Asia Pacific Regional Integrated Service Research Highlights, Q1 2022

In the first quarter of 2022, 20 new insight papers have been published in the IHS Markit Asia Pacific Integrated service, apart from the regular updated reports. This research highlight summarized the key impact papers and provides an overview the market signposts in Q1. Link to a select set of reports is provided below.

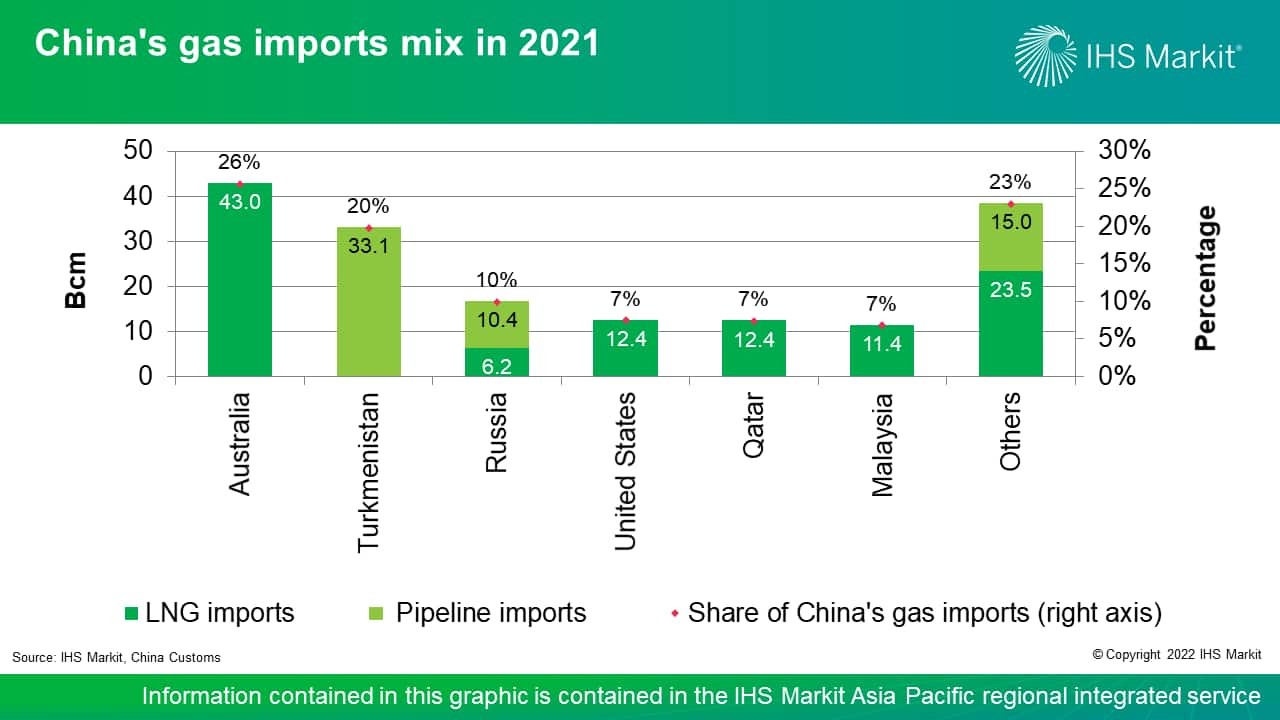

The graphic of the quarter is selected from "The Russia-Ukraine crisis and the impact on China's gas market", showing China's gas import mix in 2021.

Russia to supply an additional 10 Bcm/y of pipeline gas to China from Far East

On 4 February 2022, Gazprom and China National Petroleum Corporation signed a new gas pipeline supply agreement for 10 Bcm/y. Counting the existing 38 Bcm/y supply contract through the Power of Siberia-1 (POS-1) pipeline, the total contracted piped volumes between Russia and China are now 48 Bcm/y. To be delivered via a new Far Eastern route, the gas supply that will be tapped, from Sakhalin, is physically separated from fields currently supplying Europe, POS-1, and the still-under-discussion Power of Siberia-2 (POS-2) pipeline project. The deal will be settled in euros in an effort for both sides to diversify away from payments in US dollars. Other details, including the timing of first gas, ramp-up period, specific gas source, pricing structure, pipeline route, and entry point, have yet to be specified.

Gazprom can potentially move Sakhalin gas part of the way to China through its existing Sakhalin-Khabarovsk-Vladivostok pipeline, subject to the route's overall expansion; deliveries to the proposed entry point at Blagoveshchensk (the same as POS-1) also require construction of a 580 km pipeline from Khabarovsk.

Gazprom's Sakhalin-3 project gas resources, including the Yuzhno-Kirinskoye field, should be just enough to accommodate regional domestic demand growth and two export projects: the new 10 Bcm/y pipeline to China and the planned third train of Sakhalin-2. Gazprom's current development plan for Yuzhno-Kirinskoye still assumes that the field will start production in 2024-25 with a plateau of 21 Bcm/y reached in 2029-31.

The Russia-Ukraine crisis and the impact on China's gas market

The Russia-Ukraine crisis has injected further turmoil into an already tight global energy market, sending oil and spot LNG prices to record highs that were not thought possible previously. Russia has already been a strategic gas supplier to China, accounting for 10% of gas imports in 2021. The two countries' gas ties will strengthen in the next few years given the ramp up of the 38 Bcm per year Power of Siberia-1 (POS-1) contract and the new 10 Bcm per year (Bcm/y) Far East contract with potential 2025 first gas.

In the short term, China will feel the pain of high gas import costs. The overwhelming majority of Chinese gas imports, both pipeline and LNG, are linked to oil prices, which will lead to high landed prices of LNG imports within several months and of pipeline imports within a year, given the typical lag time to oil prices. To a lesser extent, as most Chinese importers have already stopped spot purchases, high spot LNG prices will also raise China's average landed price of imports.

China could receive more Russian LNG in 2022. As long as sanctions do not apply directly to entities buying Russian LNG, China may import more Russian LNG cargos if they need to be diverted from originally designated destinations owing to self-sanctioning through port bans or other LNG importers' fears of potential sanctions and reputational concern.

The timeline for Power of Siberia-2 (POS-2) development may well accelerate but hurdles remain. The European Union's proposal to phase out Russian fossil fuel imports before 2030 will undoubtedly fast-track Gazprom's original plan to cultivate China as a key consumer of its Western Siberia gas resources. On China's side, geopolitical pressure and the size of the deal—up to 50 Bcm/y—could be challenging. If an agreement for POS-2 can be achieved, first gas would arrive at the very earliest within three years, with significant negative impact on China's Central Asian and LNG imports.

China's ancillary services paradigm shift: Market rules adapt to a changing power system

In late December 2021, China released the first update to its power ancillary services market rules since 2006. The update proposes an expansion to types of ancillary services as well as to eligible market participants. The changes aim to increase competition and adapt ancillary markets to better serve China's evolving power system. Aligning with the fundamental power marketization reform direction, the changes also address the rising penetration of intermittent renewables and acknowledge technology advancements enabling demand-side management.

Passing through ancillary services costs through to power end-users will fundamentally change power tariff setting. Previously cycled among power generators, ancillary costs will pass through to power consumers for the first time. This codifies the long-discussed "who benefits, who pays" principle.

Impact on power generators will depend on generation type and ancillary product, differing among renewable and thermal power sources. Intermittent renewables' total allocation fees will likely increase given their status as the main beneficiaries of the deep ramping (peak shifting) ancillary product, and that demand for deep ramping ancillary services will expand with growing renewable generation. Although the magnitude of these costs is still to be determined by follow-up documents, regulators will likely also take into consideration affordability concerns.

The changes indicate increased revenue opportunities for demand-side management schemes and battery storage, though actual impact will depend on how the policy is implemented. The new ancillary market rules will remove many market-entry barriers previously faced by adjustable load resources and battery storage.

Green day-ahead market: A growing market segment for renewable capacity in India

In late October 2021, the Indian Energy Exchange (IEX) launched the green day-ahead market (GDAM), a new market segment to trade the day-ahead contracts (DACs) for renewable generation, with separate price formations for renewable and conventional power. Since its launch, 326 GWh of renewable energy generation has been traded in the GDAM, which represents roughly 1.4% of total renewable energy generation and about 1.5% of the total short-term market.

Prices continue to be divergent between the GDAM, the DAM, and RECs. As per the price convergence principle between different market segments, the prices in the GDAM should be equivalent to the prices in the DAM plus the renewable energy certificates (RECs). However, the prices in the GDAM remained divergent during the first two months of the market's operation. This result is primarily due to the absence of an intermarket optimization structure, which is inherent in the overall market design.

Buying from the GDAM results in a lower cost to buyers. Buyers are able to lower their total power procurement cost (and meet their renewable purchase obligation [RPO]) by approximately 0.22 rupees per kWh (US$3.5/MWh). The cost advantage may increase further as the Central Electricity Regulatory Commission (CERC) implements the transmission charge waiver for GDAM transactions.

Liquidity in the GDAM is expected to increase. In the first two months of the market, the volumes in the GDAM remained low, owing primarily to limited merchant renewable generation in the country and the inability of wind generation to trade on a day-ahead basis. However, going forward, volumes in the GDAM are expected to grow as new dispatchable renewable energy capacity (which is part merchant and has storage) is commissioned.

Rule change leads to increased LNG costs for South Korea's power sector

On 27th December 2021, KOGAS amended its provisions for natural gas supply, including a change in the way it passes through its LNG procurement costs. The change will result in a surge in fuel costs for many gas-fired power plants in South Korea, starting from January 2022.

South Korea has 41.2 GW of gas-fired power capacity, of which 34 GW is supplied with fuel by KOGAS, the monopoly reseller of LNG within the country. The power generation companies for the remaining 7.2 GW buy their LNG directly from the global market. KOGAS has historically passed through its LNG procurement costs, including term and spot LNG purchases, to its power generators and city gas company customers on a weighted average cost basis. However, KOGAS has not always been able to pass this through to city gas customers, as the wholesale tariff is regulated and can be changed by the government.

In July 2020, the Korean government lowered the city gas price by 11-13% as a measure to reduce costs for consumers during the COVID-19 pandemic related recession. The price was subsequently frozen every month until the end of 2021, even as KOGAS's import costs increased sharply due to high oil and spot LNG prices in the global market. As a result, KOGAS has been unable to fully pass through its LNG costs and has faced deficits in its city gas business.

US-China phase-one trade agreement: Energy target was not achieved despite surging LNG trade in 2021

The end of 2021 marked the time to evaluate the achievement of trade targets set in the US-China phase-one trade agreement. Signed in January 2020, the trade deal set aggressive incremental trade value targets of $18.5 billion in 2020 and $33.9 billion in 2021 compared with the 2017 levels for energy products.

LNG imports were a key contributor, but actual energy trade value still fell short of the targets. In 2021, China's trade value for US LNG was 10 times that in 2017, accounting for 40% of total incremental energy trade values. Still, the actual incremental energy trade values failed to reach the targets: the completion rate was only 26% in 2020 and 42% in 2021.

China's LNG imports from the United States will increasingly come from term contracts, although flexible destination will accommodate more trading activities. In 2021, China signed 10.5 million metric tons per annum (MMtpa) of new-term supply for US LNG, which is 39% of all China's new LNG agreements signed in the same period. The new contracted volumes will start to take delivery during 2022-25. On the other hand, the flexible destination known in most US supply agreements can help Chinese LNG importers further develop their trading practices.

US LNG will provide China with price diversification. China's need for new supply is the main reason behind the surging LNG imports and new contracted volumes from the United States to China, although the political support in the form of waived import tariffs also helps. In addition, supply from the United States provides price diversification for China to limit its exposure to the price volatility in the oil and spot LNG markets.

The changing landscape of renewable energy financing in Asia Pacific

In 2020 alone, Asia Pacific added 110 GW of solar photovoltaic (PV) and wind power capacity, accounting for over half of the total installed capacity in the world.

However, most Asian markets will likely fall short of the investment required to meet government renewables targets during 2021-25, with access to low-cost financing remaining one of the key challenges. New sources of finance are needed to fill the investment gap.

Most Asian markets will likely fall short of the US$125 billion of annual investment in solar PV and wind power required to meet government targets during 2021-25. Only mainland China is expected to meet the government's ambitions, while other major economies in Asia are unlikely to meet their investment requirements, as access to low-cost financing is constrained by the less developed capital market, lack of transparency in the financial regulation, and limited experience of local banks.

In Vietnam, green loans emerge as a new debt instrument for renewables projects. The issuance of green loans in the country has grown to US$1.7 billion since 2017, as the Asian Development Bank (ADB) has actively funded green loans with its innovative project finance solutions in mitigating power purchase agreement (PPA) risks.

India has significant potential to multiply renewables investment but needs to address policy, offtaker, and currency risks. India will need to quadruple its renewables investment to be able to reach its target to add about 360 GW of new renewable capacity during 2021-30. Project developers are tapping international capital markets to access low-cost financing, but the government needs to improve regulatory transparency, introduce a uniform green taxonomy, and provide targeted interventions to improve access to low-cost international capital.

The current offshore financing landscape in Japan, South Korea, and Taiwan signals a potential decrease in the perceived risk of capital providers in the near future. The high uptake of project financing, the average percentage of debt financing reaching close to 80%, and the active participation of local banks and insurance companies are pointing to a potential decrease in the perceived risk of capital providers in the near future.

Green bond rises as a new financing vehicle in Southeast Asia

As a new source of financing new projects or refinancing, the issuance of green debt has taken off in Southeast Asia in recent years. The issuance of annual green bonds and loans for funding regional renewable energy projects grew to US$4.4 billion in 2021, registering a five-fold increase over the past five years.

Renewable energy has received the largest share of allocation from green debt issuance. According to our study, which analyzed the green bond and loan market in Southeast Asia during 2017-21, renewable energy is the largest sector that has captured 40% of total proceeds, followed by green building and clean transportation.

Independent power producers (IPPs) are the most active in funding renewable energy projects using green debt. Green bond and loan market has been largely dominated by IPPs in Southeast Asia, who have issued almost half the volume directed to renewable energy projects in the past five years. With solar, wind, or geothermal projects calling for long-term capital owing to their over 20 years of operational life, green bonds offer IPPs attractive sources needed to refinance the projects.

Institutional investors are stepping up their effort to keep their portfolio in line with cutting emissions to net zero by 2050, as they have been under growing pressure to manage climate risks and achieve target investment returns as part of their fiduciary duty. This green push by global investors has spurred more investment banks to underwrite green bonds, as green-labeled investments are well aligned with investors' needs to clean up their portfolio.

Our study finds a potential emergence of greenium in the near-term, which could facilitate increased funding for renewable energy projects by green bonds. A growing number of repeat issuers and the active role of development finance institutions (DFIs) as anchor investors could improve investor confidence in green finance products, which could feed through into pricing.

Structural reforms and access to global finance key to achieving Pakistan's clean energy goals

With the recently concluded 26th Conference of the Parties (COP26), Pakistan unveiled its updated nationally determined contribution (NDC), which targets an up to 50% reduction from business-as-usual greenhouse gas (GHG) emissions and a 60% share of renewables (including hydropower) by 2030. This Insight evaluates the realism and ambition behind the NDC based on Pakistan's historical performance and outlook. It delves into the COVID-19-related constraints to Pakistan's import-intensive energy and structural and governance issues threatening Pakistan's clean energy transition. The paper also analyzes measures undertaken to upgrade clean energy infrastructure and implement market reforms and financing requirements to achieve clean energy goals.

IHS Markit's assessment of Pakistan's macroeconomic prospects and energy capacity pipeline indicates that the official mitigation targets are based on an overly pessimistic baseline, while the clean energy and GDP estimates are very ambitious (and likely unrealistic). Pakistan needs to accelerate on its path of recently implemented reforms and address specific issues plaguing the renewables sector. It needs to provide a fertile investment requirement for enabling private participation, which has a track record of energy- and cost-effective performance compared with its public sector counterparts in generation and distribution.

India's 2022 prognosis for the power, gas, coal, and renewables markets

The Indian economy, which contracted by 7.4% in fiscal year (FY) 2021 as a result of COVID-19, is slowly recovering in FY 2022 while withstanding a severe second wave of the virus. IHS Markit projects that India's GDP will grow in FY 2022, reflecting the recovery of pent-up demand in the short term. However, structural damage from the pandemic may continue to weigh on the economy in the medium term, including the impact of the pandemic on household incomes and labor markets and rising corporate and public debt with prolonged banking sector issues. Government-initiated reforms could partially offset the impact on potential growth, but implementation challenges could pose hurdles.

Energy demand also recovered in 2021, driven by an increase in economic activity and a rapid vaccination drive. While electricity demand grew by approximately 9.3%, gas demand also grew by more than 9% (primarily from growth in demand from city gas distribution and the industrial sector). At Glasgow, India presented its updated nationally determined contributions (NDCs) in line with the ratcheting requirements of the Paris Agreement (reducing emissions intensity of GDP by 45% over 2005 levels and 500 GW of renewable energy capacity by 2030). To attain its commitments, India needs to focus on deepening energy markets, providing long-term policy clarity, supporting technological advancements in storage and green hydrogen, and developing transmission infrastructure.

New climate actions demonstrate ASEAN's ongoing decarbonization efforts, but challenges remain

Association of Southeast Asian Nations (ASEAN) countries aspire to shift to a low-carbon economy. During the 2021 United Nations Climate Change Conference (COP26) or right after it, most of the ASEAN countries announced net-zero targets and unveiled new coal reduction plans, demonstrating the continuous decarbonization efforts in the region.

The recently announced net-zero targets and coal phase out plans mostly do not align with the prevailing power development plans (PDPs). Most ASEAN countries pledged to reach net-zero emissions by 2050-65, but these pledges have yet to be reflected in the countries' current PDPs, which were released or proposed no later than 2021 and are regarded to forecast thermal plants without carbon capture technology to stay online beyond 2050.

As an important measure to curb emissions, carbon pricing has been implemented progressively in the region, but is deemed insufficient to make a real impact on the power development trajectory. Only two countries, Singapore and Indonesia, have implemented or announced plans to implement a carbon tax, starting from US$3.7 and US$2.1 per metric ton of carbon dioxide equivalent (CO2e), respectively, which are perceived as not sufficient enough to stifle coal. Other ASEAN countries claimed to follow suit but have not announced any important details.

Multiple challenges still lie ahead as no holistic solutions are presented to transition the region's "coal lock in" power sector to sustainable systems. The region's power sector is estimated to grow at 3.5% per annum through 2050 and will require 18 GW of net capacity addition annually. Besides, by 2030, about one-third of the coal capacity will be younger than 10 years, making the retirement plans economically challenging. In addition, gas as the bridging power source has always been associated with issues such as insufficient supply and infrastructure investment, as well as high cost. While all the governments' PDPs seek out a shift to low-carbon systems, none of them presented well-reasoned solutions.

South Korea's presidential election: Nuclear takes center stage in the energy agenda

The two leading candidates in South Korea's presidential election on 9 March 2022 have outlined different visions for the country's energy future. Whoever wins, the new president's energy policy will shape the 10th Basic Plan for Electricity Demand and Supply (BPE) and the 15th Long-Term Natural Gas Supply Plan scheduled for early 2023, the country's most critical plans guiding energy market fundamentals over the next 15 years.

The ruling Democratic Party's candidate Lee Jae-myung intends to bolster current climate ambitions and energy transition policy, potentially further raising the NDC target to a 50% cut in greenhouse gas emissions by 2030 and accelerating the target year for carbon neutrality to 2040. A new climate and energy ministry will be established as an interministerial body, and carbon tax will be reviewed as a policy instrument to achieve the ambitious emissions targets. The current policy notion of phasing out nuclear and coal power as well as promoting solar and wind energy will be broadly maintained.

Opposition People Power Party's candidate Yoon Seok-yeol intends to pull out all the stops to revive the country's nuclear industry, overturning President Moon Jae-in's anti-nuclear energy policy. Yoon envisages nuclear power to account for 30-35% of electricity supply in 2030, 6-11% higher than the level set in the latest Nationally Determined Contribution (NDC) target. The energy policy on coal and natural gas will largely remain unchanged given Yoon's target of keeping the combined share of coal and natural gas in 2030 at 40-45%, not far from 41% in the current NDC target.

Natural gas and renewables will likely be most affected during the next president's term (2022-27). With the current nuclear phaseout policy being reassessed by both candidates, natural gas—the fuel serving mid-merit requirements and meeting residual load needs in the country's dispatch system —will likely be most affected by the outcome of the presidential election. The pace of uptake in renewable energy, particularly solar and wind, will also be significantly influenced, as the sector heavily relies on the government subsidies and the state-owned utility's grid infrastructure plan.

Installation rush in 2021 propels China to become the largest offshore wind market globally

The National Energy Administration (NEA) announced that China's offshore wind annual installations soared to 16.9 GW in 2021, accounting for over 80% of global total additions that year and quintupling China's domestic additions level from the previous year in 2020. Following the record-setting growth, China surpassed United Kingdom and Germany to become the largest offshore wind market globally.

The boom in installations resulted from a rush to meet a subsidy deadline, however, IHS Markit estimates closer to 15.0 GW of grid-connected project additions in 2021. Such rapid project rollout resulted from close collaboration among all stakeholders. Grid companies were simultaneously under pressure to bring online as much renewable power as possible. However, some of these projects may not have fully commissioned in 2021 despite registering as grid-connected to meet the subsidy deadline.

The number of offshore construction vessels increased sharply in 2021, removing the key bottleneck in supply chain capabilities for China's offshore wind installation. Developers went to great lengths to build, purchase, lease, or modify existing vessels to cope with the installation rush.

More project development experience, overtime work, and favorable weather also contributed to the record-breaking additions in 2021. However, safety and quality risks increased resulting in an uptick in accidents.

Record level offshore additions will not reoccur in 2022, but the strong momentum will continue during the 14th Five-Year Planning (FYP) period. Cost declines from a significantly lower turbine price and shared transmission lines as well as policy incentives will support the subsidy-free project pipeline.

Additional Insights and Strategic Reports published in fourth quarter 2021

- A review of 2021 and the five big questions facing Southeast Asia's power markets in 2022

- Ten big questions facing the Asia Pacific natural gas market in 2022

- Five big questions facing OECD Asia's power market in 2022

- Ten big questions for China's gas and power markets in 2022

- Hydrogen as a strategic decarbonization tool: China releases first national-level development plan

- Tokyo and Tohoku face blackout fears after Fukushima earthquake

- China's 14th Energy Five-Year Plan: Pivoting toward a "modern energy system"

Learn more about our coverage of the Asia Pacific energy research through our Asia-Pacific Regional Integrated Service.

Logan Reese is an associate director on our Asia Pacific Regional Integrated team, focusing on Australia power and gas markets.

Ankita Chauhan is a senior renewable analyst on the Gas, Power, and Climate Solutions team, covering research and analysis for Indian and South Asian markets.

Posted 7 April 2022

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.