2019 was a difficult year for traditional pumping suppliers

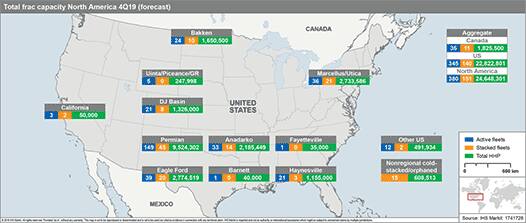

Figure 1:Total frac capacity in North America

2019-Q4 (forecast)

Financially, 2019 has been a difficult year to say the least for pumping suppliers, and unfortunately the fourth quarter did not allow them to end on a high note. Compared to the previous quarter, IHS Markit estimates a decrease of demand to around 13.2 million hydraulic horsepower (HHP), a change of about 10% when compared to 3Q19 HHP demand. The largest driver of downward demand currently is the Marcellus, with an estimated drop of around 450,000 HHP; the only silver lining for suppliers is that no such large changes are anticipated for the next few quarters.

While demand decreased over 4Q19, perhaps the more significant story has been that of decreasing supply, as pumping companies continue to stack pumps, scrap aging equipment, and write off large portions of their fleet. Schlumberger alone wrote off around $1.3 billion in pressure pumping equipment in 4Q19, and given no anticipation of improving market conditions, 2020 could see similar actions taken by other suppliers.

These actions are all a symptom of the high number of suppliers in the market, where differentiation of services continues to be a challenge given the fragmented competitive landscape. At this point, pumping horsepower is essentially commoditized, and as a result services continue to be fungible only to the extent that providers are willing to race each other to the bottom on price.

Indeed, pricing did not improve in 2019, and the pricing index for the US market continues to stagnate at the mid-40s level. For 2020, changes in supply could drive prices upwards if more equipment providers exit the market, however a significant challenge will be managing the pricing expectations of operators moving forward. Keeping in mind the current, bearish industry sentiment, our conversations with some operators lead us to believe they are expecting material price concessions off-the-bat from suppliers for them just to have the hope of sticking around for the year.

The one exception that we have observed is in electric-powered pumping services, which are indeed well differentiated. While this is still a very small piece of the overall market, the buzz these services seem to be generating with operators points to them taking a larger piece of the pie in the future. revenues.

This puts existing suppliers in a bind: they don't want to invest the tens of millions of dollars in capex to establish these electric fleets with so much of their conventional horsepower still on the sidelines, but the operators looking for this type of equipment don't care for excuses, they just want access.

That said, the established players in electric fracturing are securing as much intellectual property as they can to prevent new entrants to their turf, so perhaps the investment dilemma for existing providers is a non-issue (at least until the patents run out). Additionally, they are taking the prudent approach of not building out more fleets until they have long-term contracts in place guaranteeing their work. This strategy is in hopes of avoiding the mistakes made over several boom-and-bust cycles by traditional fracing companies. From our vantage point, if anyone has any strength in the fracing market, it's these suppliers.

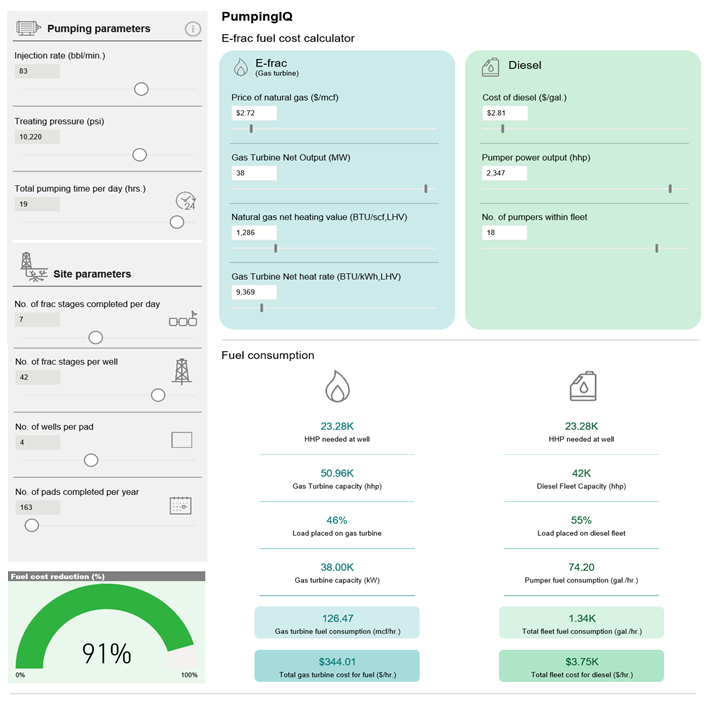

Figure 2:Partial Snapshot of e-frac cost comparison

app

Onshore Services & Materials clients can access our extensive work around electric fracturing, namely our e-frac cost comparison tool and E-Frac special report via the Connect platform.

Unfortunately given the current, depressed market conditions, all the other, traditional horsepower providers will likely have to work to leverage any differentiating factor in their arsenal (e.g. safety record, internal relationships) with operators. The sense of urgency hanging over them is real: overall utilization was 55% for 4Q2019, so the financial fuse is lit, and cash is burning quickly due to idled crews.

In summary, if 2019 was challenging for pumping suppliers, 2020 could prove to be the true acid test that determines who sticks around for 2021 and who exits the market permanently.

We provide full details of the hydraulic fracturing market in our PumpingIQ report, which is open to subscribers of IHS Markit's Onshore Services & Materials offering. Learn more about our PumpingIQ service.

Jesus Ozuna is a Principal Research Analyst at IHS Markit.

Posted 30 December 2019.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.