Answers at the speed of curiosity: Unlocking the secrets of shale oil and gas resources with big data

North American shale reservoirs are complex and it's hard to pinpoint what's driving performance. A 2019 Deloitte study of 18,000 wells in the Permian found that operators continue to struggle to optimize formation-engineering: 67% of wells drilled from 2015-2019 were over- or under-engineered.

With so many variables influencing oil and gas production, it's no wonder operators haven't found the ideal engineering equation yet. Geology varies by formation and throughout the basin, and completions designs that work for one well don't always work for the next.

Operators must determine performance drivers to tackle bigger challenges: how can we optimize oil and gas production? How are we performing relative to our peers? Is this a good investment opportunity?

So what's driving shale? The answer is in the data.

Custom analytics made easy

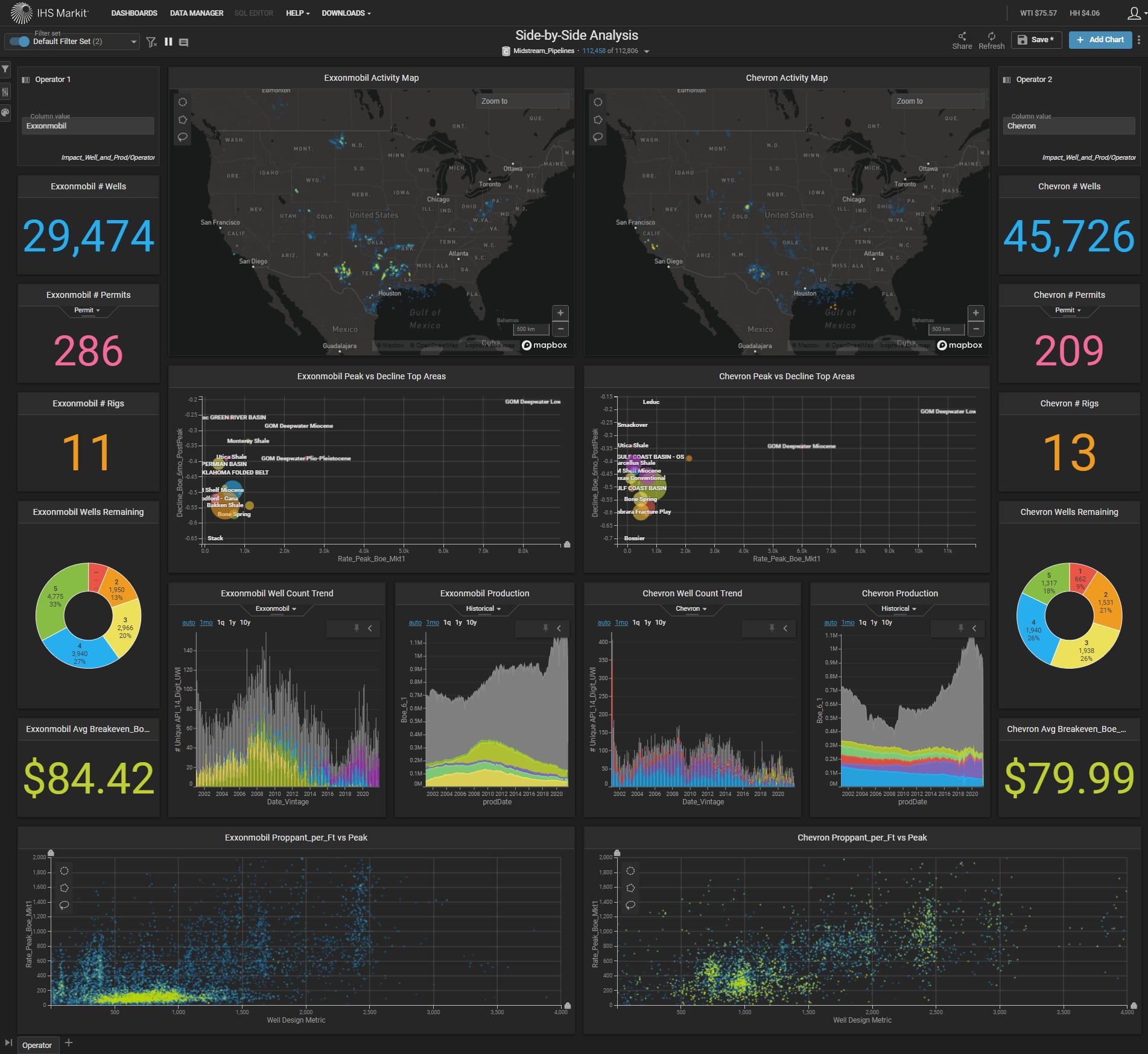

Integrating data into a single software platform provides both quick answers and technical deep-dives into the most pressing questions about oil and gas assets. Tracking metrics, making decisions and implementing them is faster and easier than ever with analytics-ready data. Teams can leverage these datasets to monitor company performance, track CAPEX spend and determine acquisition targets. Tasks that once took weeks or months to complete can be done in an afternoon with the intuitive workflows and comprehensive data in Energy Studio: Impact.

Track company performance — understand CAPEX spend and benchmark against peers

- Compare your assets to those of peers and competitors

- Identify underperforming assets

- Benchmark companies based on CAPEX spend

Opportunity screening — evaluate the acquisition potential of operators or acreage

- Benchmark the acreage/operator against peers to determine if they are over- or under-performing

- Analyze financials to see which areas have the greatest ROI and are cash-flow positive

- Model potential production and room for development

- Value acreage and assets at different pricing scenarios

Asset optimization — maximize production and ROI

- Determine how oil and gas reservoir characteristics, well designs and completions practices and impact production

- Test drilling and stimulation practices at different scenarios before investing capital

- Analyze well spacing to optimize reservoir drainage

- Normalize production data to a variety of fields

In each situation, teams can test multiple scenarios without investing time and money. All workflows can be customized with each company's KPIs and proprietary data. Company performance, both internal and compared to peers, can be tracked using any metric. High-level screens of investment opportunities can quickly show which prospects can be discarded and which are worth taking a second look at. Multiple drilling and completions designs can be tested to see how engineering and geology impact oil and gas production, without drilling a well.

A side-by-side comparison of Chevron and ExxonMobil activity in the U.S. Users can compare activity, costs, breakevens, acreage and more for any operator, in any basin, at any scale.

Cross-discipline collaboration

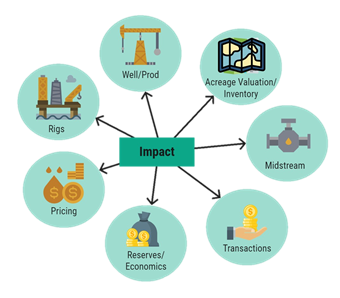

Traditionally, oil and gas data is siloed in disparate teams and databases. Energy Studio: Impact breaks down the barriers between departments. Teams can collaborate to answer complex questions faster and with greater accuracy by combining data across the entire energy value chain.

In the collaborative workspace, users can create custom dashboards and share them across disciplines. Geology, engineering, land and business development departments all evaluate assets, each with a unique focus and methodology. Both geoscience and engineering impact oil and gas production; identifying the links between the two will help teams optimize their assets' performance. Integrated data platforms provide transparency across disciplines and ensure that the data and analytical methods are consistent.

Connect data from all parts of the energy value chain in Energy Studio: Impact.

Speed and ease of integrated oil and gas datasets

The answer is in the data, so get to the answer faster with good data. Vetted and normalized datasets eliminate the need for tedious pre-work. Derivative, analytics-ready data lets teams start analyzing immediately without spending time collecting data from multiple sources. Modelling multiple scenarios saves time and money, so decisions can be implemented quickly. The only limit is a team's curiosity.

About 'Energy Studio: Impact'

Energy Studio: Impact is a web-based platform that transforms

big data into real-time energy analytics across the entire energy

value chain. It covers upstream, midstream, emissions, and

commodity pricing datasets and was created to help engineers,

geoscientists, strategists, business development, and financial

analysts to make better decisions faster.

Energy Studio: Impact provides normalized and derivative

content that accelerates the ability to extract meaningful

insights. Whether you are trying to understand what drives

productivity, do a quick screen for opportunities, or benchmark

performance, our integrated workflows will get you there

faster.

Utilizing the power of Heavy.AI's GPU processing power, you can answer questions at the speed of curiosity, and save custom dashboards in order to revisit the analyses that are most important to you. By integrating upstream and midstream datasets with derivative content, Energy Studio: Impact provides a clear end-to-end workflow solution to reduce risk, improve returns and provide objective valuation abilities.

***

Want to test Energy Studio: Impact? Book a

15-minute personalized demo and try out several M&A screening

scenarios.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.