Disruptive forces promise to reshape the trucking industry

Transportation demand accounts for over 50% percent of the world’s refined product demand, and the medium/heavy trucking sector accounts for almost half of this. But the trucking industry is increasingly exposed to disruptive forces that could alter longstanding trends and impact diesel demand globally. How these forces unfold and interact will determine the answers to the big questions facing the logistics, trucking, and energy industries. IHS Markit’s current study, “Reinventing the Truck”, examines these changes, taking into account the impact on adoption of new power-train technologies as well as deployment of autonomous technologies.

The first driver of change is new patterns of distribution and consumption. Historically, growth in trade has mirrored economic activity, but this relationship may be disrupted by changes to the way we manufacture and distribute goods. Innovations such as 3D printing shorten supply chains and may diminish demand for freight carriers, reducing shipping costs to zero in some cases.

The second driver of change is technology. There are three key ways that new technologies will change the trucking industry. First, new technologies will spur efficiency gains in the supply chain through electronic logging devices and increased access tov data, which facilitate better network optimization. Second, adoption of new drive-train technologies will alter fuel consumption patterns as electric vehicles become more numerous, particularly in urban environments. As electric drive trains allow for quieter vehicles, service hours can be extended in urban and suburban areas, altering established patterns of vehicle deployment. Third, increased levels of automation will lead to cost reductions through increased efficiency, which will be achieved via higher levels of connectivity and communication.

The third and perhaps most immediate driver is regulation at the national, state, and local level. Whether policies are designed to promote environmental sustainability, enhance fuel economy, or address labor issues, there is considerable uncertainty about the impact legislation will have on the future of the trucking industry. Germany’s recent decision to allow individual cities to ban diesel vehicles highlights the potential for additional complexity for fleet operators working in and between urban areas, each potentially with its own regulations.

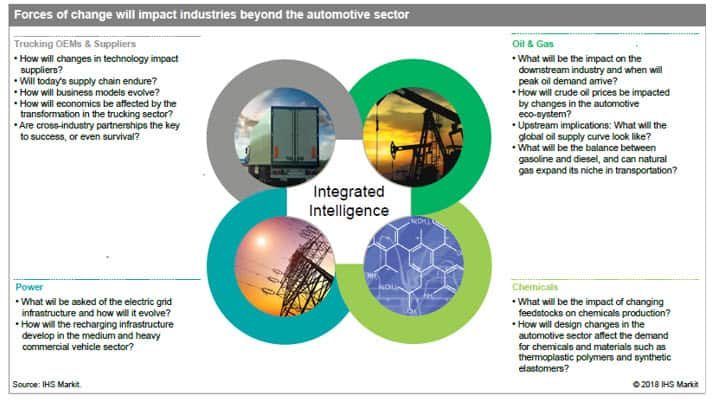

These three key drivers will not only transform the trucking industry, but will also have a significant impact on the energy and chemical industries. The substitution of oil demand via transitions to alternative drive trains and the strengthening of fuel economy standards is expected to erode diesel demand globally. In turn, this will impact refinery operations with a knock-on effect for feedstock availability for the petrochemical industry. Subsequent changes in chemical feedstock price and availability will affect the relative competitiveness of chemical feedstocks, and regional chemical investment opportunities may shift toward Asia and the Middle East. Trade patterns will shift as the North American cost advantage is eroded, thereby reducing derivative exports to Asia, where more local production capacity will be built.