Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 14, 2016

Short sellers hold steady after banner 2015

Appetite to sell stocks short has showed no signs of slowing into the new year, with demand to borrow shares up by over 14% in the last 12 months.

- 10% of shares which cost the most to short underperformed globally in 2015

- US investors had most successful year on record as top targets underperformed by 25.7%

- Short sellers not slowing down in the new year as the value of stock on loan is up 10% yoy

Last year witnessed a surge in short selling activity as the economic climate saw short sellers add to their positions across major global markets. The ongoing nature of the Chinese slowdown and commodities slump also ensured that the top short strategies also carried strong momentum into the end of the year, with shorting activity peaking in the closing weeks of 2015.

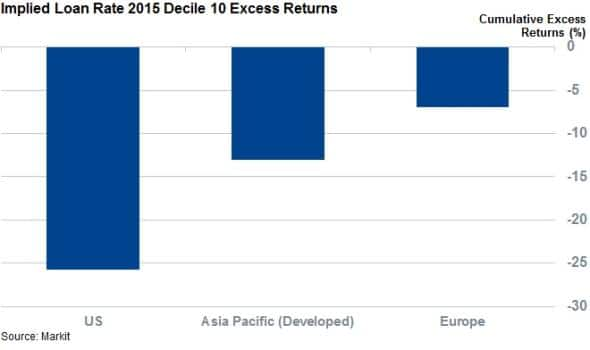

From a performance point of view, the year proved very fruitful for short sellers as the 10% of shares which short sellers were the most willing to pay up for underperformed the rest of the market by a wide margin over 2015. The small minority of stocks which make up the highest conviction shorts in the US underperformed the market by a staggering 25.7% over 2015, according the Markit Research Signals Implied Loan Rate factor.

Short sellers in Europe and Asia also enjoyed a profitable year as their high conviction positions managed to underperform the market by 12 and 7% respectively.

US returns best on record

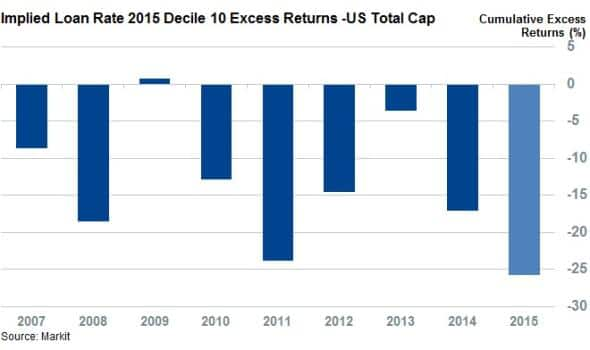

Perhaps most surprising of all is the fact that the strong underperformance of the high conviction US short positions over last year makes 2015 the best ever year for short sellers since the genesis of the Implied Loan Rate factor in 2007.

Even the financial crisis of 2008 proved less fruitful for high conviction shorts, when this group of shares only underperformed the market by 18.5%. Surprisingly, the last most profitable year for US short selling was 2011, when the most expensive to borrow 10% of US shares underperformed the rest of the market by 23.8%

Shorts show no sign of slowing down

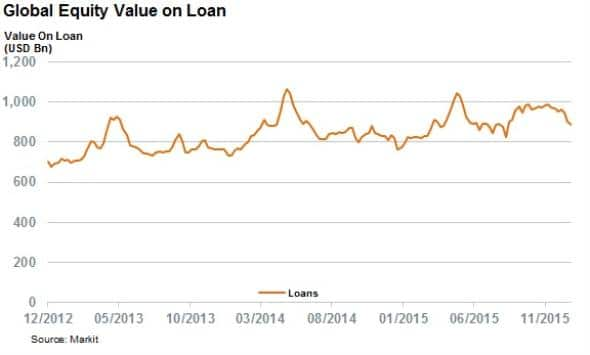

The appetite to sell shares short also shows no signs of slowing down in the New Year as last year's macro catalysts for market volatility have shown little signs of subsiding. This increased propensity to sell short looks to be playing well into the hands of the securities lending industry, as the current value of equities now out on loan is over $100bn higher currently than at the same time a year, a healthy 14% year on year increase.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012016-Equities-Short-sellers-hold-steady-after-banner-2015.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012016-Equities-Short-sellers-hold-steady-after-banner-2015.html&text=Short+sellers+hold+steady+after+banner+2015","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012016-Equities-Short-sellers-hold-steady-after-banner-2015.html","enabled":true},{"name":"email","url":"?subject=Short sellers hold steady after banner 2015&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012016-Equities-Short-sellers-hold-steady-after-banner-2015.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+hold+steady+after+banner+2015 http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012016-Equities-Short-sellers-hold-steady-after-banner-2015.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}