Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 03, 2015

Short sellers' vital convictions

Short sellers prepared to pay high fees were rewarded in August as companies whose shares cost the most to borrow continued to underperform the market.

- 12-month returns of nearly 30% delivered by long short strategies based on shorts' demand

- Shorts rush to plummeting Vital Therapies on news of failed liver therapy treatment

- Increased supply sees Shake Shack's cost to borrow fall but short sellers remain hungry

Sellers' convictions pay off

Short sellers cost to borrow or the benchmark fee charged by custodians provides an insightful gauge for the relative conviction of short sellers to hold positions in specific names.

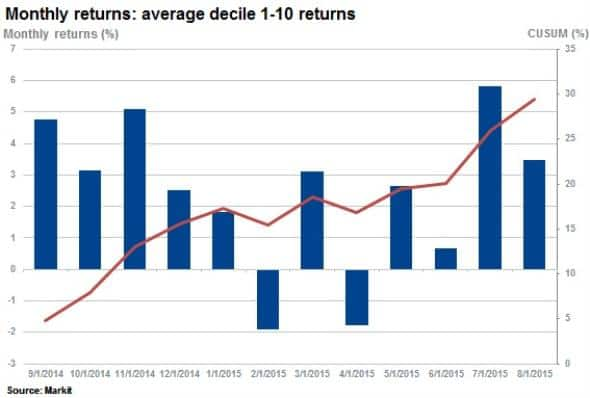

Utilising Markit Securities Finance data, Markit Research Signals Implied Load Rate factor has continued to deliver material positive returns over the past 12 months across a universe of over 3000 US stocks.

Going long the bottom 10% in demand names (low cost to borrow) and short those most in demand (high cost to borrow) has delivered cumulative returns of 29.4% over the past 12 months.

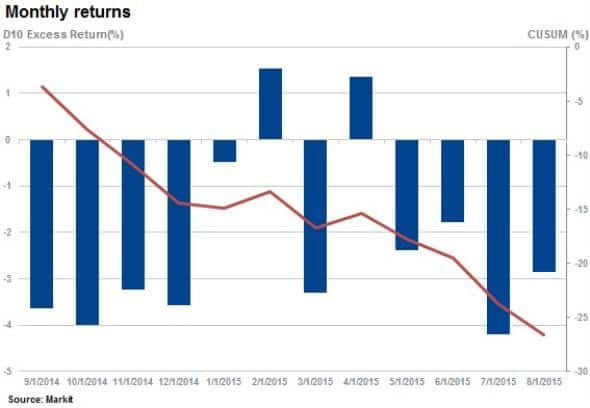

The factor reveals how successful short sellers are in identifying names that consistently underperform. Analysing monthly returns for the past 12 months reveals that 90% of returns have been delivered by the 10% most shorted names with an average monthly underperformance (short return) of 2.2%.

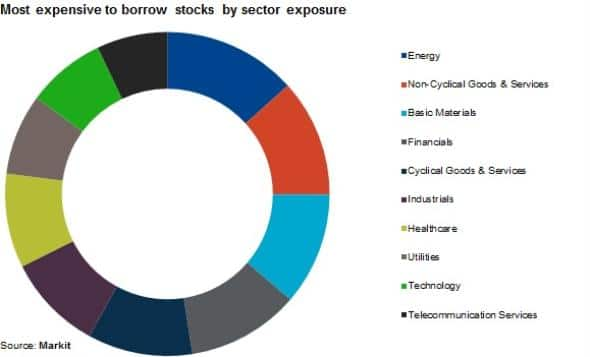

Energy sector still the most in demand

Currently, the energy sector ranks as the most in demand sector to short with an average cost to borrow of more than three times that of the average for the Russell 3000.

Demand and supply

Due to limited supply of stock in lending markets, when demand significantly outstrips supply, the cost to borrow is driven to extremes

Vital Therapies, for example, has a fee to borrow north of 80% (the annualised cost to borrow the stock). The cost to borrow Vital more than tripled in August as the company revealed that its liver therapy treatment study had failed. The stock has subsequently slumped by a staggering 80%.

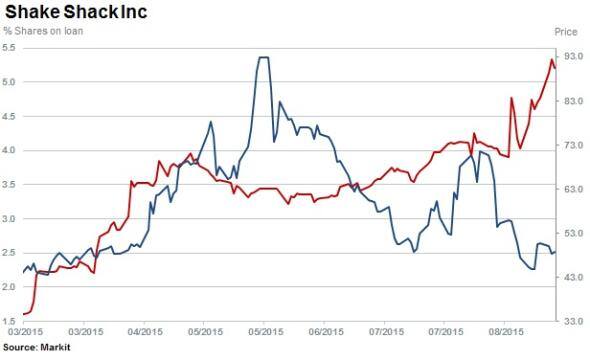

In addition to the conviction of short sellers, timing and supply are two main factors that influence the cost to borrow. Newly listed Shake Shack's cost to borrow soared above 100% as an initial limited supply of stock and a lofty share price attracted shorts.

However while short interest in Shake Shack continues to rise, with shares outstanding on loan increasing to 5.2%, the cost to borrow has fallen by almost 70% while the quantity of lendable stock has increased by 25%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-equities-short-sellers-vital-convictions.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-equities-short-sellers-vital-convictions.html&text=Short+sellers%27+vital+convictions","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-equities-short-sellers-vital-convictions.html","enabled":true},{"name":"email","url":"?subject=Short sellers' vital convictions&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-equities-short-sellers-vital-convictions.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers%27+vital+convictions http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-equities-short-sellers-vital-convictions.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}