Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 29, 2015

Week Ahead Economic Overview

Worldwide manufacturing and services PMI releases plus a US labour market update are highlights of the week alongside the Bank of England's policy decision.

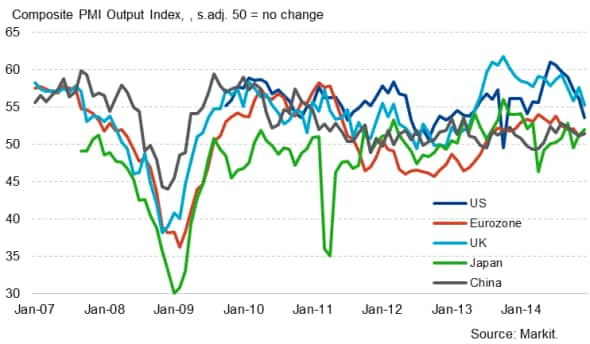

Composite PMI

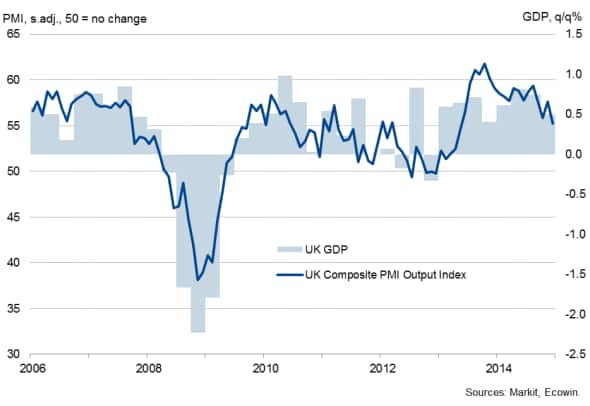

As correctly anticipated by the PMI surveys, UK economic growth slowed to 0.5% at the end of 2014 but remained robust by historical standards. Despite the persistent strong economic growth, no change in policy is expected at the Bank of England's meeting on Thursday, given that inflation fell to a 14" year low and previously 'hawkish' policymakers withdrew their calls for rate hikes at the January meeting.

Prior to the MPC meeting, manufacturing, construction and services PMI surveys will give the first insights into how the UK economy is performing in the New Year. On Friday, Markit's recruitment industry survey will also provide important updates to pay and hiring trends.

UK economic growth and the PMI

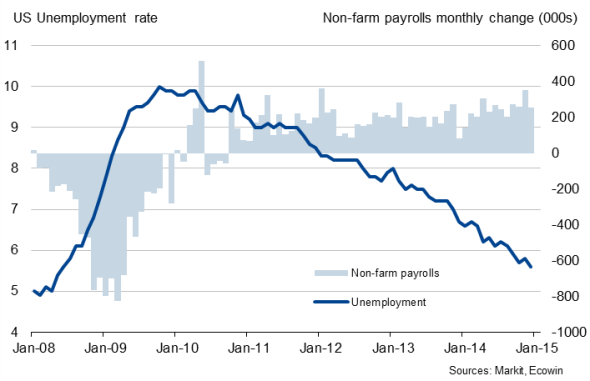

Friday sees labour market data released in the US. In December, non-farm payrolls rose by 252,000 and the jobless rate fell to a six-and-a-half year low of 5.6%. Markets are expecting another good report, but it seems unlikely that hiring will be sustained at this pace for much longer, with the business surveys pointing to a slowing in the rate of economic growth.

The job market data will provide a major steer to US policymaking, with the FOMC remaining "patient" in timing the first increase in interest rates and watching the data flow carefully in the lead up to their next meeting on 17-18 March. The FOMC are widely expected to start raising rates in the summer, but this could be called into question after January flash PMI data signalled the weakest monthly increase in new business since the recession. If confirmed by the final Markit PMI results and ISM surveys, and sustained in coming months, the slowdown in the surveys suggests that the first rate hike might be delayed until late-2015.

US labour market

Final PMI data for China, including services, will provide data watchers with insights into first quarter economic growth trends, after GDP rose at the slowest rate for 24 years in 2014.

The HSBC Flash China Manufacturing PMI" remained in contraction territory in January, but new orders increased slightly.

Hopes that economic growth in Japan will revive this year were buoyed after flash PMI results signalled a sustained expansion of the manufacturing economy in January. Final business survey results for manufacturing and services will provide more detail.

PMI results are also updated for the eurozone and include more national detail, and the region's retail PMI will also give an update on consumer spending trends. Flash PMI data signalled an acceleration in euro area economic growth at the start of 2015, to the strongest in five months, but the rate of expansion remained worryingly weak.

Other important releases from the currency bloc include trade data for France and industrial production numbers for Germany. Destatis reported a 0.1% drop in industrial output in November, dragged down by a 2.4% decline in energy production. However, PMI results signalled a return to manufacturing growth in December that was maintained into the New Year.

Monday 2 February

Worldwide manufacturing PMI data are issued by Markit.

Fourth quarter GDP numbers are released in Russia.

Building permits data are issued by Eurostat for the currency bloc.

In Brazil, trade data are out.

Spending data are meanwhile issued by the Bureau of Economic Analysis in the US.

Tuesday 3 February

A number of whole economy PMI surveys and the UK Construction PMI are released by Markit.

Trade data are meanwhile released in Australia.

The Reserve Bank of India and Reserve Bank of Australia announce their latest interest rate decision.

Italy sees the release of consumer prices.

Producer prices are issued for the eurozone and Canada.

In the UK, Halifax publishes latest house price data.

Industrial output numbers are out in Brazil.

The US releases factory orders numbers for December.

Wednesday 4 February

Worldwide services PMI results are released by Markit.

M3 money supply information are published in India.

Retail sales numbers are out for the euro area.

The European Central Bank's governing council meet, but no interest rate announcement is scheduled. The ECB also publishes its Economic Bulletin.

Iceland's Central Bank announces its latest interest rate decision.

In the US, ADP employment data are issued.

Thursday 5 January

The Eurozone Retail PMI and Germany Construction PMI results are published by Markit.

In Australia, retail sales numbers and home sales data are issued, while business confidence data are released in South Africa.

Factory orders figures are out in Germany.

The Bank of England announces its latest monetary policy decision.

Industrial import prices are released by Eurostat for the eurozone.

Canada and the US release trade balance data, with the latter also seeing initial jobless claims numbers.

Friday 6 February

The latest KPMG/REC Report on Jobs and global sector PMI data published by Markit.

The Japanese Cabinet Office releases the latest Leading Economic Index.

Wholesale price inflation data are out in India.

Industrial output data are out in Germany and Spain.

The UK and France publish trade data, with the latter also seeing the release of budget balance numbers.

Inflation numbers are out in Brazil.

Labour market data are issued in Canada and the US (including non-farm payrolls).

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012015-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29012015-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}