Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 24, 2015

Walmart wages raise performance questions

Walmart has announced a dramatic increase in wages for the company's lowest paid employees, raising its salary bill by $1bn. Management hopes that this will drive increased customer service, sales and ultimately returns.

- Walmart sales growth stagnates as 2.2 million employees generate close to $500bn in sales

- Low revenue per employee firms generated negative monthly returns of 0.26% since 2007

- Walmart employees each generate almost $20,000 more per year than Target

Wage growth: cause or effect

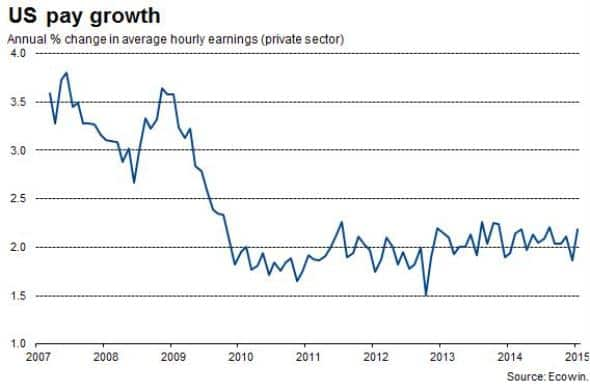

Walmart, the largest employer in the world, surprised markets last week when it announced it would be raising the wages of its lowest paid employees; effectively raising the minimum wage. This could set the stage for similar increases at other firms as the demand for labour increases as the US economy heats up. The rate of US pay growth has increased, with annual growth of 2.2% registered in January 2015.

The increase in operating costs at Walmart occurred as weaker earnings globally impact results on the back of stronger dollar as 30% of the company business is outside of the US. Material growth is becoming harder to achieve for the world's largest retailer with sales and earnings growth of 3.5% and 2.3% respectively for the past five years (CAGR). This is in comparison to Amazons five year sales CAGR growth of 29.4%, however the company's earnings are still non-existent as relentless investment in growth continues.

Management is attempting to take advantage of recent increases in store foot traffic, the first rise in three years as lower gas prices bring consumers in. Battling on price too, Walmart recently engaged in public online price checking against Amazon as the firm continues to compete with online retailers and consumers' showrooming.

Analysing revenue per employee

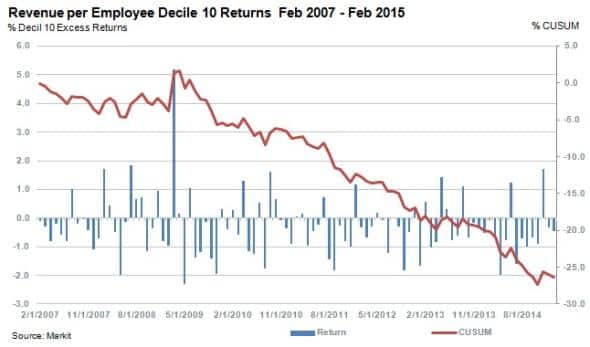

Markit's Research Signals' Revenue per Employee*(RPE) factor reveals that investors generally reward companies that generate more RPE, but that this has been most significant for 'low-RPE' firms.

Companies in thetenth decile of sample universe (Markit US Total Cap) or those with a relatively low RPE figure have delivered negative returns of 0.26% per month on average since February 2007. These returns were driven in part by smaller cap companies that have lower RPE ratios.

Walmart ranks in the seventh decile (below average) and using the latest earnings information has a RPE ratio of $220,000 per employee. Despite generating five times the revenue of online retailer Amazon, Walmart has 14 times the amount of employees and is outranked on a RPE basis. Amazon ranks in thethird decile with a RPE of $577,000. Both firms beat brick and mortar retailer Target with the company ranking in theeighth decile and a RPE of $201,000.

The implications from the RPE factor model's return data are that companies with a low RPE ratio (relatively more labour intensive) which are smaller than their peers have generally underperformed since 2007. The factor can be used to identify these historical underperformers in an environment where wages in the US are set to rise in future.

*Defined as the trailing 12-month total sales divided by the number of employees at the end of the last reported fiscal year.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022015-Equities-Walmart-wages-raise-performance-questions.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022015-Equities-Walmart-wages-raise-performance-questions.html&text=Walmart+wages+raise+performance+questions","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022015-Equities-Walmart-wages-raise-performance-questions.html","enabled":true},{"name":"email","url":"?subject=Walmart wages raise performance questions&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022015-Equities-Walmart-wages-raise-performance-questions.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Walmart+wages+raise+performance+questions http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022015-Equities-Walmart-wages-raise-performance-questions.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}