2022 ozone season NOx prices rise with natural gas prices

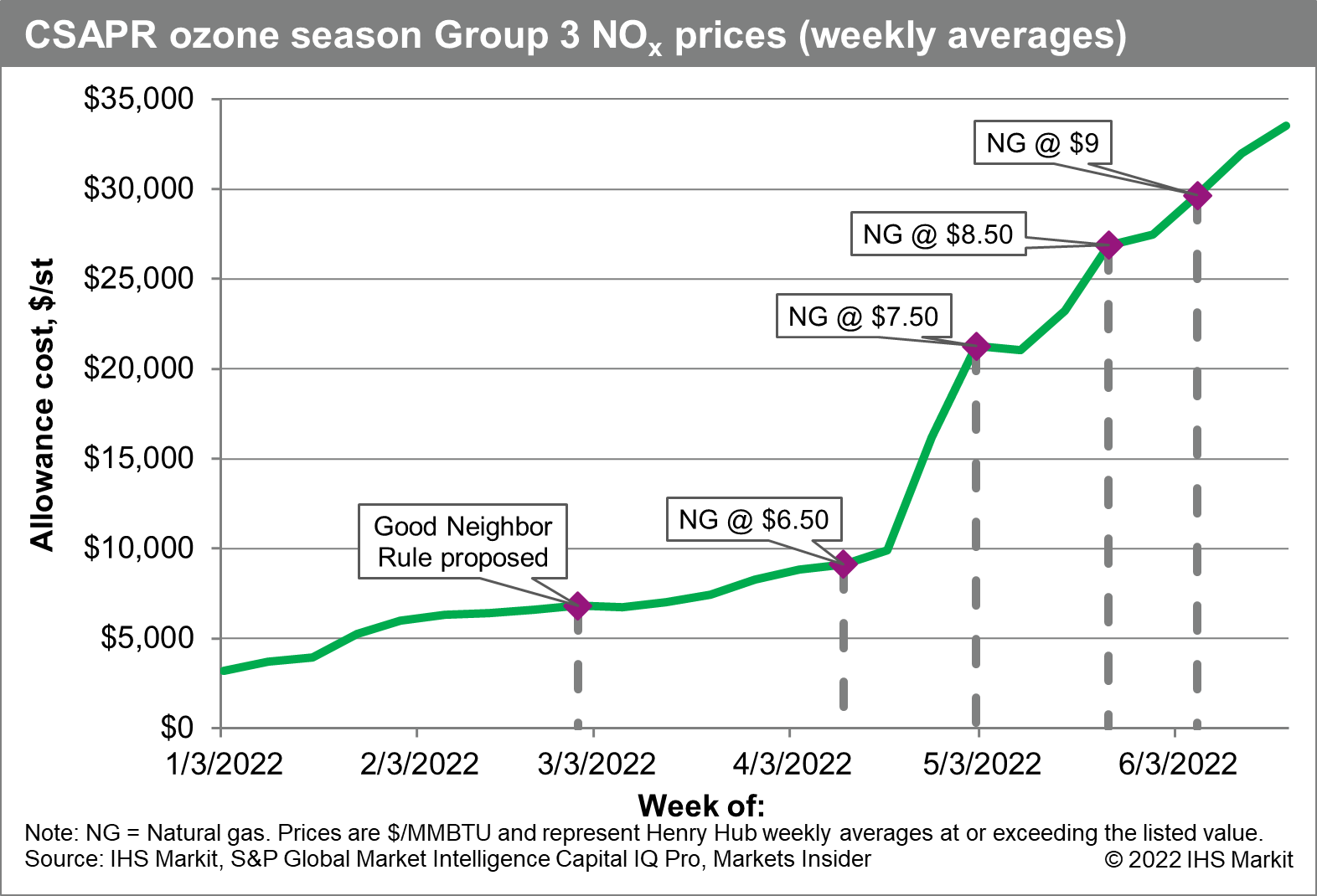

Cross-state Air Pollution Rule (CSAPR) Group 3 seasonal nitrogen oxide (NOx) allowance prices have increased over tenfold in 2022 (see Figure below). The rapid increase in natural gas prices over the last six months have made coal plants more economically competitive, driving this recent spike in NOz prices as coal plants demand more allowances. Moreover, regulatory uncertainty from a proposed update to the CSAPR program, known as the Good Neighbor Rule update, has made allowance holders wary of trading away credits that could be banked for use next summer when fewer allowances are granted.

As high wholesale power prices have made coal plants more economical and high gas prices have eroded gas plant margins, fleet operators have greater incentive to dispatch coal plants in the current market. However, they face constraints from NOx emissions limits. Emissions credits represent an opportunity to generate more revenue by being able to dispatch coal plants longer. At fuel prices around $8.71/mmbtu for natural gas and $3.00/mmbtu for coal (based on EIA data from early June 2022), a typical coal plant could pay up to $32,000 per allowance and still be economically dispatched.

Regulatory uncertainty may also have a role in current market behavior. In February, the EPA proposed the Good Neighbor Rule update to CSAPR which would add an additional 13 states to Group 3 and lower the allowance budgets for these states. This proposal may lead to less liquidity as operators hold on to allowances to build a bank for the 2023 ozone season. This reaction contributes to rising prices due to a smaller supply of allowances being traded. However, this impact will likely be temporary as 2024 will see new limitations on the use of banked allowances.

The current sky-high NOx prices are unlikely to last beyond this summer, as natural gas prices are expected to fall under $6/mmbtu by next ozone season. Coal prices are also likely to continue rising, eroding the cost benefits of coal plants. Nonetheless, S&P Global expects NOx allowance prices beyond this ozone season to be higher than previously seen under the CSAPR program if the Good Neighbor Rule proposal takes effect.

For the remainder of this summer, allowance prices will likely fall if gas prices stay below $8/mmbtu as a result of the Freeport LNG facility fire that is limiting US exports. NOx prices may fall as much as 50% if market participants adopt a similar view of gas prices for their planning purposes. Short-term fluctuations in gas prices are unlikely to impact NOx prices as operators focus on the five-month ozone season as a whole (May through September). Nonetheless, the allowance market will continue to react to external events that typically impact prices such as hot weather and increased power demand. With high gas prices, regulatory uncertainty, and an above-average summer forecast, this year's NOx prices are unlikely to cool to anywhere near last summer's values.

Learn more about North American energy research.

Thomas Hancock is a senior research analyst on the North American Power and Renewables team at S&P Global Commodity Insights.

Posted 14 July 2022

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.