Carbon capture and storage: contrasting regulatory approaches in Australia and the US

Carbon capture and storage (CCS) is in the news. With the COP26 Climate Change Conference fast approaching (31 October to 12 November 2021), governments and businesses are under pressure to convert their climate pledges into practical action. If climate targets are to be met, CCS is sure to be an important piece of the jigsaw. Australia and the US are two of the countries at the global cutting edge of CCS.

Which country has made the faster progress so far in developing its CCS industry?

Australia has the largest single commercial CCS project in the world, the Gorgon project, at Barrow Island in Western Australia. The US has the largest number of operational commercial CCS facilities in the world (14) and the largest number under construction or in the development phase (19).

Although many factors, including geology and existing infrastructure, are important, the legal/regulatory regime governing CCS is crucial in determining the viability and speed of CCS projects within a country.

Key legal/regulatory areas include:

- A specific legislative framework for CCS, clearly setting out rights and duties of project developers

- A licensing system which efficiently awards promising geological formations for CCS

- A fiscal regime which makes CCS projects commercially

attractive, through, for example:

- carbon credits

- tax incentives

How are the contrasting regulatory approaches of the governments of Australia and the US driving the industry forward (or holding it back)?

Australian approach

Legislative framework

A detailed legislative framework for CCS in the Commonwealth

offshore (beyond three nautical miles of the territorial sea

baseline) is contained in the main upstream petroleum framework

act, the Offshore Petroleum and Greenhouse Gas Storage Act

2006 (the States of Queensland and Victoria have also passed

substantial CCS-specific framework legislation).

Acreage licensing

The Commonwealth legislation establishes a sophisticated licensing

system for CCS for the Commonwealth offshore. Greenhouse Gas

Assessment Permits are awarded through bidding rounds. The third

such round, the Greenhouse Gas Acreage Release 2021, is expected to

open in December 2021, with five areas on offer.

Commercial incentives

The Emissions Reduction Fund lets companies earn Australian Carbon

Credit Units for each tonne of carbon stored. The units may then be

sold to the government or on the secondary market to provide

revenue.

At present, there are no significant income tax incentives for CCS in Australia.

US approach

Legislative framework

CCS is covered in various pieces of Federal and State legislation,

including tax legislation (see Commercial incentives below), but

there is not yet a Federal CCS framework act.

Acreage licensing

The system for licensing acreage is more complicated in the US than

Australia, partly because ownership of many of the country's

geological formations vests in private landowners rather than the

government.

Awarding CCS rights to geological structures under State or Federal land or in State or Federal waters, should be relatively simple. However, where land ownership is fragmented among numerous private landowners, the difficulty in obtaining CCS rights in the underlying geology is daunting.

Commercial incentives

There is no US national carbon credit system but some States have

carbon pricing programmes, the largest being in California.

The key measure by the US Federal Government to incentivise CCS is through a tax credit (1986 Internal Revenue Code, Section 45Q) (some US States also provide tax incentives).

Conclusion

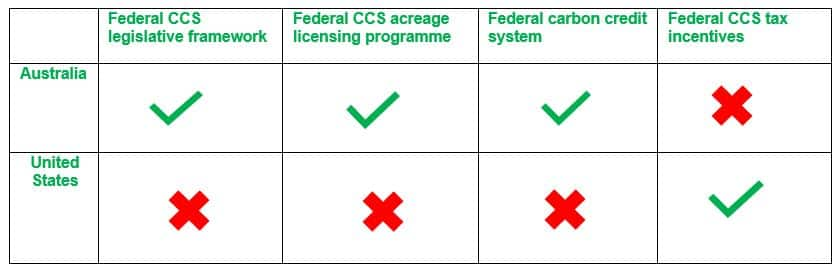

The table below highlight some of the differences between the

Federal CCS legal regimes in Australia and the US.

On the basis of the table, the Commonwealth government of Australia appears to be ahead of the Federal government of the United States in terms of CCS regulation.

However, it is early days, and the CCS legal/regulatory regimes of both countries are a work in progress. It is also worth reiterating that the CCS regulatory environment at State level may hold as much weight as that at the Federal level.

In addition, as mentioned, there are several other important factors which will dictate which countries forge ahead in the new CCS industry and which lag behind, including geology, infrastructure, the carbon price and long-term liability issues.

A new CCS starting gun will fire at COP26; who will win the race?

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.