Arresting the decline: Trinidad and Tobago’s natural gas supply alternatives

Natural gas in Trinidad and Tobago plays an important role in the economy, generating nearly 80% of the country's export revenues. Over the years, the country was able to develop its natural gas sector with exports of liquefied natural gas (LNG), ammonia and methanol accounting for at least 85% of available production. The country became the largest oil and gas producer in the Caribbean with peak gas production of 4 Bcf/d in 2010. However, production has dropped to 2.6 Bcf/d since then - a decline of more than a third from the peak.

Trinidad and Tobago has worked diligently from diplomatic and policy angles to address the gas production decline that has affected feedgas to its petrochemical industry and to the Atlantic LNG (ALNG) liquefaction facility. The government launched bid rounds to attract investors and develop gas in the onshore and offshore prospective areas. It also promoted restructuring of the ownership of the ALNG facility to simplify the commercial strategy and allow third-party access. Following a request to the US Treasury Department's Office of Foreign Assets Control (OFAC), the Trinidad and Tobago government was issued in October 2023 a special two-year license authorizing it to negotiate with Venezuela the development of the long-stalled Dragon gas field in Venezuelan waters.

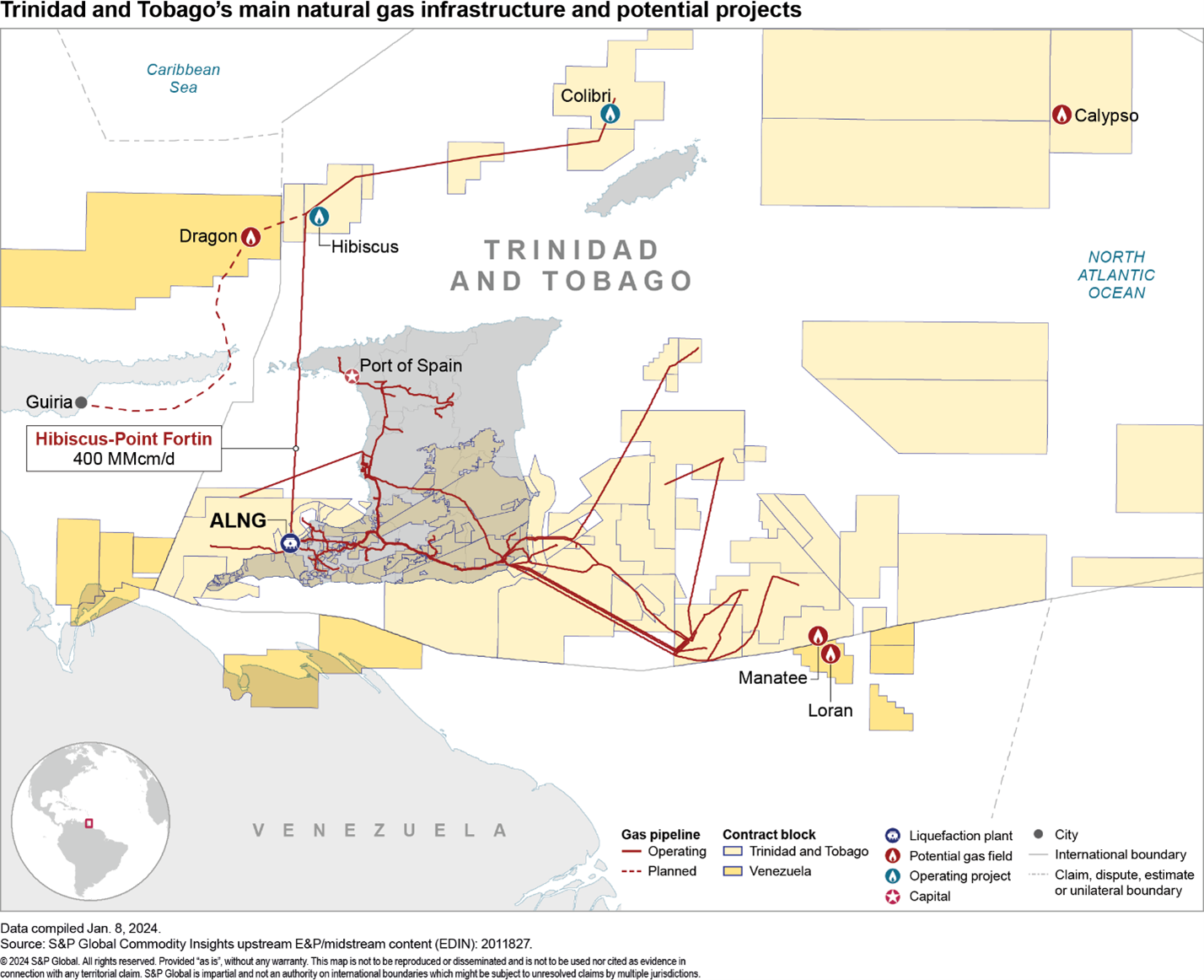

There are several possibilities on how the future of the country's gas production could evolve depending on the timing of the most relevant new upstream projects: the shallow water Manatee gas field, the deepwater Calypso gas field (both in Trinidad and Tobago) and Dragon (in Venezuela, see Map 1).

Manatee gas field is a key future development within Trinidad and Tobago, and it could supply much needed gas by the end of the decade. After several failed attempts to unitize and develop the cross-border 10-Tcf giant Loran-Manatee field with Venezuela, the government of Trinidad and Tobago, with Shell as operator, had embarked on the development of the Manatee field alone. In 2023, the operator and the National Gas Company of Trinidad and Tobago Ltd. (NGC) signed a domestic gas sales contract (DGHSC) that designates a small share of natural gas volumes from the Manatee project for the petrochemical sector.

Undeveloped deepwater gas discoveries in the Tobago Basin and the Northeast Caribbean Deformed Belt present promising opportunities for additional recoverable reserves. However, these resources face challenges related to technical and economic feasibility due to their significant water depth and remote location. Woodside's Calypso project requires further appraisal work and investments in both upstream and midstream infrastructure. Its economic viability currently remains uncertain. Identifying additional gas resources near the field could improve its economics and mitigate risk.

Recent acquisitions of deepwater exploration blocks by two international oil and gas companies offer potential for future development in the region. But progress on projects may be extended depending on exploration schedules.

The development of the Dragon field presents a potentially near-term opportunity to improve the Trinbagonian government's revenue allowing for more exports of LNG, ammonia and methanol. Excluding the geopolitical risk, this project would be considered low-hanging fruit as the field is located 20-km from existing infrastructure already connected to ALNG. Given the aboveground risk and Trinidad's need for gas, a short schedule coupled with the lowest capital expenditure could be the way forward to develop the field through a subsea tie-back. However, a technical assessment of existing infrastructure and a reservoir development plan are still needed.

The timing of Trinidad and Tobago's upstream gas project portfolio will be key to offset the fall in production. These projects are characterized by different economics, volumes, and risks. Ultimately, Manatee is one of the most attractive assets in Trinidad and Tobago's portfolio owing to its lower technical and operational risk and low breakeven price for gas. Aligning interests between the government and developers to bring these and further projects to execution would significantly improve future gas supply in the country.

To learn more about S&P Global Commodity Insights Vantage valuation results and methodology,click hereor

To learn more about our S&P Global Commodity Insights Global Gas Service coverage and the report featured in the blog, click here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.