Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 15, 2018

Chinese healthcare companies to deliver extravagant dividends

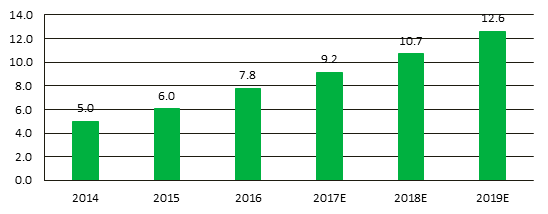

- Chinese healthcare aggregate dividends are estimated to grow by 61.5% over a three-year period to reach CNY 12.6bn in 2019.

- Acceleration in payouts is directly driven by robust earnings outlook, as companies adopt performance-linked payout practices.

The Chinese healthcare sector has delivered increasing dividends in recent years, growing from around CNY 5.0bn to CNY 7.8bn over the period between 2014 and 2016. The growth in dividends in recent years was mostly attributed to higher earnings, which stemmed from demographic changes, favourable policies, and the ability of companies to gain access to markets due to the expanding coverage of public health insurance. Buoyed by a robust earnings outlook and the influence from the Chinese government to increase payouts, we see the positive momentum in dividend growth to continue, and are forecasting dividends from the sector to surge to CNY 12.6bn in 2019.

Aggregate dividends from Chinese healthcare sector (CNY bn)

Source: IHS Markit, FactSet.

*Dividends from A shares only. Excludes one-off payment

In our study, we noted that Healthcare companies in China generally have stable payout ratios despite the volatility in costs. Companies do not deviate too far from the payout ratios in preceding years, and tend to be consistent in the proportion of earnings that is distributed as dividends. As street analysts are expecting profit from the sector to jump by 67.1% on a per share basis over the next three years, we expect dividends to grow alongside with higher earnings given the adoption of performance-linked dividend policies by companies.

We will also discuss other systematic factors, such as the Chinese government’s push for higher dividends and company-specific factors that will have an impact on the sector’s future dividends.

To access the report, please contact dividendsupport@markit.com

Derek Fang, Senior Research Analyst at IHS Markit

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-healthcare-companies.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-healthcare-companies.html&text=Chinese+healthcare+companies+to+deliver+extravagant+dividends","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-healthcare-companies.html","enabled":true},{"name":"email","url":"?subject=Chinese healthcare companies to deliver extravagant dividends&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-healthcare-companies.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+healthcare+companies+to+deliver+extravagant+dividends http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-healthcare-companies.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}