Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 19, 2016

iTraxx Series 26 roll notes

Speculations around the demise of single name European CDS markets were premature given the market showed ample liquidity heading into the September iTraxx roll

- Liquidity criteria suffices to fulfil the crossover constituents

- 42 of the constituents of the new crossover index originally came from the supplementary list

- Spread premium for crossover inclusion is 66bps lower than the previous series

The Markit iTraxx Crossover index was able to entirely fill its constituent from the list of the 1000 most liquid CDS contracts in the six months leading up to September's roll. Thin liquidity in high yield single name contracts has meant that historically, crossover index rolls had to be filled by a supplementary list of alternate high yield contracts based on recently issued debt. These issuers have ample stocks of deliverable bonds but don't see enough liquidity in their CDS contracts to warrant inclusion to the crossovers index on liquidity grounds alone.

Since its introduction in September 2011, the supplementary list has played a key role in the crossover index, with 52 names joining the index through this process to date. 42 of the series 26 crossover constituents originally entered through the supplementary list. This demonstrates the sustained liquidity generated by the supplementary list process given that the entirety of the series 26 index was selected through the liquidity criteria.

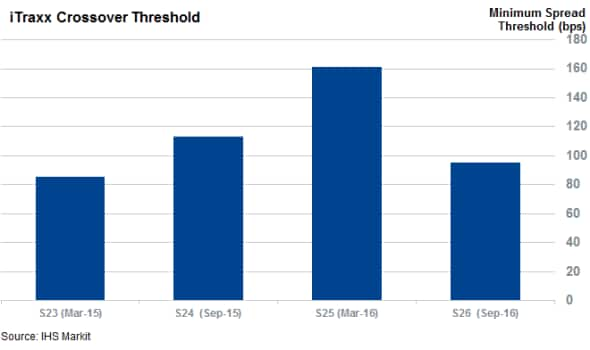

Ongoing quantitative easing in Europe has also helped broaden this roll's field of eligible crossover contracts as the threshold for inclusion in the crossover, 1.5x the main iTraxx Europe Non-Financial index level, has fallen drastically since the previous roll. Contracts trading wider than 95.46bps were eligible for inclusion into the crossover index - over a third lower than the previous threshold of 161bps. This lower threshold helped fill the inclusion list as it enables names to enter the index that had previously been excluded due to having insufficiently wide CDS spreads.

Names which entered the index due to this trend include Nokia and Deutsche Lufthansa which were both trading 30bps tighter than the series 25 cutoff in March.

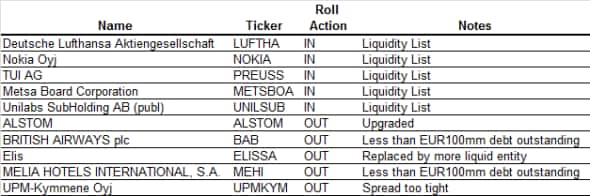

The ample liquidity also ensured that only one of the index's changes occurred due to insufficient trading volumes. That constituent was French cleaning service contractor Elis Group. The other constituent deletions were Melia and British Airways which became ineligible for the index due to having less than the " 100m debt outstanding, Alstom which dropped out of the Crossover universe after its bonds were upgraded to investment grade status and UPM-Kymmene which traded tighter than the 95.46bps threshold for index inclusion at the end of August.

Liquidity also played a role in the main iTraxx Europe index roll as Compass Group was replaced by newly upgraded, and more liquid, Imperial Brands.

German utility RWE was the other removal from the main index after its May downgrade. UK utilities provider SSE Plc will replace RWE in the series 26.

Financials steady for now

The Financials index did not see any constituent changes in the most recent roll. Markit is aware of the recent the recent spate of HoldCo level issuances driven by bank needs to address their minimum requirement for own funds and eligible liabilities (MREL) around recapitalization and bail in events. Markit has asked the industry for its views of transitioning bank entities currently included at OpCo level to Holdco entities for future versions of the iTraxx Europe Series.

Markit is observing debt issuance, CDS liquidity on different bank entities as well as taking into account market participant feedback ahead of making any index rule changes for future index series.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19092016-Credit-iTraxx-Series-26-roll-notes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19092016-Credit-iTraxx-Series-26-roll-notes.html&text=iTraxx+Series+26+roll+notes","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19092016-Credit-iTraxx-Series-26-roll-notes.html","enabled":true},{"name":"email","url":"?subject=iTraxx Series 26 roll notes&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19092016-Credit-iTraxx-Series-26-roll-notes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=iTraxx+Series+26+roll+notes http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19092016-Credit-iTraxx-Series-26-roll-notes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}