Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 09, 2015

October rally powers HY; AB InBev credit risk rises

Bonds rally after September woes, although bank risk surges. Bond investors demand more for big M&A deal.

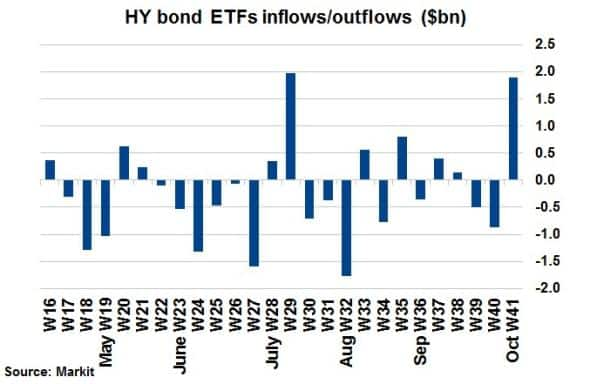

- HY bond ETFs have seen $1.9bn of inflows this week, highest since second week of July

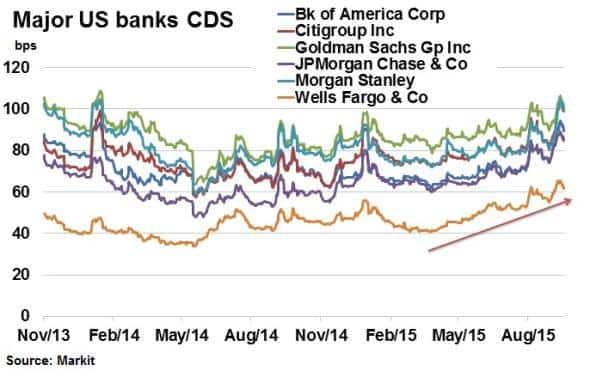

- Citigroup's five year CDS spread at its widest in two years; other US banks also wider

- AB InBev's five year bond now trades wider than an equivalent five year SAB Miller bond

October fest

After a dismal September for US corporate bond investors, October has started with strong gains. Last week's below par jobs report set the notion that the Fed may introduce QE4, sending treasury yields lower. This coupled with a strong week for commodity prices has seen credit risk among corporate bonds ease.

High yield (HY) bonds, seen as the riskier end of the corporate bond spectrum, have seen spreads tighten 45bps this week, according to the Markit iBoxx $ Liquid High Yield (HYG) index. On a total return basis, this represents 1.98% so far this month.

Unsurprisingly, October's risk-on sentiment has seen investors pile back into HY bonds through ETFs. This week has seen $1.8bn of inflows, the biggest since the second week of July, according to Markit's ETP service. Interestingly that was same week Greece agreed a bailout with its creditors, relieving global tensions around a eurozone breakup. With September's severe market volatility out of the way (VIX is below 20 now), this week has similar connotations.

Other risky areas of the global corporate bond market have also performed well. Emerging market debt denominated in US dollars, susceptible to US interest rate policy, has seen substantial returns so far this month as expectations got pushed back. The Markit iBoxx USD Emerging Markets Corporates Overall index has returned 1.51% so far this month.

Banks

Amongst September's market volatility, US banks saw credit risk surge. Tough trading conditions have already led some banks like Morgan Stanley to estimate sharp declines in FICC revenue this quarter. Adding to the mix a flatter yield curve due to the Fed stalling, which in turn affects lending margins, banks have had a challenging last quarter.

Bulge bracket bank Citigroup's five year CDS spread, a proxy for perceived credit risk, widened to over 100bps this week for the first time since October 2013. Its credit risk is now on par with the likes of Goldman Sachs and Morgan Stanley, investment banks who tend to delve in the riskier side of banking.

CDS spreads are, however, nowhere near the levels seen in 2011-2012, when Citigroup's 5 yr CDS topped 300bps, signalling little sign of panic just yet.

M&A risk

This week the CEO of AB InBev, the world's largest brewer in the world, said that the potential acquisition of SAB Miller, the second biggest brewer in the world, would create social value. AB Inbev's pursuit has lingered for some time and after a third bid this week, which was duly rejected (again), the final price paid may question economic value.

Bond investors are already demanding more for their money as spreads for both corporations have crept up ever since the initial advances. AB InBev's five year bond is actually now trading 13bps wider than an equivalent five year SAB Miller bond, having been 15bps tighter in mid-September, showcasing the risk involved in what would be the third biggest M&A deal of all time.

Neil Mehta, Analyst, Fixed Income at Markit

Posted 9 October 2015

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102015-credit-october-rally-powers-hy-ab-inbev-credit-risk-rises.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102015-credit-october-rally-powers-hy-ab-inbev-credit-risk-rises.html&text=October+rally+powers+HY%3b+AB+InBev+credit+risk+rises","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102015-credit-october-rally-powers-hy-ab-inbev-credit-risk-rises.html","enabled":true},{"name":"email","url":"?subject=October rally powers HY; AB InBev credit risk rises&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102015-credit-october-rally-powers-hy-ab-inbev-credit-risk-rises.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=October+rally+powers+HY%3b+AB+InBev+credit+risk+rises http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102015-credit-october-rally-powers-hy-ab-inbev-credit-risk-rises.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}