Australia, Japan, and Vietnam lead in our new Clean Power Additions Ranking for Asia Pacific, while fossil fuel plants continue to be built across the region

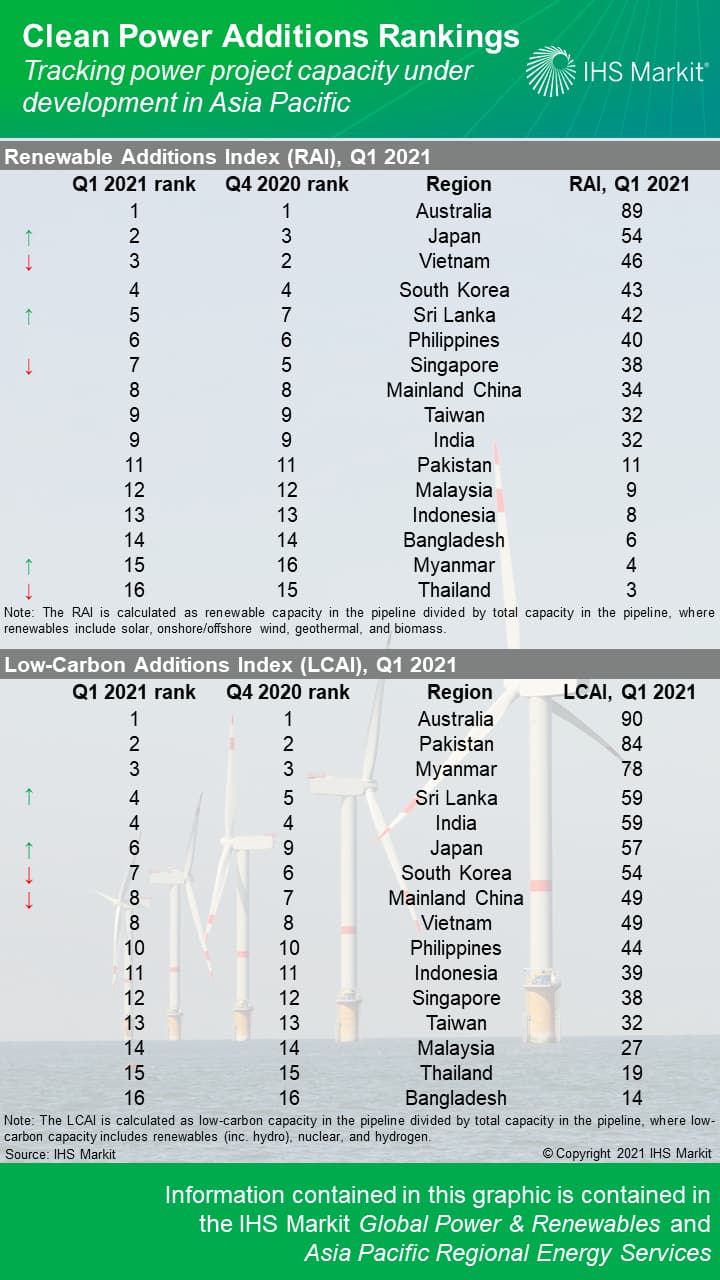

IHS Markit has launched its Clean Power Additions Ranking (CPAR) for Asia Pacific, comprising two difference indices: one focused on nonhydro renewables and one more broadly on low-carbon power that also includes nuclear and hydro.

These indices provide quarterly updates on power generation projects that are under construction and in pre-construction development in 16 key markets in the region.

The Asia Pacific region accounted for over 95% of world incremental electricity demand during the past decade, a trend that will continue, requiring significant new investment in power generation projects.

Many governments in the region have announced clean energy ambitions, while others - including China, Japan, and South Korea - have gone even further to commit to net zero emissions. While many medium- to long-term goals have been announced, actual development on the ground may differ in the near term. The new IHS Markit ranking attempts to provide continuous monitoring of what is getting built in Asia's power markets on a quarterly basis.

In our inaugural release, which provides a snapshot of the power project pipeline at the end of 2020, developed markets such as Australia and Japan lead the region in the Renewable Additions Index (RAI), with the majority of their upcoming projects being wind or solar power. Some emerging markets such as Vietnam, Sri Lanka, and the Philippines also have significant nonhydro renewable energy in the project pipeline.

Significant hydro power development activities in Pakistan, Myanmar, and Sri Lanka are boosting their rankings in the Low-Carbon Additions Index (LCAI), which also includes hydro, nuclear, and other low-carbon generation technologies.

Our ranking shows that income level is not the sole determinant in a country's willingness to pursue clean energy and that renewable energy is no longer a "rich nation" luxury as its cost continues to decline.

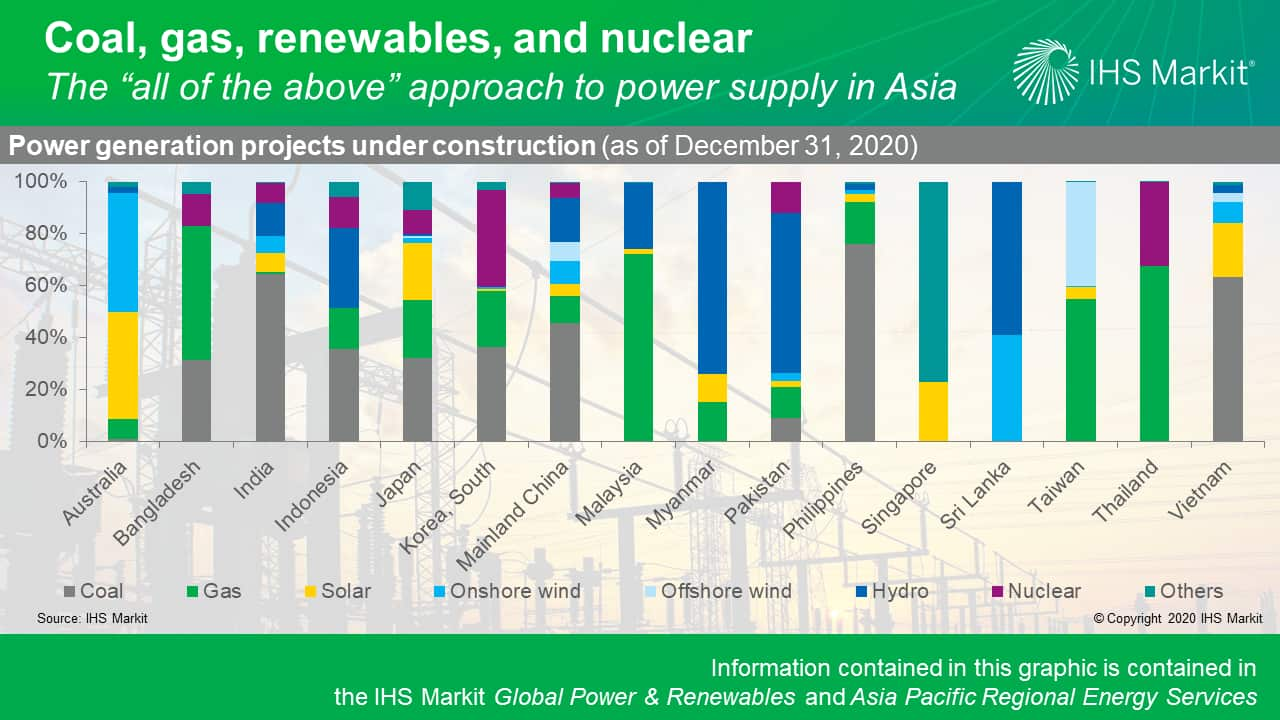

However, while clean energy is growing rapidly in the region, many markets continue to build significant fossil fuel plants - often as a way to ensure reliable power supply. Developed economies tend to face less pressure in this regard as their power demand growth is much slower or has already peaked, but we observe coal plants being built even in rich countries such as Japan and South Korea.

Overall, 451 Gigawatts (GW) of power projects are currently under construction in Asia Pacific, with coal and gas accounting for 43% and 14% of the total, respectively. Another 962 GW are in pre-construction planning, but among these, coal and gas have much lower shares, at 17% and 27%, respectively, whereas wind and solar account for 21% and 20% of the pre-construction pipeline, respectively.

Key market highlights from our inaugural issue of the Clean Power Additions Rankings for Asia Pacific:

- Australia leads the region in clean power development in terms of share in its upcoming projects. Overall, 87% of all power projects currently under construction in the country are wind or solar. If hydro and other renewables are included, this figure goes up to 90%.

- Japan and South Korea are ranked 2nd and 4th, respectively, thanks to their large pipeline of offshore wind projects in pre-construction development as well as Japan's significant solar capacity being developed and built.

- Vietnam leads emerging markets with 3rd place ranking. With its aggressive renewable policies especially feed-in tariffs, Vietnam has unleashed its technical as well as commercial potential for solar, onshore wind, as well as offshore wind power, with a third of its under-construction projects and 45% of its pre-construction projects being wind or solar.

- Mainland China remains the largest renewables market in absolute terms. For projects under construction, it accounts for 58% of onshore wind projects and 33% of solar projects in the region (or 9.2 GW and 18 GW for onshore wind and solar, respectively.) However, it only ranks 8th place because of its large coal- and gas-fired power development pipeline.

- Significant fossil fuel capacity is still being built, with 192 GW of coal plants and 65 GW of gas plants under construction in the region. When completed, these plants have so much capacity that they can technically power half of the United States. In particular, Mainland China and India together account for 77% of coal plants under construction in the region, followed by Vietnam, Indonesia, Bangladesh, South Korea, and Japan. For gas-fired power, Mainland China, Thailand, and Bangladesh are the most active and have the most capacity in project pipeline.

The CPAR will be issued on a quarterly basis in February, May, August, and November of the year. The full report containing market-level details and technology-specific analysis is issued to clients of the IHS Markit Global Power & Renewables Service and Asia Pacific Integrated Energy Service.

A word on methodology

The IHS Markit Asia Pacific Clean Power Ranking represents two interlinked indices that track the region's electric generation project pipeline:

- Renewable Additions Index (RAI): This index draws upon the share of nonhydro renewable power capacity in the project pipeline, where renewable power includes power generation capacity of solar, onshore/offshore wind, geothermal, and biomass.

- Low-Carbon Additions Index (LCAI): This index draws upon the share of low-carbon power capacity in the project pipeline, where low-carbon power includes power generation capacity of solar, onshore/offshore wind, geothermal, biomass, nuclear, hydro, and hydrogen.

The capacity of projects in pre-construction development is discounted by 25%, reflecting uncertainties associated with projects' permitting, financing, and/or other regulatory and market risks widely observed before projects at early planning stages can move to start construction. The discounting factor is derived from the average rate of canceled projects out of the total project capacity in pre-construction development. Coal- and oil-fired power plants receive an additional 25% discount given high regulatory risks associated with the coal phaseout move in most markets.

The capacity of projects already under construction stage is not discounted, since they are almost certainly going to come online.

Learn more about our power and renewables research from our Global Power and Renewables and Asia Pacific Regional Integrated Energy service pages.

Xizhou Zhou is a vice president in the Climate & Sustainability Group at IHS Markit and leads the company's power and renewables practice globally.

Posted on 4 February 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.