Are we entering an age of increasing power supply disruptions?

As much of the world battled through an energy supply crunch in 2021, a recent IHS Markit report titled "Are we entering an age of increasing power supply disruptions?" takes a look at some of the major power supply challenges during the past year, assessing impacts, drivers, and emerging trends.

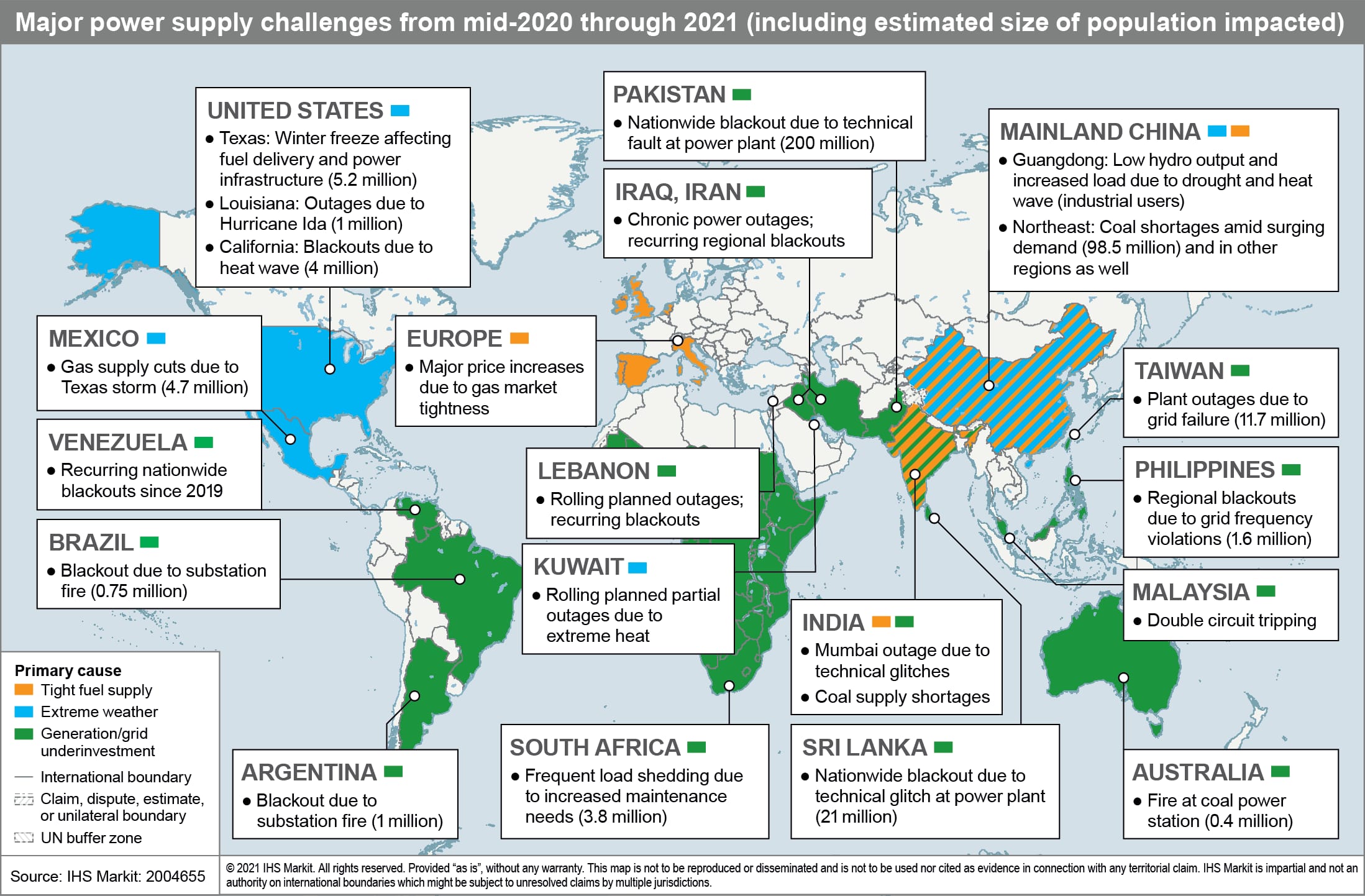

According to the report, at least 350 million people, or more than 4% of the global population, were impacted by major power outages over the past year. Power supply challenges ranged from a massive nationwide blackout in Pakistan due to a technical fault at a power plant, to rolling blackouts in northeast China caused primarily by coal shortages amid robust demand growth, to outages in parts of the United States driven by extreme weather events and soaring energy prices in Europe, to name just a few. Some of the largest power supply disruptions included regions that have had relatively reliable supply like China and Texas, United States, while others inflicted further stress on markets with existing problems, such as Pakistan and Sri Lanka.

While power supply challenges are not something new and power supply disruptions have long plagued certain parts of the world, new challenges are emerging and exacerbating older ones. We describe below three of these common difficulties.

Poor maintenance and chronic underinvestment in generation and the grid continue to challenge power systems. Power supply shortages in many markets around the world have been caused by lack of maintenance and chronic underinvestment in generation and grid assets. In particular, grid investment has lagged in many developing countries, making it hard for generation investment—for both conventional plants and renewables—to materialize. This issue continues to challenge many power systems today and is driven by factors such as poor planning and shortsighted policies, distorted policy frameworks or market structure issues, indebtedness of public utilities, and complex permitting processes, among others.

Climate-related extreme weather events are increasingly impacting supply and demand. In recent years, climate-related extreme weather events have intensified, impacting both supply and demand and challenging power system reliability while also rendering weatherizing equipment increasingly important and making hydro-heavy markets more susceptible. In the United States, for instance, the February 2021 winter storm impacted over 5 million people, with Texas alone having over 4 million customers without power, while an additional 4.7 million people in Mexico were also impacted.

In hydro-heavy markets such as South China and Brazil, climate change can impact hydropower supply and strain the system. In Guangdong Province, for example, soaring power demand—driven by economic growth and hot weather—and lower-than-expected hydro imports due to the drought in neighboring southwest China resulted in inadequate capacity in 2021. Brazil has also been facing the worst drought in almost a century, increasing its exposure to the surging global gas prices.

The pace of the energy transition across the value chain is unsynchronized. With climate change driving decarbonization efforts across the world, an unsynchronized pace of transition across the value chain can also strain power systems and expose energy markets to increased volatility. For instance, if fossil fuel supply—still the dominant form of energy in most parts of the world—is curbed faster than the pace at which fossil fuel demand declines—and before alternative technologies can fill the gap—shortfalls can arise, leading to soaring prices.

As evident from the 2021 global energy crunch, tight gas and coal supply in the face of surging post-COVID-19 demand resulted in skyrocketing power prices in Europe and rolling blackouts in China. In the past, these high prices would naturally lead to more supply in gas and coal, but energy transition pressure has broken that market linkage as investors shun new investment in fossil fuel production. Meanwhile, the COVID-19 pandemic had created supply chain bottlenecks, exacerbating the situation and intensifying volatilities. Indeed, many wholesale power markets experienced major power price jumps in 2021, while intra-year volatilities increased significantly.

In addition to fuel supply and power generation, there is also an unsynchronized pace of transition in power generation and transmission and distribution infrastructure. This is becoming increasingly the case with wind and solar resources typically located farther away from load centers. This in turn can lead to grid bottlenecks and supply curtailments, which can heighten the risk of power disruptions.

With an increasing share of wind and solar generation also comes increased exposure to weather patterns and new forms of variability. Today, dispatchable thermal generation is typically used to balance the variability of renewables, but as power systems decarbonize, new flexible and carbon-free firm technologies—some of which are not commercially available yet—will be needed. Power networks will also need to evolve to facilitate the integration of larger volumes of distributed generation.

Learn more about our global power and renewable energy research.

Rama Zakaria is an Associate Director, Global Power and Renewables, IHS Markit.

Posted on 10 January 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.