Are electric vehicle makers putting the cart before the horse?

The dramatic impact of global warming on the environment has finally led governments to begin establishing strict targets to lower CO2 emissions. Achieving these governmental goals will require greener transportation modes that are powered by clean electricity and stored in batteries.

There are a number of factors that will influence the adoption of electric vehicles (EVs), including legislation, charging infrastructure, fuel cost, and tax incentives. The most important issue is the battery, in terms of both cost and efficiency. The lithium-ion battery (LIB) is the most important cost component of an electric car and its cost has dropped by 80% since 2010. However, one cost that has not dropped is that of raw materials such as lithium.

Lithium, the lightest metal, can be found in phones, computers, and EVs. It allows batteries, along with other materials, to store energy efficiently. Lithium supply has been tight over the last two years. An increase in demand in an unprepared market led prices to surge.

As the industry slowly wakes up, we are seeing investments that will bring new lithium capacity on stream. Developing lithium mining projects can take as long as 10 years. To overcome delays, a number of junior lithium producers are finding partners in the industry with available expertise and funding, both of which are crucial to developing a successful project.

Lower CO2 emissions targets push faster EV adoption

In the coming years, the EU, China, and the US are expected to reduce transportation-related CO2 emissions. Selling more EVs is essential to meeting these targets, and some governments are proposing a rapid phase-out of the internal combustion engine. In China, 20% of all vehicles sales are to have some form of electrification by 2025, while France and the UK propose to end the sale of all cars emitting greenhouse gases by 2040.

In 2017, most traditional auto manufacturers announced new EV models. Volvo announced that all models will be electric or hybrid beginning in 2019. IHS Automotive estimates that hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs) and EVs will represent around 45% of all car production by 2030, with pure EV representing 5%.

EV production drives lithium demand

Lithium demand was estimated to be more than 220,000 tons LCE (lithium carbonate equivalent) in 2017. Historically, industrial applications including glass and ceramics, grease, polymers, pharmaceuticals, and air treatment consumed the most lithium. Recently, batteries for portable devices became important, and today, lithium demand is led by electric mobility.

Our base case scenario is that total lithium demand will grow at 14% per year by 2025, when it will reach more than 600,000 metric tons (mt). Our high case scenario assumes an 8% penetration of EV by 2025 instead of 4%, creating an increase of 18% per year in lithium demand.

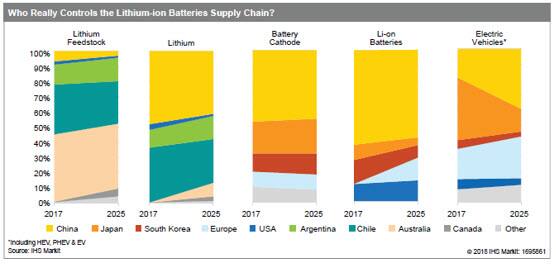

LIB market chain concentrates in Asia

Until 2016, the LIB market was powered by demand in portable devices. In the near future, growth rates will be driven by EV demand. Auto and battery manufacturers are making substantial investments in new production facilities. Although Tesla's gigafactory in Nevada receives substantial attention, the most ambitious company is CATL in China. CATL plans a tenfold increase in LIB capacity to 50GWh by 2020. Around 95% of all LIB capacity is currently located in China, Japan, and South Korea. Most investments will be in this region, but several producers have announced plans to build factories in Europe. For example, LG wants to open Europe's largest EV battery factory.

Most EV makers do not actually produce batteries. Battery cells are produced by Japanese, Korean, and Chinese companies such as Panasonic, Samsung, LG and CATL. Only in China do EV makers such as BYD produces their own battery cells. So far, car makers are prioritizing strategic partnerships with battery manufacturers rather than investing in making the batteries themselves. Daimler and Nissan used to produce batteries, but have stopped in the last two years because costs and technology could not compete with Asian manufacturers.

The main cost component of an EV is its battery pack. Battery cost decreased from around $900 per kWh in 2010 to approximately $200 per kWh in 2017, a drop of 80%. Battery costs are expected to decline further, albeit at a slower rate, as manufacturers build large battery factories and achieve economies of scale.

Decreased costs have allowed LIB technology to become much more competitive recently, but there is still much discussion about new types of batteries that could replace LIB.

New battery technologies appear on the horizon

Until 2015, nickel metal hydride was the preferred technology for hybrid vehicles. Since then, LIB technology has cornered the market. In 2025, LIB will represent more than 95% of all EV battery types. However, some new technologies could compete with LIB in the future, such solid-state batteries that eliminate the liquid electrolyte and improve energy density. Most of those new technologies are still at a very early development phase, however, and it will take years before they can replace LIB.

Cathode evolution dominates in the short term

The cathode is the battery component that consumes lithium. Cathodes are a sintered blend of lithium, cobalt, nickel, manganese, and other materials. In the next five years, nickel, manganese and cobalt (NMC) will represent more than 60% all cathode types used in e-mobility. Some manufacturers favor nickel-rich NMC in order to reduce the amount of cobalt required for production. Most cobalt originates from the Democratic Republic of Congo, where a portion of production comes from artisanal mining that sometimes employs child labor.

Lithium supply questions arise

Do we have enough lithium to power electric cars? Measured and indicated lithium resources are estimated at over 250 million tons LCE. Proven and probable reserves that are economically extractable are closer to 60Mt LCE. This does not include lithium deposits that have yet to be explored. If all cars were EVs by 2050, this would represent a cumulative consumption of 60Mt LCE. When we look beyond cars and add other battery applications, future lithium demand could be larger than today's lithium reserves.

Potentially limited lithium reserves could be augmented by recycled lithium from LIB. The LIB recycling process is still uneconomical and years from reality. Using batteries in second-life applications, such as home energy storage, could be a practical first step in recycling.

Lithium is produced from either brine-based deposits or from hard-rock mineral deposits. Brine production comes mostly from South America. Lithium brine is extracted from beneath salt flats and pumped into ponds where it is concentrated for up to a year before being refined to make lithium chemicals. Lithium can also be produced from rock mining, mainly spodumene. Almost 100% of all lithium rock mining occurs in Australia, but spodumene processing into lithium chemicals is done in China.

The main refined product is lithium carbonate. Lithium hydroxide has mostly been used in the production of grease, but it is becoming the preferred lithium chemical for cathode manufacture. Demand for lithium hydroxide is anticipated to grow faster than lithium carbonate.

Control over the lithium supply creates challenges

Lithium raw material production is dominated by Australia, Chile, and Argentina, which represented 90% of global production in 2017. Albemarle, SQM, Tianqi, and FMC accounted for approximately 70% of global supply. As numerous new producers enter the market, the market share of existing players will decline.

Because the entire conversion of rock to lithium chemicals takes place in China, fully half of all global lithium chemical production takes place there. By 2025, Australia will have developed some domestic rock conversion plants, but a majority of the spodumene will still be exported to China.

China has been investing in foreign lithium assets for many years. The largest investment occurred when Tianqi secured a 51% share in Talison Lithium in Australia in 2013. Since then, Chinese companies continued investing and securing offtake agreements, mostly in Australia and in South America. In 2016, a surge in prices saw continued activity. In 2017, many Chinese companies - from lithium players to battery manufacturers, automakers, and traders - invested in numerous assets and secured a many offtake agreements. In fact, two-thirds of all offtake agreements concluded in 2017 were negotiated by Chinese companies.

Offtake volume represented less than 20,000t LCE in 2017, but by 2025 it could represent more than 300,000t LCE. Offtake agreements allow suppliers to mitigate risk because they can count on the ability to sell future production. These agreements also allows buyers to secure volume in a potentially tight future market.

Lithium supply dreams and reality loom large

Existing lithium producers have announced significant expansion plans in Chile, Argentina, the US, and Australia. A number of new producers are also willing to enter the market. New Australian players are ramping up production and increasing exports to China. Three plants in Australia are likely to start production in the second half of 2018.

In order to meet 2025 demand, producers need to build a supply of approximately 500,000 mt of lithium - three times more than we have today. With an average capex of 16,000US$ per ton, the industry requires an investment of at least $7 to 8 billion during the next 10 years. Yet bringing a lithium plant on stream is a complex, time-consuming process. The average lithium brine production site requires an average of seven to 10 years to come on stream. A new rock mine takes four to six years to become productive.

In 2017, there were more than 400 known lithium operations and development projects. However, only 3% of all those assets are operational, while 2% are in the construction phase and another 5% are in a feasibility stage. Being at a feasibility phase does not guarantee that lithium production will start. The remaining 90% of operations are either at an exploration or pre-exploration stage, which means they are many years away from potential production. In order for any of these projects to be developed, lithium must be extracted economically and financing must be secured. The best case is that production will expand from 230kt today to around 700kt LCE by 2025,growing at 16% per year.

Lithium supply balances and prices will take timeto stabilize

In our base case scenario, which assumes that demand grows 14% per year to 2025, the lithium market will not be fully balanced despite supply that exceeds demand. This is due to a number of factors, such as potential operational issues at lithium plant, plants that deliver non-battery grade lithium, delays in plant start-ups, and lower-than-expected production.

However, if EVs reach 10 million units instead of five million EVs by 2025, the lithium market will be undersupplied. Supply has been tight over last the two years, leading to price increases and supply anxiety from car and battery producers. Contract prices more than doubled during the last two years. Large lithium players have shortened contract lengths due to the uncertainty of upcoming supply.

In the short term, lithium resources are tight and will struggle to keep up with strong demand from the battery sector. We expect prices for lithium chemicals to remain at a high level for at least two to three years before significant new capacity comes on stream and prices strat eroding. However, we do not expect prices to be restored to their historic levels.

Conclusion

The lithium industry will require significant investment to allow a smooth transition to EV mobility. China accounts for only 7% of lithium extraction, but controls 48% of lithium chemical production and 62% of LIB capacity. China is also the largest EV producer today.

Chinese lithium, battery, and car producers have been negotiating foreign investment and offtake agreements to secure lithium supply, mainly with Australian projects. Approximately 70% of recent off take agreements were with Chinese lithium converters and battery manufacturers. In early 2018, only one site was sending product to its off-taker.

Automakers will continue trying to develop long-term deals to secure lithium, but pricing discussions will be complex. Lithium prices are not likely to return to their historic levels but will likely remain high for some time.