Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 15, 2024

Anticipating risks to CCUS as US elections near

With the US gearing up for hotly contested elections in November 2024, investors and other stakeholders in the carbon capture, utilization and storage (CCUS) industry are wondering what a potential a change in administration could portend for future project activity and investment.

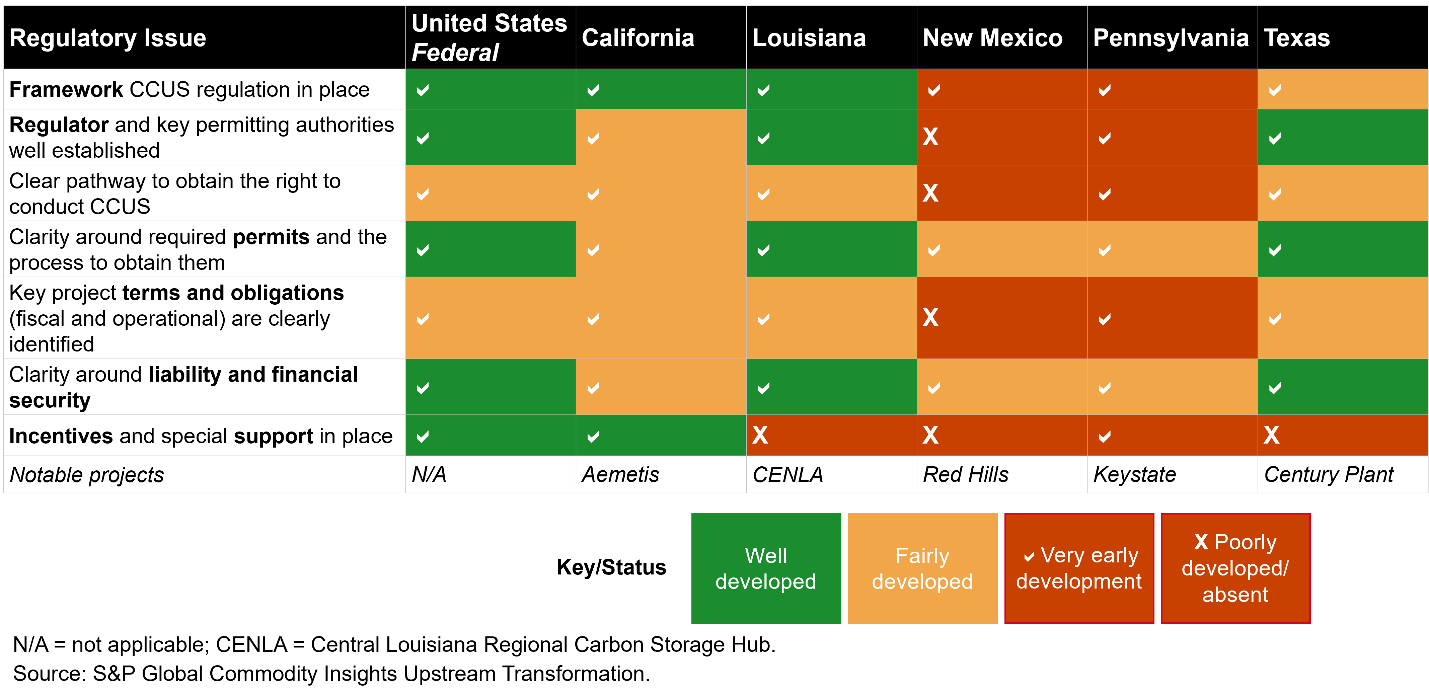

Tackling this question requires us to assess policy and regulation at both the federal and state levels. At the federal level, current policy may not be as vulnerable as some in the industry may fear thanks to rare bipartisan support. The subnational view, meanwhile, is nuanced, and we consider five major oil and gas producing states (Texas, Louisiana, New Mexico, California and Pennsylvania) to show how regulation is developing.

Regardless of the who wins, it is anticipated that access for developers to storage sites on federal lands and waters through bid rounds will be formalized and become regular events in future. It is likely that the most significant difference between possible administrations would be with regard to regulatory burden, with a Trump administration potentially relaxing environmental impact assessments while streamlining the CCUS bureaucratic process. By contrast, a second Biden term would likely mean the continued gradual development of safety, transport and environmental impact regulations, which is to be expected for an industry that is still maturing.

Our base case is for major considerations related to federal CCUS incentives — the 45Q tax credit, R&D and grant funding, and loan programs, in particular — to remain broadly stable regardless of which candidate wins, with potential to either tighten funding requirements (under Trump) or to increase CCUS funding (under Biden). That said, a Trump presidency presents more of a wildcard given his stated hostility towards the Inflation Reduction Act (IRA), and upcoming federal funding talks in 2025 could lead to substantially watered down IRA funding or even repeal, though the latter option is less likely given the support it has from Republican representatives.

Away from the federal level, which lacks a CCUS regulatory framework, it is important to appreciate how state frameworks vary as the table below shows.

California, Pennsylvania and New Mexico are advancing major CCUS legislation and regulatory initiatives, but not all will be certain to succeed, prolonging the uncertainty and delaying the deployment of CCUS projects.

Even in states with developed CCUS frameworks, lingering issues demand regulatory clarity. For example, in Louisiana, which has received Class VI well primacy, the state's framework covers most of the important aspects of CCUS activities, but storage and leasing fees and licensing procedures on state lands remain unclear.

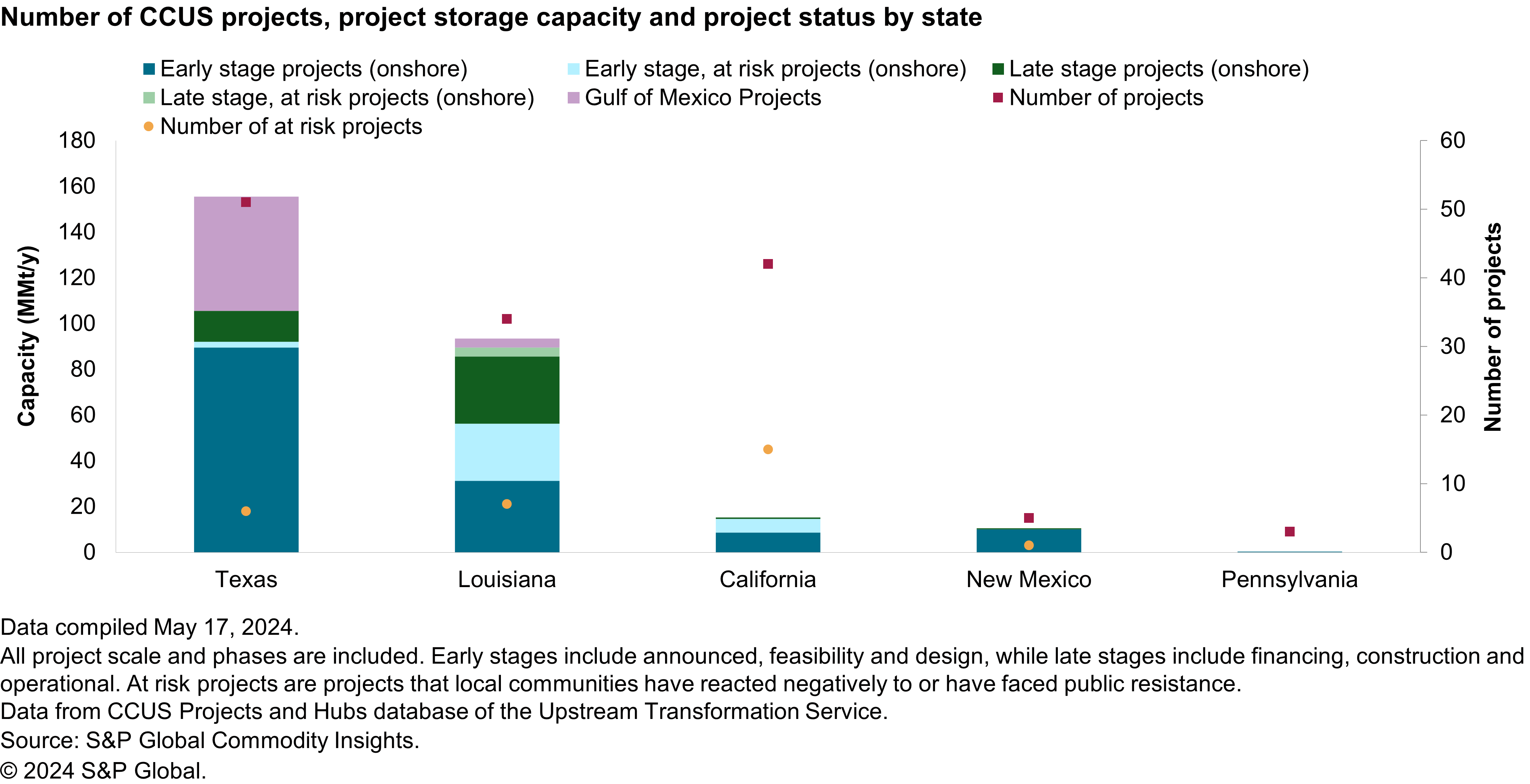

Increasing civil society risks at the state and local level and the persistent lack of a cohesive nationwide CCUS framework could jeopardize the country's plans to construct CCUS hubs and risk stranding many emitters with no access to CO2 storage areas.

In the five states reviewed here, civil society risks could narrow the project pipeline and lead to project concentration in areas where transport is unnecessary, CO2 pipelines already exist or would only need to be relatively short, or where transport rights-of-way can be utilized. Based on analysis of Upstream Transformation's CCUS Projects and Hubs database, almost 17% of storage capacity in these states are at risk of cancellation owing to some form of public resistance towards CCUS projects.

The US still stands to be the largest CCUS adopter based on CO2 capture and storage capacity of proposed and existing projects, but project success is far from a given. As can be seen, not all challenges facing the industry depend on who occupies the Oval Office. Local- and state-level regulatory and transport issues can also have a decisive impact on project viability. That said, facing these challenges would doubtlessly be easier knowing that federal funding incentives are not at risk. The bipartisan support for the industry and the difficulty presented by overturning IRA legislation suggest that risks are low, but greater certainty will have to wait until after November.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fanticipating-risks-to-ccus-as-us-elections-near.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fanticipating-risks-to-ccus-as-us-elections-near.html&text=Anticipating+risks+to+CCUS+as+US+elections+near+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fanticipating-risks-to-ccus-as-us-elections-near.html","enabled":true},{"name":"email","url":"?subject=Anticipating risks to CCUS as US elections near | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fanticipating-risks-to-ccus-as-us-elections-near.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Anticipating+risks+to+CCUS+as+US+elections+near+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fanticipating-risks-to-ccus-as-us-elections-near.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}