Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 24, 2015

Russian credit withstands crisis

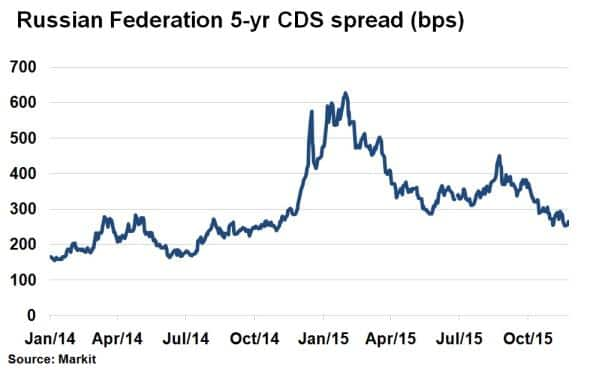

Military tension with Turkey has sent Russia's CDS spread wider this morning but Russia's apparent rapprochement with the west has seen investors treat Russian bonds in a much brighter light.

- Russian CDS spreads jumps 10bps on the news that Turkey shot down one of its planes

- Even with the recent surge, Russian credit risk stands at less than half the 2014 highs

- Russian government bonds have returned over 30% year to date

After spending the first three months of the year in purgatory due to the continuing fighting in East Ukraine, Russian credit has begun to regain favour among investors in recent months.

The recent willingness of the international community to put aside past differences on policy towards Syria in order to fight Islamic State saw Russia's sovereign CDS spread trade at the tightest level in over 12 months last week. This development, which came despite initial scepticism from the US, means that Russia's CDS spread has tightened by 110bps since they first started to bomb parties opposed to Syria's ruling party.

Tuesday's developments

But the above trend came to an abrupt halt this morning when news broke that Turkey shot down a Russian plane, which it claimed had violated Turkish airspace. This sent Russia's CDS spread 8bps wider intraday as the market reaction digested the news that a Nato country had shot down a Russian military plane.

While the impact of this action is still developing, the market reaction has so far been relatively calm. Russian credit is still trading with less than half of the credit risk seen during the depths of this winter's Ukraine crisis-induced highs.

Even Turkey, whose CDS spreads were 10bps higher in the wake of this morning's developments, still trades with a much lower level of credit risk than the levels seen before the country's recent election last month.

Bonds still perform strongly

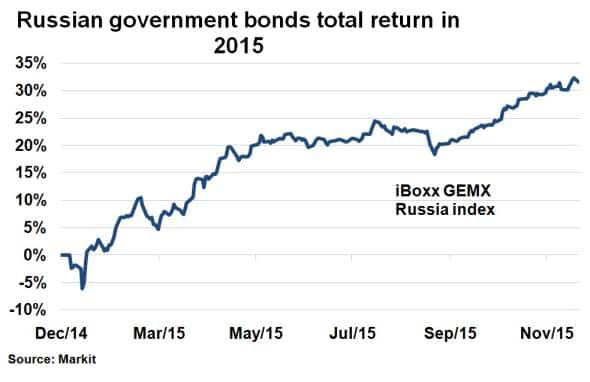

Russian credit has been one of the stand out performers among all asset classes in 2015. Russian government bonds, as represented by the Markit GEMX Russia index, have returned 31.6% on a total return basis so far this year. The recovery has been driven by in part by the bottoming out on oil prices, a key Russian export, but also easing tensions in Ukraine and sound monetary policy. The gains also see a retracement from 2014's losses.

The recovery in Russian sovereign credit has also reflected onto corporate bonds. The Markit iBoxx USD Corporates Russian Federation Index has seen its index spread decline from over 1,000 bps in January this year to 440bps as of November 23rd. This is the lowest level since July 2014 and comes as no surprise since many corporates in the index are heavily tied to the Russian state and the price of oil. In fact the largest constituents in the index by weight are the oil & gas and basic resources, which make up 55%.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-Credit-Russian-credit-withstands-crisis.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-Credit-Russian-credit-withstands-crisis.html&text=Russian+credit+withstands+crisis","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-Credit-Russian-credit-withstands-crisis.html","enabled":true},{"name":"email","url":"?subject=Russian credit withstands crisis&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-Credit-Russian-credit-withstands-crisis.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Russian+credit+withstands+crisis http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-Credit-Russian-credit-withstands-crisis.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}