Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 15, 2016

Will 2016 be the year of the bear for the HSI?

A rough start to the year for the Hang Seng has been seized upon by short sellers. Demand to borrow the blue chip index's constituents has surged as economic growth continues deteriorate.

- HSI down by 32% from its peak in 2015 as overseas ETF investors cash out

- Average short interest across the HSI constituents is up by a quarter ytd

- Short sellers pay up for positions in coal miners that have proved profitable in 2016

Hang Seng decline accelerates into 2016

The Chinese market selloff of 2015 had until recently impacted Hong Kong blue chips to a lesser degree than mainland listed equities and the broader local market. However, the continued sell off in global equity markets in 2016 has seen even the largest companies of the Hang Seng fall and close the gap on the declines seen on the mainland.

On a price return basis the iShares FTSE A50 China Tracker ETF (A50) and the Hang Seng Index ETF are down 32% and 35% respectively from highs reached in April 2015.

The Hang Seng Index ETF has fallen 16% year to date, more than double 2015's decline of 7.2%. The A50 has however not been out done in 2016, falling 22% year to date. Combined with 2015 losses, the A50 has erased all its gains achieved during 2014. The Hang Seng has however erased both gains of 2014 and those of 2013.

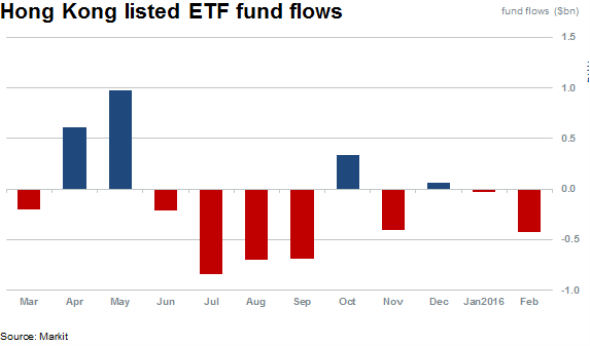

ETF investors yet to buy the dip

With multi year lows in the indexed level of both China and Hong Kong listed equities, investors have yet to be enticed back. Aggregate outflows across foreign listed ETFs exposed to the region have seen $460m of outflows year to date.

Shorts on the scent

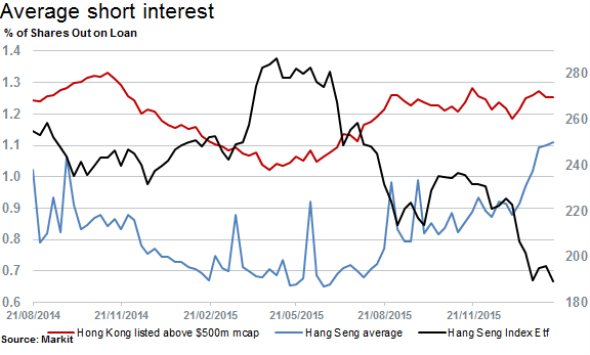

Short sellers look to have caught the recent Hang Seng selloff, with short interest in the larger companies comprising the index with a significant 23% increase in shares outstanding on loan to just above 1.0%.

Across the wider Hong Kong equity market (firms with at least $500m in market capitalisation), average short interest had already increased during 2015's sell off and has largely remained static hovering around 1.2%.

Shorts look to move into software and services

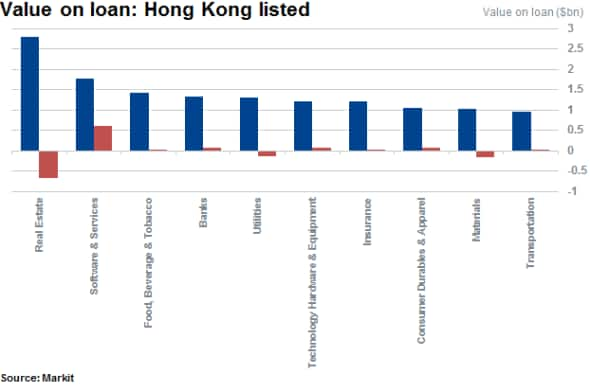

Ranking Hong Kong listed firms by current value on loan reveals that by sector, real estate firms remain the most shorted by value. This is in part due to the numerous companies above $500m in market cap being real estate by nature (~20%).

Real estate has seen value on loan decline by $677m year to date. Half of this is in fact explained by a reduction in short positions exposed to China Vanke Co. Short interest in the residential property developer has declined by almost two thirds from highs in 2015 to 8.0% of shares outstanding on loan currently.

Software and services is the second highest sector in Hong Kong by aggregate value on loan. Unlike real estate, the sector has seen a large rise in demand to borrow as the aggregate value of short positions has jumped by over $600m year to date. However, again this is largely influenced by one large company with a rise in short positions in $160bn Tencent Holdings. With a relatively low amount of shares outstanding on loan at 0.9%, this represents over $1.5bn in short positions.

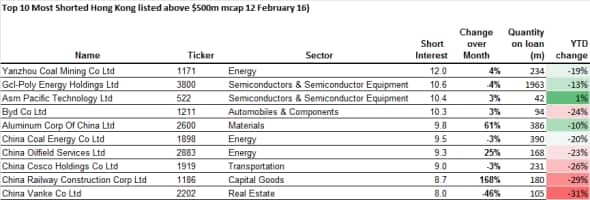

Coal shorts most in demand

The most shorted stock (above $500m in market cap) currently is Yanzhou Coal Mining with 12% of shares outstanding on loan and the stock losing 19% year to date.

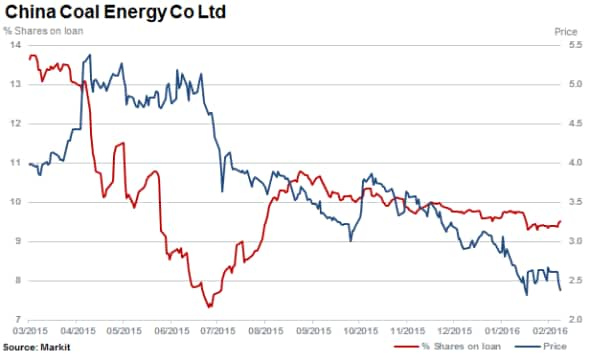

Despite both Yanzhou Coal Mining and China Coal Energy (below) falling more than 40% in the last 12 months, demand to borrow both remains high. This indicates strong levels of conviction among those still willing to go short.

China Coal Energy has fallen 20% year to date with 9.5% of its shares currently out on loan.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15022016-equities-will-2016-be-the-year-of-the-bear-for-the-hsi.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15022016-equities-will-2016-be-the-year-of-the-bear-for-the-hsi.html&text=Will+2016+be+the+year+of+the+bear+for+the+HSI%3f","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15022016-equities-will-2016-be-the-year-of-the-bear-for-the-hsi.html","enabled":true},{"name":"email","url":"?subject=Will 2016 be the year of the bear for the HSI?&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15022016-equities-will-2016-be-the-year-of-the-bear-for-the-hsi.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Will+2016+be+the+year+of+the+bear+for+the+HSI%3f http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15022016-equities-will-2016-be-the-year-of-the-bear-for-the-hsi.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}