Argerich-1 draws attention to deepwater exploration in Argentina and Uruguay

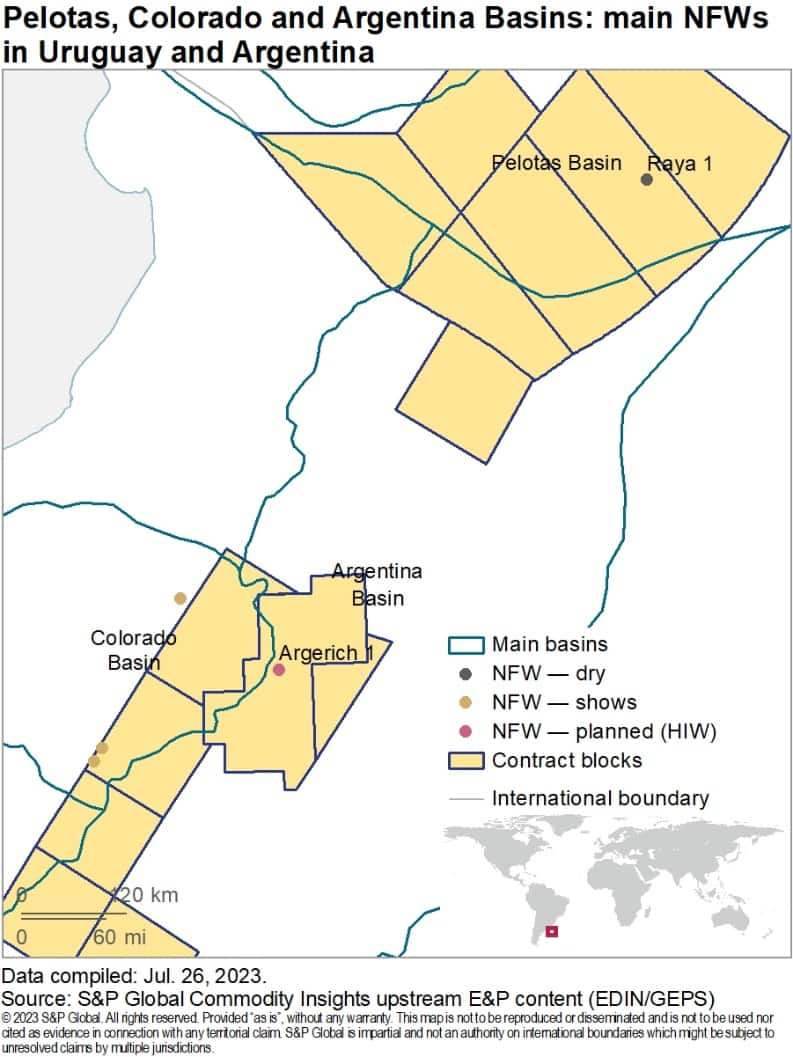

An announcement made by the Argentine government in early July 2023 has focused attention on offshore activities. Equinor and partners have been granted permission to drill the country's first offshore ultra-deepwater well, Argerich-1, in the Argentina Basin's CAN-100 block. Most of the country's hydrocarbon exploration is concentrated onshore (with both conventional and unconventional plays), and in shallow shelf waters of the Austral and Malvinas basins. The Argerich-1 new-field wildcat well (NFW), in a water depth of over 1,500 m, will test a new exploration frontier.

The high expectations rest for Argerich are founded largely on the recent deepwater exploration success in Namibia's Orange subbasin, where Venus, Graff, and Jonker were discovered. The discovery of more than 6 billion barrels of oil equivalent (boe) of recoverable resources in the last two years in the south region of the African conjugate margin has reignited interest in the southern Atlantic coastal margin. Over the last four years, international oil companies and independents have built interesting positions in the Argentina, Colorado and Pelotas basins in Argentina and Uruguay. TotalEnergies, Shell, and QatarEnergy have all had success in southern Namibia's deepwater and are currently present in the Latin America Atlantic coast basins.

The Argerich-1 NFW is operated by Equinor in partnership with Shell and YPF and planned for the end of 2023. It is considered to be a high-impact well (HIW) with potential resources estimated at 1,100 million boe. The target is expected to be the Cretaceous basin floor fan sandstones, similar to those found in the Namibian discoveries, that remains untested in the Latin American Atlantic margin. TotalEnergies drilled a NFW in late 2016, the Raya-1 well, in deepwaters of Pelotas Basin targeting the Oligocene, however the result were disappointing. The well was plugged and abandoned after being declared dry. To date, the only evidence of hydrocarbons in exploration wells in this general area have been from shows seen in the shallow water of Colorado Basin. Argerich-1 results will likely shape exploration in the region for the foreseeable future.

An oil discovery at Argerich might potentially be developed via a floating production, storage, and offloading (FPSO) vessel, utilizing existing port infrastructure in the Argentinian coast. The gas narrative is different and could be challenging, due to the lack of existing infrastructure to monetize offshore gas, and due to competition from the growing gas production coming from the Vaca Muerta onshore shale play.

An early assessment by YPF has indicated that an FPSO with a processing capacity of 200,000 bbl/d could be deployed for an oil development, with the oil transferred in shuttle tankers. In this scenario the gas will most likely be re-injected and used for onsite power generation during operations, which may also present a strategy to reduce CO2 emissions.

These assumptions and parameters were adopted to model a potential asset development using S&P Global cost estimation tool Que$tor™. The Argerich development analysis has indicated a strong economic outcome in preliminary valuation results, with production starting 10 years after discovery. Notional Argerich project economics show a positive net present value (NPV) of more than 5 billion USD at a 10% discount rate and an internal rate of return (IRR) greater than 20% under the current oil price scenario. Over a 25-year period, total capital investment is expected to exceed 20 billion USD1. Furthermore, even if oil prices fell below $50 per barrel, the field would still be profitable. There is a high level of uncertainty linked with, but not limited to, technical development choices and geological risks, which might have material impact to the valuations.

Note: 1 Valuation is provided at the $82/bbl oil price with adjustments for crude quality (API). Vantage assumes a forecast annual inflation rate of 2% from the current year forward which is applied to both costs and prices unless fixed by known contracts. All prices are assigned up to and including the current year with all nominal future prices adjusted by inflation thereafter (constant in real terms). Mid-year discounting has been applied with a default nominal discount rate of 10%. Valuation is conducted current year forward.

For more insights, please refer to High impact exploration offshore northern Argentina and Uruguay: Namibia success revives interest in deepwater conjugate margin plays

Solutions

For more information regarding well, field & basin summaries, please refer to EDIN

For more information regarding asset evaluation, portfolio view, and production forecasts, please refer to Vantage

For more information regarding E&P costs, please refer to Que$tor™

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.