10 Key Takeaways from the EPC Industry in 2021

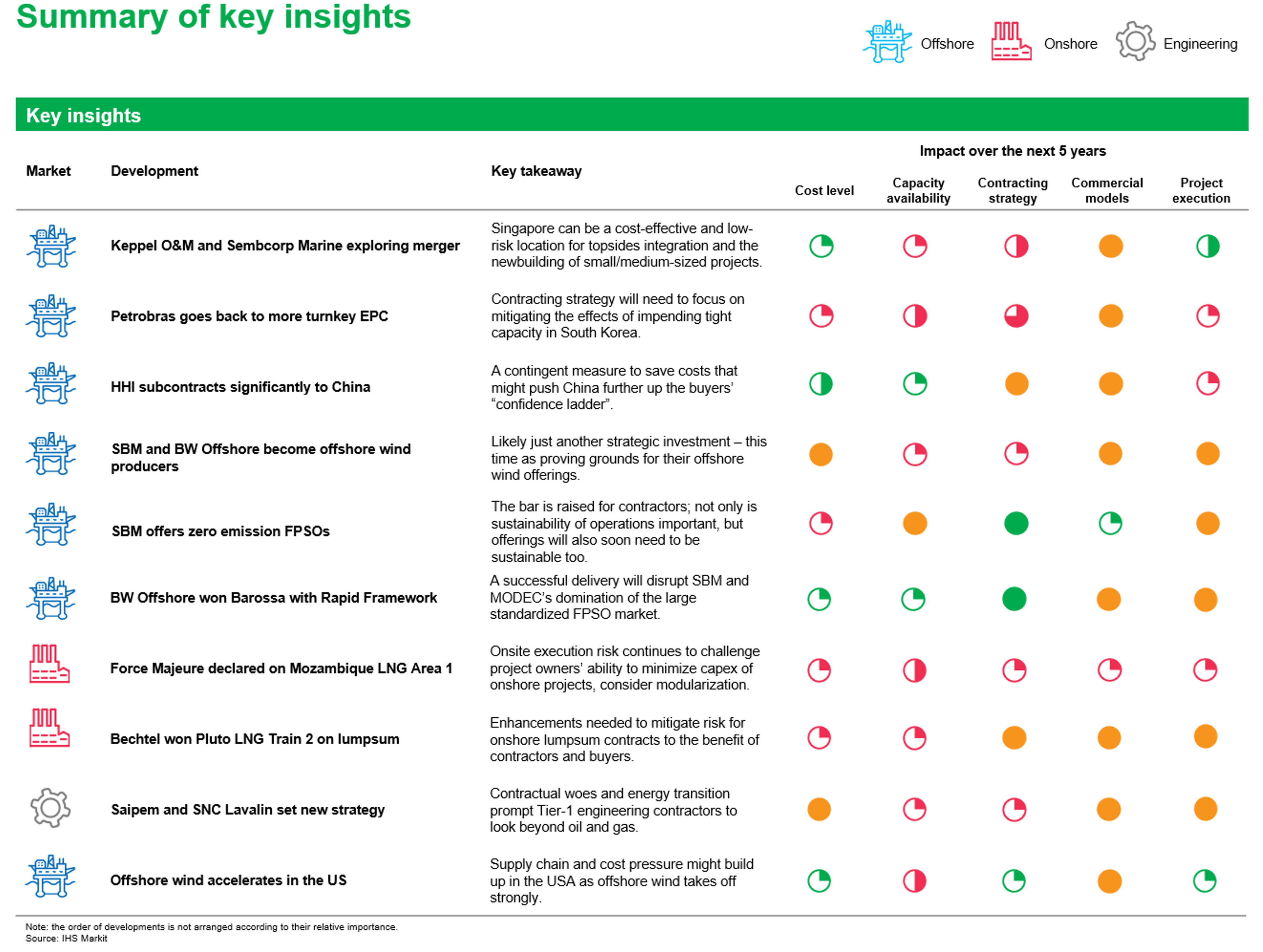

The year 2021 was the year offshore demand recovered. Offshore is no longer just offshore oil and gas. Offshore wind has, and soon other renewables will, begin playing an increasingly larger role in the offshore fabrication scene. Offshore renewables are not a hype, but we believe its impact on the offshore EPC supply chain might have been overstated. At least in the next five years, their impact will largely be localized either by geography or contractors as we will discuss in this report using the US market as an illustration.

Despite the hopes that renewables bring, offshore oil and gas projects remain larger in value and are technically more complex. As such, for most major yards, a clean swing away from oil and gas means moving down the capability ladder. They will not pursue this course. Therefore, major yards are fighting for the still-important oil and gas market. The possible Sembcorp Marine-Keppel O&M merger, and South Korean yard re-entering the Brazilian market are examples of this trend.

Cost remains an important factor for contractors to win projects and to execute them profitably. Therefore, cost control, internally or for clients, is a centre piece of many contractors' strategy. Leasers such as SBM and MODEC are dominant cost innovators in their markets. Other such as HHI has chosen to reassess their supply chain and project delivery strategy. We will discuss the implications and future of these examples in this report.

Onshore EPC houses have taken on exceptional risk especially in the LNG boom years. This has plunged many of them into financial disaster. Many are de-risking their energy operations and this mostly entailed moving away from lumpsum EPC. Consequently, buyers are losing a proven way to transfer risks. Qualifying and mitigating risks are increasingly important themes in the onshore EPC market as the force majeure declared on Mozambique LNG as well as the 'middle-of-the road' lumpsum contract for the Pluto expansion project will illustrate.

The industry is moving beyond the traditional emphasis on Health, Safety and Environment (HSE). Sustainability and climate change is becoming the next important pillar of success besides costs and capability. Just like costs, sustainability extends beyond one's own operations. The ability to help buyers achieve to lower their environmental footprint and work towards their sustainability targets is a competitive advantage. In addition, although EPC is a capital cost, the facilities we built and technology we incorporate into them will have an impact on operating cost subsequently. Many EPC players know this and are working towards it just like SBM's low-carbon FPSOs.

The year 2021 was an interesting year. It is a visibly clear beginning, but neither the actual beginning nor surely an end. Change is a process and 2021 is the step that made the change be felt. It is an infection point that accelerates change. The events of 2021 are just yet another manifestation of a long transition of the EPC industry. What makes it special is that it marks the visible point of change where both buyers and suppliers have nowhere to hide and will need to react to the realities of the future. The year 2022 is when many of us will have to seriously begin contending with these realities.

Through this report, we hope to summarize and create a high-level appreciation of the more significant trends of 2021 in the engineering and construction space. We hope to illustrate through them, the broader trends in the market and their impact on buyers' immediate and longer-term bargaining power and supply chain strategy.

The full report is available to clients on the IHS Markit Connect platform.

Learn more about our research on Engineering and Fabrication markets.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.