.

Vital Therapies shares rose by 90% in October but saw short sellers add 13% to positions, pushing shares outstanding on loan to 13.2%.

The cost to borrow stock has remained above 60% as demand to short the stock continues to remain high after the company revealed in August that its liver therapy treatment study had failed.

** Defined as the value and time weighted average fee for the rate charged by the custodian to the borrower of a security. Markit ranks this factor in ascending order.

Relte Stephen Schutte, Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02112015-Equities-Short-sellers-red-October.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02112015-Equities-Short-sellers-red-October.html&text=Short+sellers%27+red+October","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02112015-Equities-Short-sellers-red-October.html","enabled":true},{"name":"email","url":"?subject=Short sellers' red October&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02112015-Equities-Short-sellers-red-October.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers%27+red+October http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02112015-Equities-Short-sellers-red-October.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}