Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 15, 2015

German automakers idle on

Almost a month after Diesel-gate at Volkswagen, European automakers look to have recovered from an acute sell off but previous signs of weakness linger on, clouding the road ahead for the global industry.

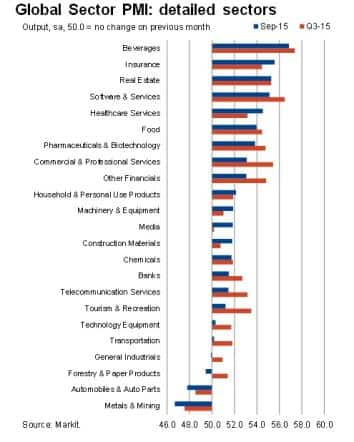

- Global automakers second from bottom of the September sector PMI

- VW volatility subsides to initial reaction levels as markets digest the impacts of the blunder

- European auto part suppliers Autoliv and Grammer highly shorted pre Diesel-gate

VW the catalyst

The global automotive sector had already shown signs of being under pressure in August 2015 with weak PMI data, coupled with meagre sales levels reported out of China. Prior to the scandal, BMW, Daimler and Volkswagen shares had retreated 6%, 3.3% and 10%, respectively, as Chinese equities began to falter.

More weak PMI data released for September 2015 indicated that production levels had fallen further at global automobiles and auto parts companies, priming markets for the recent increased volatility.

Made in America

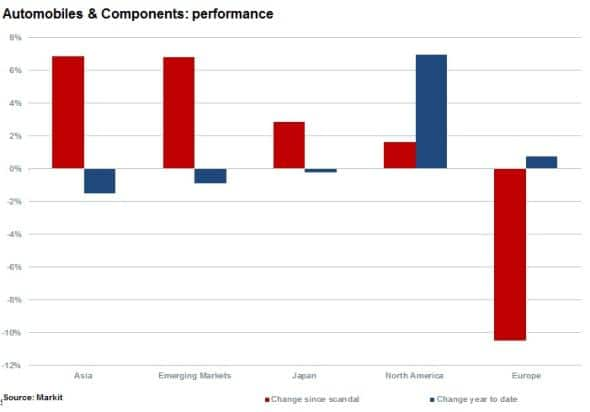

News of the scandal saw significant falls in German carmakers' stocks. Additionally, the increased uncertainty impacted the industry's credit metrics. However, despite the scandal impacting European carmakers specifically, the segment is still outperforming Asia and emerging markets year to date on average.

The clear winners of the sector thus far are US carmakers, who have benefitted from lower oil prices despite a stronger dollar making imports more attractive.

Time the best healer

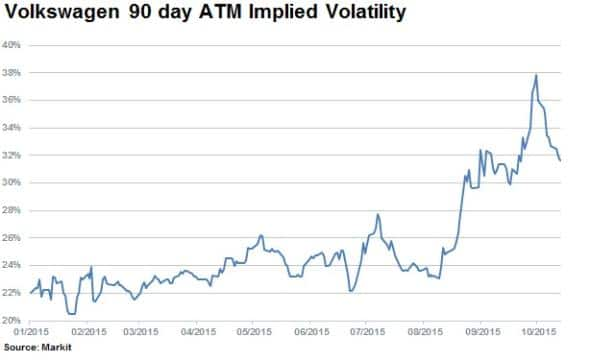

The negative sentiment and increased scrutiny will undoubtedly plague German automakers for some time. Volatility levels continue to remain at scandal levels for VW, after falling 13% (as measured by 90 day ATM Implied Volatility below).

VW started off the year with the lowest levels of implied volatility across ten global European and US automakers. Levels rose sharply as the emissions news broke, sending shares plummeting. Though its stock fell 51% in the days following news of the emissions scandal, shares in VW have recovered by 27% in recent weeks. This return to normalcy is reflected in the options implied volatility.

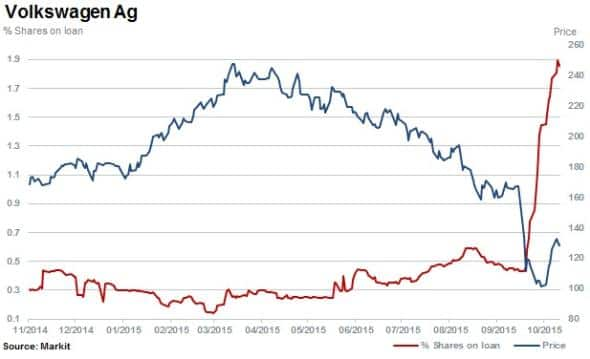

Though options implied volatility seems to indicate a return to normalcy, short interest in VW shares seem to indicate that the company is not out of the woods. Its short interest more than tripled to 2% of shares outstanding on loan since the news broke last week. The other major European carmakers have not seen much in the way of short interest, despite the recent headwinds.

Parts makers see the action

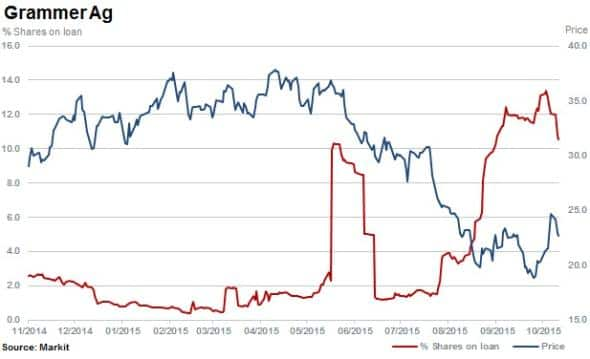

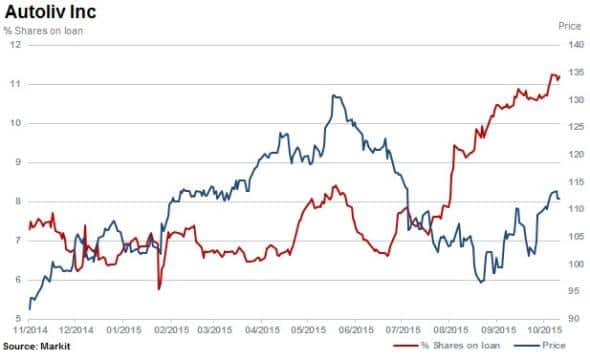

With German carmakers under additional pressure due to the fallout created by VW, short sellers are targeting component manufacturers such as Grammer and Autoliv, who may be affected by the scandal as it continues to play out.

German based Grammer supplies interior components and has seen short interest increase since March to 10.5% of shares outstanding on loan.

Headquartered in Stockholm, Autoliv supplies airbags, seatbelts and other components to the auto industry. Shares outstanding on loan have increased to 11.2%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102015-Equities-German-automakers-idle-on.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102015-Equities-German-automakers-idle-on.html&text=German+automakers+idle+on","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102015-Equities-German-automakers-idle-on.html","enabled":true},{"name":"email","url":"?subject=German automakers idle on&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102015-Equities-German-automakers-idle-on.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+automakers+idle+on http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102015-Equities-German-automakers-idle-on.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}