Another deep-water success in Indonesia: Eni’s Geng North discovery to revive ultra-deep water exploration and gas production in the Kutei Basin

Another deep-water success in Indonesia: Eni's Geng North discovery to revive ultra-deep water exploration and gas production in the Kutei Basin

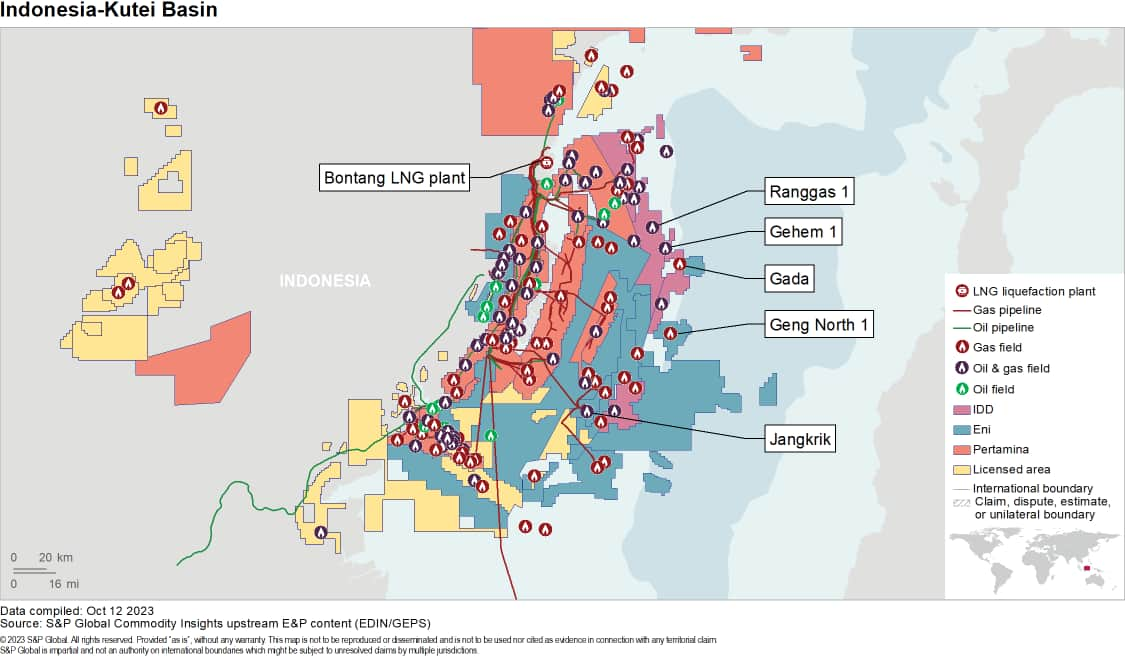

Eni's Geng North is the second significant gas discovery in Indonesian deep waters in the span of a few months. These successes are likely to revitalize exploration activities not only in the Kutei Basin but also in other basins throughout the country. The much-needed fossil energy resources, particularly gas, are key to energy security during the energy transition period. In this article, we will look at the impact and possible implications of the latest success for Indonesia's upstream industry.

- The Geng North gas and condensate discovery represents the most significant gas discovery not just in the Kutei Basin but for Indonesia in the past two decades, second only to Inpex's Abadi field. This is also another exploration success in the ultra-deep water, following Harbour's Timpan 1 discovery in 2022 (located in the North Sumatra Basin).

- Geng North is one of the top global discoveries this year (as of early October 2023).

- This discovery supports Indonesia's production targets of 1 million barrels per day (MMbbl/d) of oil and condensate and 12 billion cubic feet per day (Bcf/d) of gas by 2030. Geng North will bring much needed backfill volumes to the Bontang LNG facility, where utilization rates have been declining. Developing Geng North could reverse this trend, while further exploration success in the area could increase the prospect of restarting the idled Train 5.

- This exploration success represents a significant opportunity for Eni which is set to further grow its position in the Kutei Basin following the acquisition of Chevron's operating stake in the Rapak, Ganal and Makassar Strait PSCs and Neptune Energy's international portfolio.

Geng North discovery and potential development

The Geng North discovery was announced by Eni on October 2, 2023. The high impact well (HIW) Geng North 1 was drilled using the "Capella" drillship to a total depth of 5,025 m in deep water of close to 2,000 m. The well intersected a 50 m gas column within Miocene sandstones. Although a DST was conducted, the actual flow rate was constrained by the test equipment, however the operator reported estimated flow rates of 80-100 million cubic feet per day of gas (MMcfg/d) and 5,000-6,000 barrels per day of condensate (bc/d).

The Geng North structure is estimated to contain in place resources of 5 trillion cubic feet (Tcf) of gas and 400 million barrels (MMbbl) of condensate, which places it as one of the largest finds worldwide in 2023.

The new discovery benefits from its proximity to existing infrastructure though it holds sufficient resources to justify a standalone development. A new floating production unit with subsea production wells would be the most likely development option for the Geng North discovery.

Furthermore, the Geng North development is also well positioned as a new development hub for unlocking the long-stalled Gehem, Gula and Ranggas fields which were previously part of Chevron's Indonesia Deepwater Development (IDD) Northern Hub of the Rapak and Ganal PSCs, now being acquired by Eni. The fields had previously been mooted as potential backfill for the Bontang LNG but never quite got off the ground as project economics proved challenging.

Turnaround for Bontang LNG?

Declining gas production has resulted in the lack of available feedstock gas, with utilisation at the Bontang liquefaction plant currently well below full capacity. The reduction in liquefaction capacity has followed the step change in feedstock availability as liquefaction trains were gradually taken offline or temporarily mothballed. At present, of the eight liquefactions trains, only Trains 7 and 8 are continuing to operate. The discovery of Geng North would finally reverse this declining production trend, while further exploration successes could increase the prospects for the restarting of the idled Train 5. The fast-track development of Geng North and the revitalisation of the IDD projects also holds the promise of significantly improving current utilization rates and extending the life of the remaining liquefaction trains.

Looking Forward

For the next two to three years, Eni could potentially drill more exploration and development wells, surrounding the Geng North 1 location, particularly in some of the blocks adjacent to the North Ganal PSC. The exploration and development strategy not only showcase the company's commitment in this area, but also will likely further strengthen the company's portfolio in Indonesia.

Overall, the recent deepwater successes at Geng North 1 and Harbour Energy's Timpan 1 in North Sumatra show that Indonesian basins with a long exploration and production history are still able to deliver significant resources, as long as operators are willing to take exploration risk supported by strong technical skills and geological knowledge. Furthermore, the relative proximity to existing markets provides clear pathways towards monetization of these resources in support of Indonesia's 2030 production targets.

A more detailed analysis on future impacts of the Geng North discovery is available in S&P Global Upstream Intelligence services (GEPS).

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.