Asia-Pacific - An offshore wind powerhouse

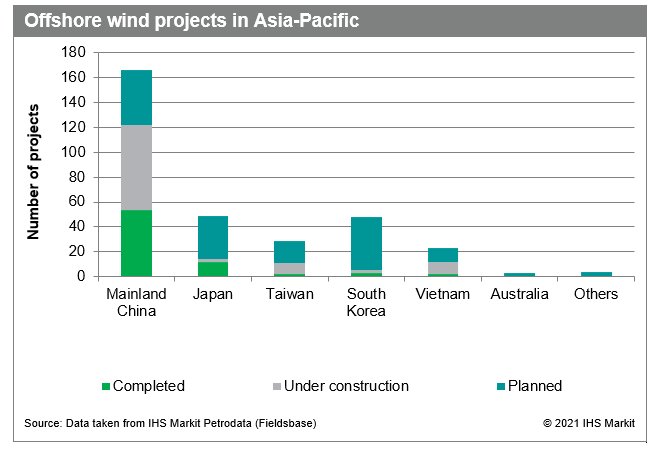

There are currently 695 offshore wind projects worldwide, according to IHS Markit's Petrodata Fieldsbase. Asia-Pacific (APAC) hosts 46% of global offshore wind projects, of which 24% are in mainland China. Chinese offshore wind leads the region with 52% or 166 of the projects in APAC. The pace of development is also accelerating in other APAC nations, with a significant number of projects located in Japan (49), South Korea (48), Taiwan (29) and Vietnam (23).

Figure 1: Offshore wind projects in Asia-Pacific

The rapid growth seen in Chinese offshore wind capacity is spreading to other regions of the world. Figures from the Global Wind Energy Council's (GWEC) 2020 annual report for 2010 through 2020 show the annual number of new offshore wind farm installations worldwide increased by an average 24% each year. From just 2 GW of global offshore wind power output in 2010, generating capacity grew by an average 30.7% annually, totaling 29.1 GW in 2020.

Despite challenges created by COVID-19 lockdowns, 6.6 GW global offshore wind generation was added in 2020, 8.2% more than in 2019. Mainland China overtook Europe, installing 4 GW compared to Europe's 2.3 GW. The rest of APAC added only 0.3 GW last year, but even this was three times more offshore wind capacity than it had ever installed before.

Mainland China

From 102 MW in 2010 and 565 MW in 2014, mainland China's offshore wind power generating capacity has grown at a 66% annual rate since 2015, totaling 7.03 GW in 2019. With over 11 GW of offshore capacity installed as of January 2021, it accounts for over 94% of APAC's current operational offshore wind power generation and 31% of world wind power capacity. It added 2.4 GW of offshore wind power capacity in 2019, 4 GW in 2020 and is expected to install another 5 GW in 2021. From 2020 through 2030, it plans to add 52 GW of offshore wind capacity.

In 2020, 18 offshore wind projects including CNOOC's first offshore wind farm, were commissioned. Situated off northeast mainland China, this 300 MW, 67 turbine development is 39 km east of Jiangsu province's coast at a depth of 12 meters. CNOOC holds a 47% stake and its first batch of wind turbines became operational in September 2020. In December 2020, China General Nuclear's (CGN's) 400 MW Yangjiang Nanpeng Island commenced commercial operations. It features 73 units of Mingyang 5.5 MW wind turbines.

Growing 743% from 7 GW in 2020 to 59 GW in 2030, mainland China will continue to generate more offshore wind power than any other nation - but other APAC countries will grow even faster at 1,989%. By 2030, they are set to produce 60% to 65% as much offshore wind power as mainland China.

Taiwan

Taiwan, supported by policies that promote renewable energy, is one of APAC's fastest growing offshore wind markets. From 0.24 GW in 2020 and 1.7 GW in 2021, it plans to generate 10.7 GW of offshore wind power by 2030. Formosa 1 is Taiwan's first commercial-scale offshore wind farm. The demonstration phase commissioned in April 2017 features two, 4 MW Siemens turbines installed on monopile foundations. Completed in October 2019, Formosa 1 phase two features 20 Siemens Gamesa 6 MW wind turbines installed on monopile foundations. Taiwan has eight offshore wind projects under construction, with three scheduled for completion this year.

Japan

Japan also has ambitious plans to develop untapped offshore wind resources, with plans to generate 7.5 GW of offshore wind power by 2030 and 45 GW by 2040. Construction of Japan's first large commercial offshore wind farm is underway. Akita Offshore Wind Corporation is developing the 139 MW Akita Port and Noshiro Port offshore wind project. A total of 33 MHI Vestas V117-4.2MW typhoon variant offshore wind turbines will be installed 2 km from the Akita Prefecture coastline. Thirteen turbines will be installed at the Akita site and another 20 at the Noshiro site. This wind project is expected to be ready in 2022. As many as 10 offshore wind projects in the country are expected to be commissioned between 2023-2025.

South Korea

South Korea is targeting an ambitious near 10-fold increase in wind power generation. From the current 124.5 MW, it seeks to boost offshore wind power generating capacity to 12 GW by 2030 and 20 GW by 2034. The country currently has three offshore wind farm projects underway. For both wind farm developments and the development of relevant technologies, South Korean firms frequently undertake joint ventures, often in partnership with government agencies.

Vietnam

Vietnam has developed only 1% of the 160 GW of offshore wind generating capacity within 5-100 km from shore. The country currently has the Cong Ly Construction-Trade-Tourism-developed 99.2 MW Bac Lieu nearshore wind farm operational in the Mekong Delta region. The first phase was commissioned in 2013 with 62 units of 1.6 MW wind turbines. The Bac Lieu wind farm became fully operational in January 2016.

Mainstream Renewable Power and Phu Cuong Group are building Southeast Asia's largest offshore wind farm. Construction of the 1.4 GW Phu Cuong Soc Trang offshore wind farm in Soc Trang province is expected to commence in the third quarter of 2021. The offshore wind project will be developed in two phases comprising 400 MW for phase one and 1 GW for phase two. Phase one, which will feature between 29 and 45 wind turbines, is targeted to be operational in 2023.

Australia

Australian power is 79% derived from fossil fuels, with coal and gas accounting for 79% of electrical generation. Australia has no operational offshore wind farms, but three projects are in the planning stages. These are Star of the South off Victoria, Newcastle Offshore Wind off the New South Wales coast, and Western Australia's Mid West Wind and Solar Project. The country's first proposed project is the 2.2 GW Star of the South off Gippsland, and it could start generating power from 2025. Proposed offshore wind turbines, cables, and substations will connect to the onshore grid at Latrobe Valley, Victoria.

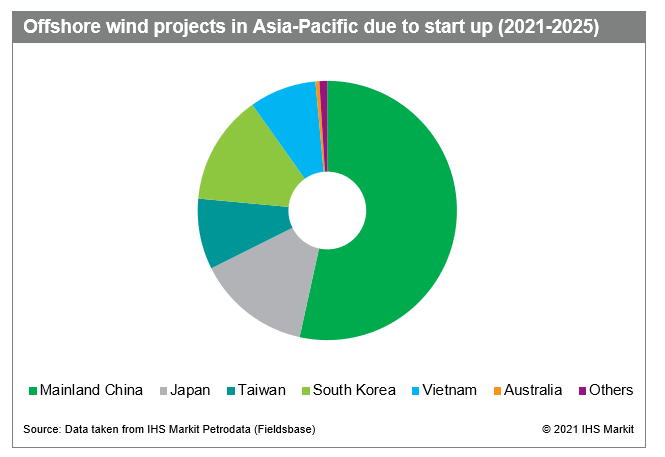

Figure 2: Offshore wind projects in Asia-Pacific due to start up (2021- 2025)

Findings and Implication

However, the growth of new offshore wind power capacity in mainland China is set to slow down significantly from 2022 due to the phasing out post-2021 of a cost subsidy for the first 20 years of a new wind farm's operation. But the accelerating pace of investment elsewhere in APAC should make up for this: South Korea (12 GW), Taiwan (9 GW), Japan (7.5 GW) Vietnam (5 GW), and the Philippines (1 GW) all intend to increase their wind power capacity by a factor of 10 or more by 2030.

From a record 5 GW increase in 2021, mainland China's annual offshore farm power generation capacity will increase at a lower rate of 3.0 GW to 3.5 GW from 2022 to 2024. From 2025 until 2030, it will return to the 5.0 GW to 6.0 GW range of growth seen in 2021. Outside mainland China in 2029-30, East Asia will invest 6.9 GW to 7.0 GW in new wind power generating capacity.

Still, mainland China will remain by far the world's largest offshore wind power producer. Meanwhile, the rest of APAC's offshore wind power generating capacity will rise from 13% of mainland China's volume in 2020 to 64% by 2030. More importantly, half a dozen APAC nations will overtake mainland China in annual offshore investment and become the growth locomotives of Far Eastern offshore wind power.

This report was generated with content from IHS Markit's Petrodata Fieldsbase product. Learn more about Petrodata Fieldsbase.

Algena Lee is a senior research analyst at IHS Markit.

Posted 22 February 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.