Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 06, 2015

Global dividend growth slows

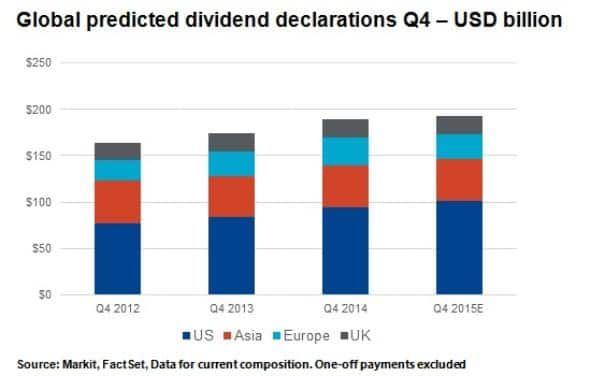

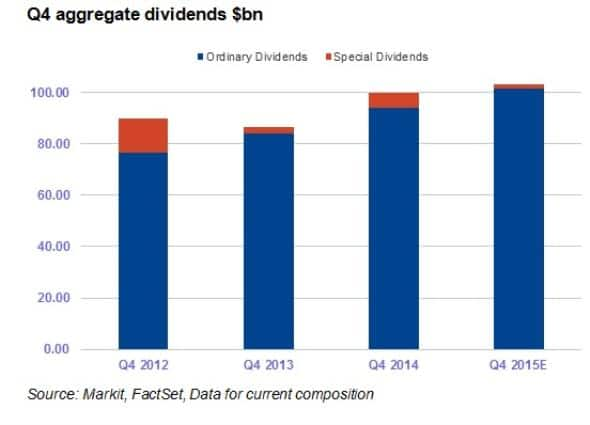

Markit Dividend Forecasting expects global declared dividends in the fourth quarter to stall, increasing by 1.8% to reach $193bn in total, compared to the 8.8% growth seen in Q4 2014.

- Regular dividends in Europe (ex UK and Ireland) to shed more than €1bn in Q4

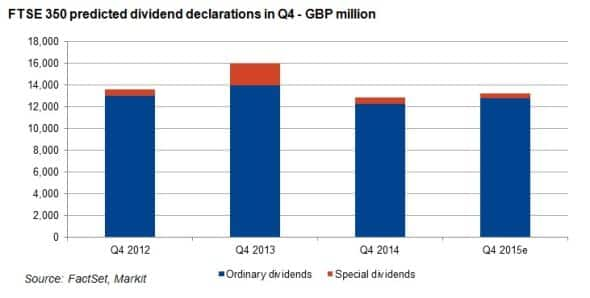

- UK and Ireland to grow Q4 dividends to "13.2bn as firms reiterate commitment to distributions

- Strong payments from oil majors still expected despite continued depressed oil prices

Markit Dividend Forecasting has released four detailed regional reports on global dividend payments expected in the fourth quarter of 2015. To receive the full report(s) or to find out more, please contact us.

Global dividend payment slows

Globally, dividend payments are set to slow in the fourth quarter of 2015, lead by contractions in Europe and Apac. UK companies are restructuring and trimming costs to maintain short term payout levels, and dividend growth in the US slows.

$193bn in total dividends is expected in the quarter, comprising $101bn from the US, $46bn from Europe combined and $45bn from Apac.

Preference for dividends stuck in UK

Corporate earnings and stock prices have experienced sharp declines after a sell off led by emerging markets erased year to date gains. In the UK and Ireland, equivalent or proportionate decreases in dividends have not yet been evident. This has provided some cushion to investors hit by lower prices.

As a result of lower earnings, earnings cover for dividends have hit lows not seen since the depths of the great recession. There have been some cuts, such as Glencore, but overall there is determination by management teams to protect dividends, which have seen yields rise.

Based on recent comments from management of key dividend payers like HSBC, BP, Royal Dutch Shell and Vodafone, the overall level of payments is not expected to drop in Q4.

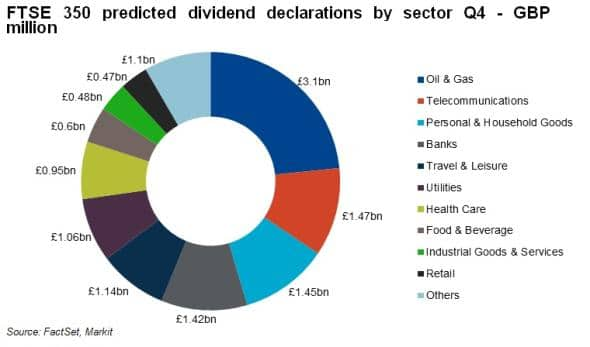

Oil & Gas to remain strong payers

Lower oil prices continue to place pressure on energy firms, with BP management indicating it believes that prices will be "lower for longer". However, oil majors have managed to maintain dividend levels, perhaps due to being better capitalised and diversified as well as benefiting from refining operations.

UK retailers' payments fall

Retailer payouts are predicted to fall 21% on lower dividends from supermarkets battling for market share. Tesco is not expected to pay a dividend in Q4 while Sainsbury's is expected to see a 36% decline in its dividend, after a cut in 2015.

Marks & Spencers, however, is forecasted to increase its payout by 5%. The star performer in the sector once again is Next and expectations are for management to raise its dividend by 20%.

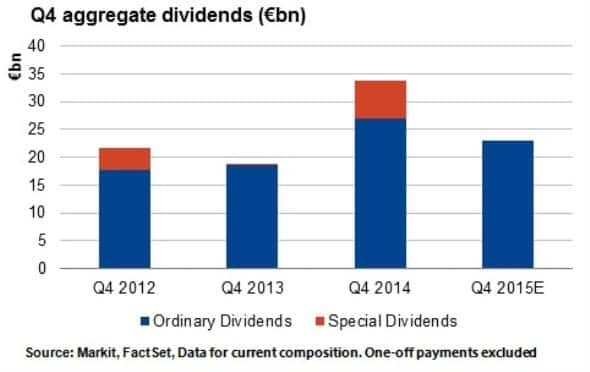

Europe

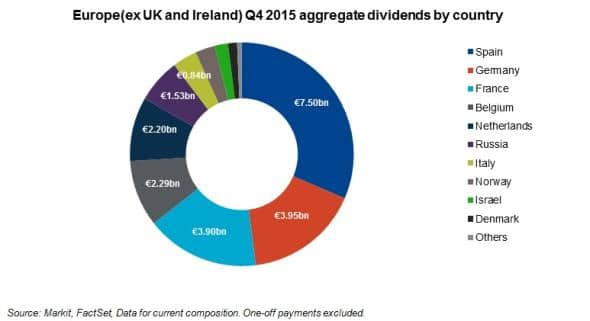

Matching the negative outlook from Markit's PMI, which showed some countries in Europe and China struggling in the current environment, Markit is forecasting ordinary dividends to decrease by 4.3% in the current quarter to €23.9bn.

Dividends from Russian Basic Resources account for the largest drop in European dividends, being €2.3bn lower than Q4 2014.

Spanish dividends account for €7.5bn or 30% of total payments in the region. The figure is down €0.5bn due to Santander's dividend cut. Dividends from German companies are the next biggest contributors in the region and forecast to approach €4bn, up 10%.

As in the UK, Oil & Gas giants Royal Dutch Shell and Total are expected to be the biggest payers despite lower oil prices.

The fourth quarter is a quiet period in Europe in terms of dividends. However, 89 announcements in Europe (ex UK and Ireland) are expected in the fourth quarter of 2015, a steep decrease compared to 99 announcements in the same period the previous year.

US dividend growth

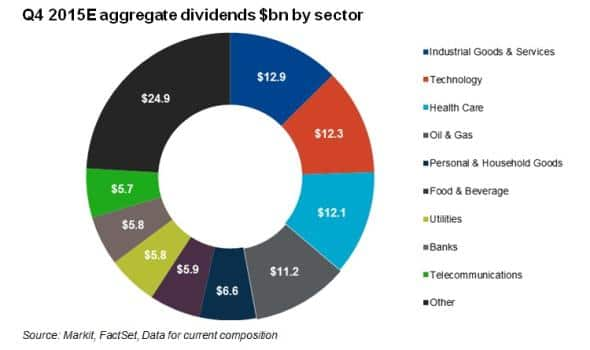

Dividends from US blue chips are expected to increase by only 3.4%, lagging 2015 full year growth estimates of 12.3%. Markit forecasts top US corporates to declare $103bn in cash dividends for this quarter, with the biggest increases expected from the Travel & Leisure, Food & Beverage and Retail sectors.

Sectors dragging payout growth include Basic Resources, Media, Real Estate, Technology and Health Care. Major Q4 dividend increases include Visa, CVS Health Corp, MasterCard and Starbucks Corp.

Apac dividends fall

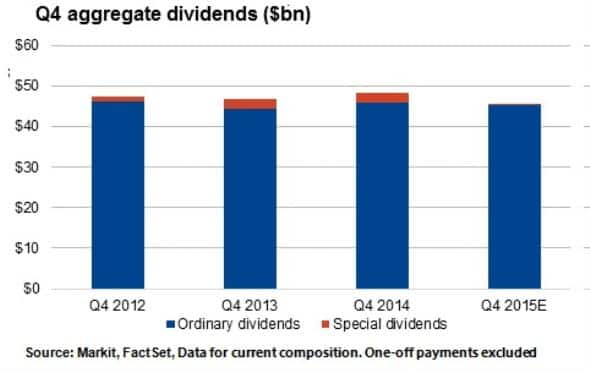

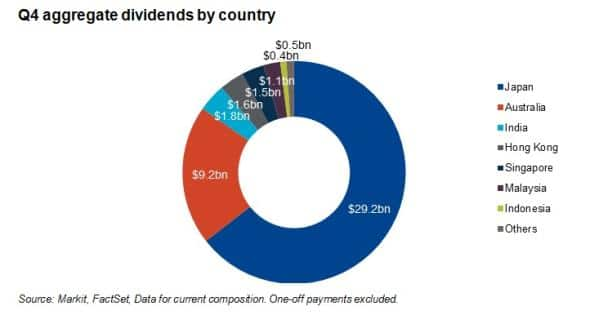

For the final quarter of this year, total dividends announced in the period are forecast to fall by 5.5% to $45.5bn in Apac. The drop is influenced by a small dip in ordinary dividends and a marked 86.6% slump in special dividends.

Almost two-thirds of the quarter's aggregate dividends are expected to be contributed by Japan, due to its regular interim dividend announcement season that stretches until early November.

Australian dividends are projected to make up 20% of Q4 dividends, with the bulk of the country's dividends contributed by the banking sector.

While dividend growth is expected to remain muted across India, Hong Kong and Singapore, an 18.3% leap in Indonesian dividends is expected. Conversely a 23.5% cut in Malaysian dividends in dollar terms is forecast, primarily due to the steep local currency depreciation in recent months and weakness from key sectors.

Leading dividend payers are expected to include Australian big banks as well as Toyota Motor Corp. Apac dividends are forecasted to finish the year on a downward trend. Compared to a marginal 3.1% increase in the first half of the year, total dividends in the second half are expected to be down 7.5% year-on-year.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06102015-equities-global-dividend-growth-slows.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06102015-equities-global-dividend-growth-slows.html&text=Global+dividend+growth+slows","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06102015-equities-global-dividend-growth-slows.html","enabled":true},{"name":"email","url":"?subject=Global dividend growth slows&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06102015-equities-global-dividend-growth-slows.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+dividend+growth+slows http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06102015-equities-global-dividend-growth-slows.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}